The Saudi Investment Bank (SAIB)

The Saudi Investment Bank (SAIB) is a Saudi Arabian joint stock company which was established by Royal Decree No. M/31 dated June 23, 1976, as the Saudi Investment Banking Corporation and is headquartered in Riyadh.

Our Vision

To offer the simplest and most accessible products and services to each of our customers.

Our Mission

Towards our customers

- We make banking simple and accessible for each of our customers.

- We are flexible, adaptive and responsive to deliver what suits our customers.

- We listen to our customers and understand their needs and preferences in order to evolve and improve.

Towards our employees

- We value ideas, inputs, and initiatives.

- We empower our staff to bring out their best and go the extra mile.

- We recognise individual contribution and we support individual development.

- We enhance team spirit, which allows us to collectively build the smartest solutions.

Our sustainability framework

SAIB’s sustainability strategy is built on five sustainability pillars, based on Islamic values, which are described below:

History and Operations

When the Bank commenced operations in March 1977, its business was mainly the medium-term financing of Industrial projects. In 1983, with the adoption of the SAIB name, the Bank moved into full commercial banking. The ALASALAH Islamic banking brand was launched in September 2006 with the opening of 10 Shariah-compliant branches.

Our operations include wholesale, retail and commercial banking products, both Shariah-compliant and traditional. Our finance operations offer a range of non-interest bearing banking products including Murabaha, Istisna’a and Ijarah. Islamic principles are at the heart of all our operations. Adherence to Shariah principles in product build and product development is assured by our Shariah Committee.

Our Personal and Corporate Banking product lines include deposits, loans, and other credit products for individuals, SMEs, mid-corporates, corporates, and other institutional customers. We also offer several Treasury and Investment Banking products including money market services and managing investments.

Through our joint ventures and subsidiaries we provide investment banking, share trading, asset management, leasing finance, mortgage finance, and credit card services. Our wholly owned subsidiary, Alistithmar Capital (ICAP), provides brokerage services, investment products, and corporate finance services.

The Bank currently operates through a network of 49 branches, of which 44 are fully Shariah-compliant and 12 of the branches have ladies sections to serve our lady customers. The Bank’s commercial activities are confined to the Kingdom of Saudi Arabia.

As at December 31, 2017, the Bank operated 416 ATMs and 9,178 point-of-sale terminals; the total Bank staff was 1,506. The Bank follows a consistent policy of Saudization with 85.4% of staff being Saudi nationals at the end of 2017. Females accounted for 18.3% of the workforce.

The Bank has four subsidiary companies, all of which are 100% owned by the Bank viz.,

- Alistithmar for Financial Securities and Brokerage Company (ICAP) which offers brokerage and other services within the Kingdom.

- The Saudi Investment Real Estate Company; the main business of which is to hold assets given to the Bank as collateral.

- Saudi Investment First Company Limited. which holds the shares in American Express Saudi Arabia.

- SAIB Markets Limited Company, which the Bank has 100% ownership. This Cayman Islands limited liability company does not have any debt instruments issued. The objective of SAIB Markets Limited Company is trading in derivatives and Repo activities on behalf of the Bank.

In addition the Bank also has investments in the following three associate companies.

- American Express Saudi Arabia, the principal activity of which is to issue credit cards and handle other American Express products in the Kingdom, in which the Bank holds a 50% interest.

- Saudi ORIX Leasing Company, of which the primary business activity is lease financing servicing and in which the Bank has a 38% ownership.

- Amlak International for Finance and Real Estate Development Company which offers real estate finance products and services and in which the Bank has a 32% ownership.

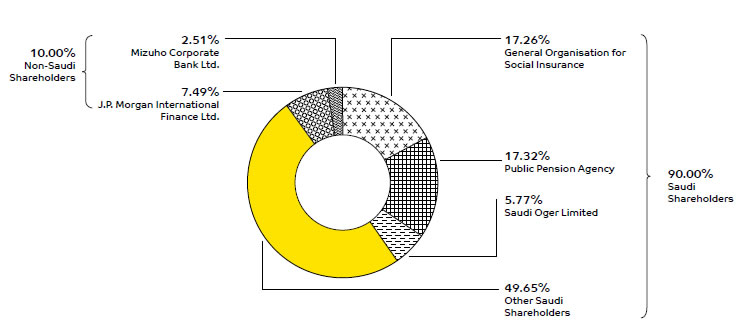

The Bank’s major shareholders with their shareholdings are listed below:

SAIB’s commitment to Vision 2030

SAIB is firmly committed to play a major role in the realisation of Vision 2030 of the Kingdom of Saudi Arabia. The bedrock of the Vision is the following three themes. The detailed goals under the Vision and SAIB’s envisioned contribution are detailed below:

| Theme | Vision | Vision goals | SAIB’s contribution | ||

A Vibrant SocietyA vibrant society with strong roots, fulfilling lives and strong foundations.  |

|

Islamic values | Moderation, tolerance, excellence, discipline and transparency | The Islamic principles of Takleef, Nummow, Re’aya, Hifth and Awn | |

|

Serve Umrah visitors | 30 million Umrah visitors | Infrastructure/tourism infrastructure finance | ||

|

Living healthy, being healthy | 40% of citizens to exercise once a week | Fitness club memberships, football, bowling and basketball teams, awareness campaigns, FlexxBike and healthy dietary tips | ||

|

Developing our cities | 3 KSA cities among top 100 | Urban Infrastructure Project Finance | ||

|

Environmental sustainability | Resource efficiency, pollution reduction, nature conservation | GHG tracking, evaluate EMS, UNPRI and implementation of a Building Management System (BMS) | ||

|

Caring for families | 5% increase in home ownership by 2020. 80% of parents are engaged in school activities by 2020 | Al Asalah Home Finance | ||

|

Developing our children’s character | Empowering educational, cultural and entertainment institutions | Woow Alkhair Programme, Community investment, Minopolis and Kidzania activties | ||

A Thriving EconomyA thriving economy which rewards opportunities, invests for the long term, is open for business and leverages its unique position as the hub of three continents.  |

|

Learning for work | Reduce unemployment to 7%, sector councils, vocational training | 41% youth employment; Programmes such as Fast Track, Graduate Programme and Young Hires | |

|

Small businesses | Small business SMEs contribute 35% to GDP, financial institutions allocate up to 20% of funding to SMEs | SME specific products – 0.22% of funding to SME’s | ||

|

Equal opportunities | 30% female employment | 19.2% female employees, 28% of new hires are women | ||

|

Talent attraction | Improve living and working conditions for non-Saudis | Expatriates personal finance | ||

|

Promising sectors | Renewable energy, industrial equipment, retail, tourism and leisure, digital economy, mining, oil and gas, 75% localisation of oil and gas, 9.5 GWh renewable energy | 2.53% of loan portfolio for environmentally friendly, low carbon activities | ||

|

Business environment | 65% private sector GDP 5.7% FDI of GDP Top 10 Global Competitiveness Index | Specialised products and services, ICAP a signatory to the United Nation Principles for Responsible Investment, Global Reporting Initiative Gold Member, signatory to the United Nations Global Compact | ||

|

Regional logistic hub | Rank 25 in the Logistics Performance Index, Invest in construction of ports, railways, roads and airports | Infrastructure project finance Evaluate Equator Principles | ||

An Ambitious NationAn ambitious nation which is effectively governed and responsibly enabled.  |

|

Embracing transparency | Top 5 E-Government Index | Ranked 7th in S&P Hawkamah ESG Pan Arab Index in 2017 for disclosure of environmental, social and governance (ESG) issues | |

|

Protect vital resources | Build safe and sufficient strategic food reserves | 2.53% of loan portfolio for environmentally friendly projects, low carbon activities | ||

|

Engaging everyone | Interactive, online and smart engagement methods | E-services, online banking, annual and sustainability reporting | ||

|

Responsible lives | 10% household saving Greater financial independence | 4 financial literacy awareness sessions delivered in 2017 | ||

|

Responsible business | Corporate Social Responsibility | Creation and implementation of sustainability strategy and action plan, designated CSR Unit within the Bank | ||

|

Responsible society | 1/3 of NPO projects have deep and measurable social impact 1 million volunteers by 2020 | Increase in community investment, active volunteer program and policy |

Networking

We are a signatory to the United Nations Global Compact (UNGC) which seeks to align the operations of commercial as well as non-profit organisations with principles of human rights, environmental protection, labour, and anti-corruption. Description of the relevance of these four main areas and descriptions of concrete actions taken regarding them have been communicated to UNGC. The methodology of monitoring and evaluating performance as well the outcome of the measurements have also been communicated.

The required behaviour of employees are enshrined in our HR Policy Code of Conduct.

Our investment brokerage subsidiary Alistithmar Capital (ICAP), is also a signatory to the United Nations Principles for Responsible Investment (UNPRI). So far, we are one of two entities in the Kingdom to take this step. UNPRI encapsulates six principles of which three are related to environmental, social, and governance issues. The others are related to advocacy for the principles, joint action regarding the principles, and reporting.