Corporate Governance

Corporate governance encompasses the system of policies, rules, procedures and practices that underpin the stewardship of a bank. It includes not only a well defined documented element but also intangible elements such as culture, ethics, values, integrity, and reputation. Governance involves sustainable value creation in the short and long term while balancing the interests of the diverse stakeholders of the Bank – shareholders, management, customers, business partners, suppliers, employees, Saudi citizens, the Government and the environment. It involves managing the synergies and the trade-offs between the stakeholders. SAIB was the only Bank in the Kingdom which was ranked amongst all Saudi listed companies at the 1st Corporate Governance Office Conference hosted at Al Faisal University 2017 in collaboration with Harvard University. The Bank was also ranked among the top 10 in the 2017 S&P Hawkamah Pan Arab Index for Environmental, Social and Corporate Governance Practices in the Middle East and North Africa Region.

Compliance

The Bank fully complies with the Principles of Corporate Governance for banks operating in Saudi Arabia issued by Saudi Arabian Monetary Authority (SAMA) in March 2014. The Bank also complies with the Corporate Governance Guidelines in the Rules Governing Companies in the Kingdom issued by the Capital Market Authority of Saudi Arabia (CMA) on 21/10/1427H corresponding to 12/11/2006G and all the subsequent amendments except the following:

General principles

The main principles of corporate governance at SAIB are:

- Exercising internal control, driven by the Board and supported by documented guidelines to safeguard the interests of all stakeholders.

- The framework, policies, procedures, and processes to effectively identify, monitor and control risks and minimise their impact.

- The timely and accurate flow of information in a sufficient level of detail to internal and external stakeholders including regulators, investors, and employees.

- Demonstrate commitment and follow strong, ethical and effective governance by continuous monitoring, follow-up and improvement.

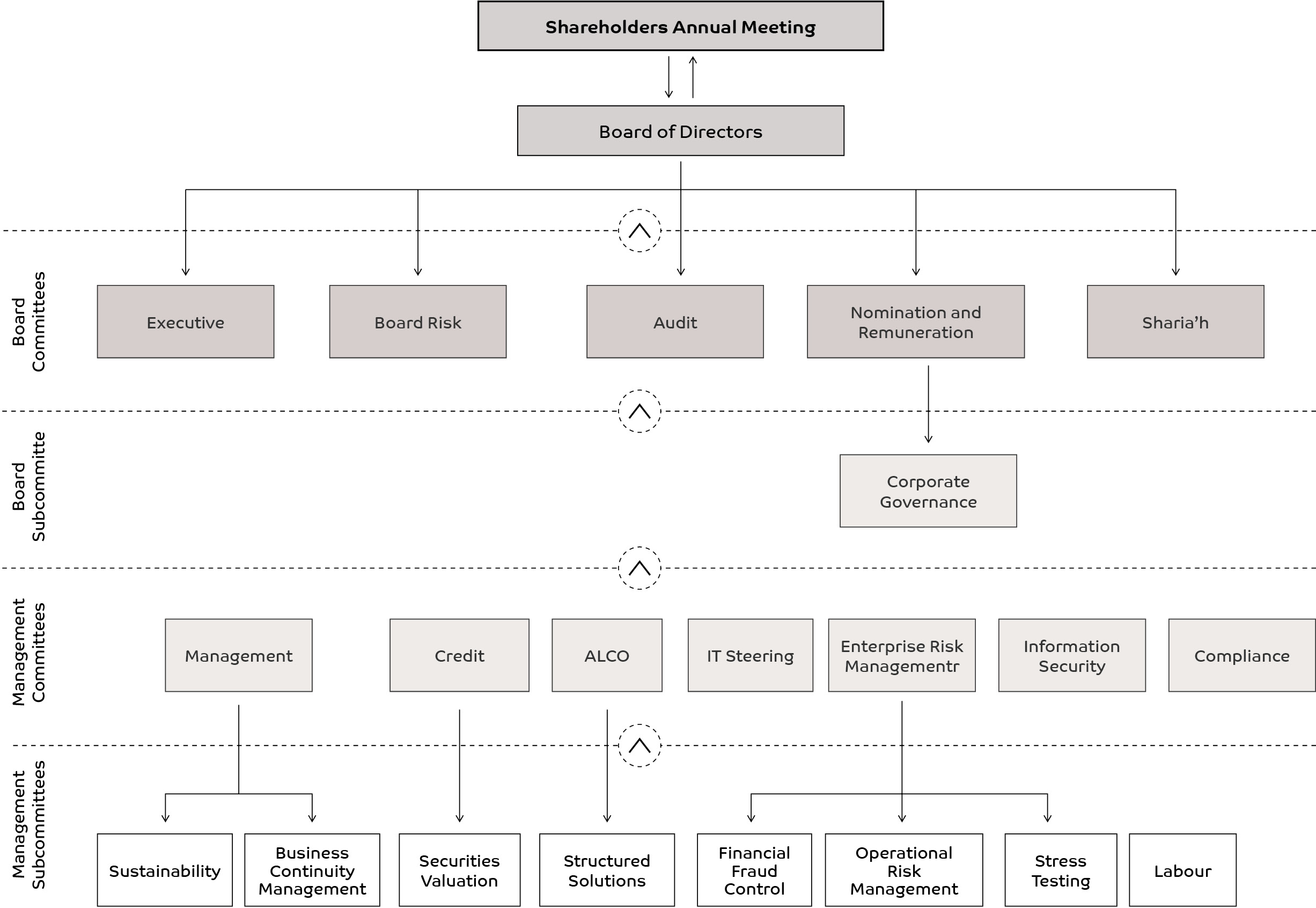

Governance structure

Our corporate governance structure has three broad pillars; establishing strategic direction; executing strategy and managing risks; and stewardship through conformity with policy and established procedures.

This governance structure is underpinned by policies and practices to ensure good corporate governance, values and ethics, organisation structure design, adherence to policies, efficient and effective procedures, the Bank’s authorities matrix and effective internal and external communication.

The Bank’s governance framework, the Board Executive Management governance structures, the key policies, guidelines and control functions, and duties and restrictions on Board members are clearly set out in the corporate governance manual. The General Manager – Corporate Governance, overseen by the Bank’s Corporate Governance Subcommittee is responsible for keeping the manual regularly updated.

The manual, is accessible to the general public via the Bank's website.

Employees and others who wish to contact the Board or any member of the Audit Committee to make any complaint or report any concern with respect to fraud, financial matters and restitution, noncompliance with laws and any other matters, may do so anonymously via the online submission form found on the Bank's website.

The manual is in accordance with the guidelines of the regulatory authorities; SAMA, the CMA and the Basel Committee on Banking Supervision. It is updated to be kept in line with the requirements of these regulatory authorities.

The Bank’s governance structure is depicted in the diagram below:

Board of Directors

The General Assembly will appoint the members of the Board in accordance with the procedures for such appointment approved by itself. The Board members are appointed for a period of three years and membership for more than 12 consecutive years is discouraged in accordance with SAMAs Principles of Corporate Governance. Subject to the foregoing, Board members may be reappointed unless provided otherwise in the Articles of Association. Compensation to Board members will be in accordance with SAMA regulations and any other relevant regulations.

Board composition

The Board should consist of at least nine members of which not more than two should be executives of the Bank. The Board members should have the blend of skills, expertise and knowledge to guide the Bank and ensure good governance.

The criteria for Board membership in terms of past records for honesty, integrity, reputation, and personal financial soundness are also specified. In addition members of the Board are also required to be able to function independently and be free of conflicts of interest. The Chairman and Vice-Chairman are required to be Non-Executive Directors. No member of the SAIB Board may serve on the Board of another Saudi bank licensed and incorporated in the Kingdom, on the Board of another financial institution that may cause a conflict of interest, on the Board of a significant or potentially significant competitor, or on the Board of more than four other listed companies. Board members have a duty to keep the Bank informed about all participation in Boards outside the Bank and executive positions they hold in other listed companies.

The members of the Board have diverse strengths and experience including banking, IT, commerce, regulatory functions, audit, capital markets, and strategic planning. The composition of the Board conforms to the requirements laid down in the governance manual. The Board presently consists of nine members, of which five are Non-Executive Directors and four are Independent Directors.

The details of the members of the Board including area of expertise, status, date of appointment, number of Board meetings attended and other directorships held are given in the table below:

| Name | Status | Classification | Date of appointment | No. of Board meetings attended |

Other directorships | |

| Mr. Abdallah Saleh Jum’ah | Chairman | Non-Executive | February 14, 2010 | 4 | Board member, Hassana Investment Company (UL) Board member, Saudi Arabian Airlines Corporation (UL) The Saudi Investment Bank (L) Vice-Chairman, Zamil Industrial (L) |

|

| Mr. Abdulaziz Al-Khamis | Vice-Chairman | Non-Executive | February 14, 2007 | 4 | Tawuniya Insurance Co. – Board Director The Saudi Investment Bank The United Insurance Co. Bahrain | |

| Dr. Fouad Al Saleh | Board member | Non-Executive | February 14, 2013 | 4 | The Saudi Investment Bank | |

| Dr. Abdulraouf Mannaa | Board member | Independent | February 14, 2010 | 3 | The Saudi Investment Bank | |

| Dr. Abdulaziz Alnowaiser | Board member | Independent | February 14, 2013 | 4 | The Saudi Investment Bank | |

| Mr. Abdulrahman Al-Rawwaf | Board member | Non-Executive | February 14, 2010 | 4 | The Saudi Investment Bank | |

| Mr. Mishari Al-Mishari | Board member | Non-Executive | February 14, 2010 | 4 | Board member of the Saudi Re-Insurance Co. The Saudi Investment Bank Board member of Hana food Industries Company Chairman of Droob AlElm for Training and Education | |

| Mr. Muhammed Al-Ali | Board member | Independent | July 1, 2014 | 3 | The Saudi Investment Bank Saudi Energy Efficiency Services Company | |

| Mr. Saleh Al-Athel | Board member | Independent | February 14, 2014 | 4 | Board member Saudi Telecommunication Company The Saudi Investment Bank |

The following collective skills in the respective fields are required from members of the Board:

Banking experience

Three to four members of the Board should have the following experience.

- At least 15 years banking experience

- Previously been a member of the board in a bank, a bank CEO or a senior executive of a bank.

There should be at least one member which each of the following:

- Strong risk management expertise in banking

- Strong IT expertise in banking

Commercial experience

Three to four members of the Board should have the following skills and experience.

- Extensive commercial experience and network within the Saudi market

- Collective experience should cover key Saudi economic sectors

Regulatory skills and experience

One or two members should have strong regulatory skills and experience

- Ten to fifteen years in banking regulatory function, or

- Central Bank regulatory experience at a senior level or senior banking experience with deep regulatory focus

Audit/Governance

One or two members of the Board should have strong audit/governance skills as follows;

- Over 15 years of audit, compliance or governance experience

- Previously partner at a big 4 accounting firm or a senior executive in an audit, compliance or governance role

Other skills that Board members should possess include are but are not limited to include:

- Capital markets

- Financial Stability Issues

- Strategic Planning

- Compensation

- Corporate Governance

Responsibilities of the Board

The responsibilities of the Board may be grouped as strategy responsibilities, risk responsibilities, performance management responsibilities, and organisational responsibilities.

They include crafting and implementing strategy, approving policies and plans, ensuring effectiveness of internal controls, ensuring compliance with laws and regulations, risk management, performance management, being responsible for the appointment/removal of key members of the management team, approval of compensation packages and setting the cultural and ethical tone of the Bank.

A Board member has a fiduciary duty to keep confidential all non-public information he has obtained in the course of his duties. No member shall use confidential information for his own personal benefit or for the benefit of any person/entity inside or outside the Bank. A Board member may divulge confidential information, whether during or after his service, only with the written permission of the Chairman of the Board.

Board process

The number of general Board meetings should be at least the minimum required by Saudi laws and the meetings should be scheduled at the beginning of the year. Additional or extraordinary meetings can be convened or requested by the Chairman and two or more Board members. The agenda and information packs for meetings should be sent out at least seven days in advance and the Board Secretary is responsible for this. For extraordinary meetings it should be sent as much in advance as feasible. In addition to face-to-face meetings teleconference or videoconference meetings are also permissible. The quorum for a Board meeting shall be:

- The Chairman or Vice-Chairman

- At least five Board members either in person or by an authorised representation by another Board member subject to the fact that a Board member may not represent more than one member.

Board decisions shall be by a simple majority of members present or represented with the Chairman’s (or Vice-Chairman’s in his absence) vote being the deciding vote in the case of a tie.

The Board Secretary is tasked with assisting the Chairman in the smooth functioning and logistics of the Board and Board Committee meetings. He should maintain minutes of meetings including discussions, votes, objections, and abstentions from voting. Minutes should be dispatched not later than 10 days from the meeting date.

The details of the attendance at the respective Board meetings are given below:

| Date of meeting | Directors present | |

| March 23, 2017 | Mr. Abdallah Saleh Jum’ah – Chairman Mr. Abdulaziz Al-Khamis – Vice-Chairman Mr. Abdul Rahman Al-Rawaf Dr. Abdulaziz Alnowaiser Dr. Abdulraouf M. Mannaa Dr. Fouad Al-Saleh Mr. Mishari Al Mishari Mr. Saleh Al Athel Mr. Mohammed Al Ali |

|

| May 25, 2017 | Mr. Abdallah Saleh Jum’ah – Chairman Mr. Abdulaziz Al-Khamis – Vice-Chairman Mr. Abdul Rahman Al-Rawaf Dr. Abdulaziz Alnowaiser Dr. Fouad Al-Saleh Mr. Mishari Al Mishari Mr. Saleh Al Athel |

|

| September 26, 2017 | Mr. Abdallah Saleh Jum’ah – Chairman Mr. Abdulaziz Al-Khamis – Vice-Chairman Mr. Abdul Rahman Al-Rawaf Dr. Abdulaziz Alnowaiser Dr. Abdulraouf M Mannaa Dr. Fouad Al-Saleh Mr. Mishari Al Mishari Mr. Saleh Al Athel Mr. Mohammed Al Ali |

|

| December 11, 2017 |

Mr. Abdallah Saleh Jum’ah – Chairman Mr. Abdulaziz Al-Khamis – Vice-Chairman Mr. Abdul Rahman Al-Rawaf Dr. Abdulaziz Alnowaiser Dr. Abdulraouf M. Mannaa Dr. Fouad Al-Saleh Mr. Mishari Al Mishari Mr. Saleh Al Athel Mr. Mohammed Al Ali |

Board committees

The ultimate responsibility for safeguarding the interests of SAIB through effective governance lies with the Board of Directors. The Board is supported in its governance function by several committees; five Board Committees and one Board subcommittee. The Board Committees are:

- Board Executive Committee

- Board Risk Committee

- Board Audit Committee

- Board Nominations and Remuneration Committee

- Board Shariah Committee

Functions and Responsibilities of the Board Committees

| Committee | Responsibilities |

| Board Executive Committee | Oversee SAIB’s business strategy and its execution |

| Risk Committee | Advise the Board on current and future strategies for the Bank’s risk management and oversee execution of such strategies. |

| Audit committee | To assist the Board of Directors in its oversight of financial control, financial reporting, internal controls, internal and external audit |

| Nominations and Remuneration Committee | To make recommendations for new Board appointments and senior management appointments; assess the effectiveness of the Board together with the Corporate Governance sub-committee; oversee the Bank’s human resources policies including the design and operation of the compensations system |

| Shariah Committee | Ensuring the Bank’s compliance with Shariah principles |

Board Committee Members

| Executive Committee | Audit Committee | Nomination and Remuneration Committee | Risk Committee | Shariah Committee |

| Mr. Abdulaziz Al-Khamis, (Chairman) |

Mr. Muhammad Al Ali (Chairman) | Dr. Abdulaziz Al Nowaiser (Chairman) | Mr. Mishari Al-Mishari (Chairman) | Dr. Muhammad Ali Elgari (Chairman) |

| Mr. Abdulrahman Al-Rawwaf | Dr. Fouad Al-Saleh | Dr. Abdulraouf Mannaa | Mr. Abdulrahman Al-Rawwaf | Dr. Fahad Nafl Alsigheir |

| Dr. Fouad Al-Saleh | Mr. Abdullah Al-Anizi (non-board) | Mr. Mishari Al-Mishari | Mr. Muhammad Al Ali | Dr. AbdulAziz Ahmad Almezeini |

| Mr. Mishari Al-Mishari | Mr. Mnahi Al-Muraki (non-board) | Mr. Saleh Al- Athel | Dr. Abdulraouf Mannaa | |

| Dr. Abdulaziz Alnowaiser | Mr. Saleh Al-Khulaifi (non-board) | Mr. Abdulrahman Al-Rawwaf | Dr. Abdulaziz Alnowaiser |

Board Committee Meeting Attendance

| Board Committee Member | |||||||||||||||

| Board Committee | Meeting date | Mr. Abdulaziz Al-Khamis | Dr. Fouad Al Saleh | Dr. Abdulraouf Mannaa | Dr. Abdulaziz Alnowaiser | Mr. Abdulrahman Al-Rawwaf | Mr. Mishari Al-Mishari | Mr. Muhammad Al-Ali | Mr. Saleh Al-Athel | Mr. Saleh Al-Khulaifi | Mr. Mnahi Al-Muraki | Mr. Abdullah Al-Anizi | Dr. Muhammad Ali Elgari | Dr. Fahad Nafl Alsigheir | Dr. AbdulAziz Ahmad Almezeini |

| Executive Committee | January 23, 2017 | ||||||||||||||

| February 28, 2017 | |||||||||||||||

| March 21, 2017 | |||||||||||||||

| April 18, 2017 | Ab | ||||||||||||||

| April 30, 2017 | |||||||||||||||

| May 25, 2017 | |||||||||||||||

| June 20, 2017 | |||||||||||||||

| July 23, 2017 | |||||||||||||||

| September 19, 2017 | Ab | ||||||||||||||

| October 02, 2017 | |||||||||||||||

| October 24, 2017 | |||||||||||||||

| November 21, 2017 | |||||||||||||||

| December 14, 2017 | |||||||||||||||

| Audit Committee |

February 06, 2017 | ||||||||||||||

| March 22, 2017 | Ab | ||||||||||||||

| May 23, 2017 | |||||||||||||||

| September 25, 2017 | |||||||||||||||

| December 10, 2017 | |||||||||||||||

| Nomination and Remuneration Committee |

January 03, 2017 | ||||||||||||||

| April 18, 2017 | Ab | ||||||||||||||

| September 19, 2017 | |||||||||||||||

| November 27, 2017 | |||||||||||||||

| Risk Committee | January 22, 2017 | ||||||||||||||

| March 06, 2017 | Ab | ||||||||||||||

| April 30, 2017 | Ab | ||||||||||||||

| September 19, 2017 | Ab | ||||||||||||||

| November 27, 2017 | |||||||||||||||

| Shariah Committee |

February 16, 2017 | ||||||||||||||

| April 27, 2017 | |||||||||||||||

| June 06, 2017 | |||||||||||||||

| November 08, 2017 | |||||||||||||||

| December 05, 2017 | |||||||||||||||

| December 21, 2017 | |||||||||||||||

Board subcommittee

There is one Board subcommittee which is on corporate governance.

The role of the Corporate Governance Subcommittee is to ensure that corporate governance systems and procedures are in line with international standards and that these standards are followed throughout the Bank. The Committee reports to the Board Nominations and Remuneration Committee.

The General Manager – Corporate Governance, performs the role of the executive arm of the subcommittee at management level. He is charged with ensuring observance of sound Corporate Governance Policies.

Board Sub-Committee Membership and Meeting Attendance

| Board Subcommittee | Meeting date | Board Subcommittee Members | ||

| Dr Abdulraouf Mannaa | Dr Abdulaziz Alnowaiser | Mr Saleh Al-Athel | ||

| Corporate Governance | September 25, 2017 | |||

| November 23, 2017 | ||||

Management

The Board is responsible for the appointment of the CEO and the continuing evaluation of his performance. There should be clear division of responsibilities between the Chairman and the CEO to ensure separation of the roles of Executive Management and the Board.

The management process is overseen through a system of management committees and subcommittees.

Management committees

Management committees execute policies and directives issued by the Board and the Senior Management and also recommend, decide, approve and monitor matters in their area of specialisation. They also provide platform for exchange of views at Senior Management level in a formal manner.

There are seven Management Committees which are listed below:

- Management Committee

- Credit Committee

- Asset and Liability Committee

- IT Steering Committee

- Enterprise Risk Management Committee

- Information Security Committee

- Compliance Committee

Functions and Responsibilities of the Management Committees

| Committee | Functions |

| Management Committee | To monitor and manage the execution of the Bank’s overall strategy, sustainability strategy, business continuity management, financial and operational performance, customer experience and oversee the implementation of the recommendations of other committees |

| Credit Committee | Approving, reviewing and monitoring of credit risk and activities and overall credit risk management function |

| Asset and Liability Committee | Monitor and manage the balance of assets and liabilities |

| IT Steering Committee | Establish and enforce the IT and project management standards, procedures, policies and standards throughout the Bank |

| Enterprise Risk Management Committee | Support the implementation of sound practices for managing enterprise risk, in coordination with the other risk functions. This includes financial fraud management, operational risk management and stress testing. |

| Information Security Committee | To discuss and disseminate information security issues taking a multi-disciplinary perspective |

| Compliance Committee | Ensuring adherence and ensuring efficient implementation of the compliance policies and function at the Bank in accordance with the principles and controls established by SAMA |

Management subcommittees

The Management Subcommittees make recommendations on a specific topic to a predetermined Management or Board Committee.

There are eight Management Subcommittees which are listed below:

- Sustainability Subcommittee

- Business Continuity Subcommittee

- Securities Valuation Subcommittee

- Structures Solution Approval Subcommittee

- Financial Fraud Control Subcommittee

- Operational Risk Management Subcommittee

- Stress Testing Subcommittee

- Labour Subcommittee

Functions and Responsibilities of the Management Sub-committees

| Committee | Functions |

| Sustainability Sub-Committee | Performing an oversight, advocacy and advisory role in supporting the implementation of the SAIB sustainability framework |

| Business Continuity Sub- Committee | Functions and Responsibilities relating to responding to contingency situations/ disasters |

| Securities Valuation Sub- Committee | Assist the Management Credit Committee in fulfilling its responsibilities especially by recommending the fair values of securities offered as collateral |

| Structures Solution Approval Sub- Committee | To support the recommendation, introduction and review of structured solutions products to the Bank’s portfolio |

| Financial Fraud Control Sub- Committee | Ensure and oversee that policies and preventive measures are developed /adopted to mitigate the impact and occurrence of fraud risks |

| Operational Risk Management Sub- Committee | Oversee the effective implementation of policies for management of environmental risk |

| Stress Testing Sub- Committee | Management of stress tests in accordance with SAMA guidelines to protect the Bank’s capital and profitability |

| Labour Sub- Committee | Ensure that the working environment of Bank conforms to the regulatory requirement |

Since Board members have no individual power to give directives to members of the staff, communication between Board members and management outside of Board and Board Subcommittee meetings should be through the Corporate Secretary who will then obtain the consent of the Chief Executive Officer for the meeting or contact. The CEO can opt to participate in the discussion if he so desires.

Financial disclosure and transparency

SAIB follows the:

- International Financial Reporting Standards (IFRS) as modified by SAMA for the accounting of Zakat and Income Tax, which requires adoption of all IFRS as issued by the International Accounting Standards Board (IASB) except for the application of International Accounting Standard (IAS) 12 – “Income Taxes” and IFRIC 21 – “Levies” in so far as these relate to Zakat and Income Tax. As for the SAMA Circular No. 381000074519 dated April 11, 2017 and subsequent amendments through certain clarifications relating to the accounting for Zakat and Income Tax (SAMA Circular), the Zakat and Income Tax are to be accrued on a quarterly basis through shareholders’ equity under retained earnings; and

- Are in compliance with the Banking Control Law, the applicable provisions of regulations for companies in the Kingdom of Saudi Arabia, and the Bank’s Articles of Association.

The Financial Statements for the year ended December 31, 2017 have been approved by the Directors in detail to ensure that they present a true and fair view of Company’s affairs for the period under review.

IT governance

Information technology plays a vital role in the Bank’s strategy and operations across all business units and supporting divisions. The Bank has a clear IT strategy which has been crafted to give the Bank a competitive edge in the market. All IT activities and projects are conducted in accordance with best practices and standards including the following.

- ISO 20000

- The System Development Life Cycle

- Bank’s IT Policies and Procedures

- Project Management Frameworks

- IT Architecture Standards

- Cyber Security Standards

The Bank’s IT strategy has been developed to contribute to the Bank’s overall strategy by alignment with the business strategy.

SAIB has a comprehensive Information Security Policy which is the foundation of the Information Security Management Security (ISMS). ISMS is intended to safeguard the Bank’s digital assets and processing facilities. It thereby assures the information security interests of customers, employees and other stakeholders by minimising exposures to risks. A management framework has been put in place defining the roles and responsibilities to implement the ISMS. All digital assets should have a nominated owner and rules for accessible use should be established. Access to IT systems and facilities are on a “least privilege” and “need to know” basis. Critical and sensitive information processing facilities should be housed in secure areas with appropriate security barriers and entry controls.

A consistently configured environment should be maintained which is secure against known vulnerabilities in operating systems, network components/software and application software. Appropriate controls should be installed to make swift, effective, and appropriate responses to information security incidents including communication on security incidents and weaknesses.

Ethics and standards

The Bank maintains high ethical and professional standards in all its activities which are governed by a code of conduct. The Code of Conduct ensures that a culture of professionalism is maintained where ethical standards prevail. The Code of Conduct is based on fundamental principles of ethics, confidentiality, and professionalism. It applies to all persons who may represent the Bank including Directors, employees, consultants and affiliates. The importance of following ethical standards is instilled into employees in the process of training and career development. The Code of Conduct provides a guide for making ethical decisions in day-to-day operations. The Bank operates under the governing authority of its Board of Directors which oversees the implementation of the ethical standards and code of conduct. The Board is governed by the Directors Code of Conduct.

Internal control

An effective system of internal controls is an indispensable component of good corporate governance and is necessary to achieve the strategic objectives of the Bank. A system of internal controls includes the policies, procedures, systems, and processes required to ensure effective, efficient, and ethical functioning of the Bank.

Internal controls are overseen by the Internal Control Unit which is independent of the line management of the Bank. The Unit is responsible for assessing the adequacy and effectiveness of the internal controls across the Bank. The Unit reports its significant and material findings to the Audit Committee.

Internal control is not merely a top-down process. Efforts are made by all functions of the Bank to make a contribution towards reviewing and streamlining controls. The Audit Committee actively monitors the internal controls to safeguard the interests of the Bank. The internal control system has been designed to provide reasonable assurance to the Board on minimising risks and safeguarding assets. However, the management is very conscious of the fact that no system is absolutely foolproof and may not detect all possible control deficiencies. Moreover the changes in products, services and operations may place new demands on the rigour of control systems. The control system needs to be tested at regular intervals and revisions to the system made if necessary.

Whistleblowing

We have policies and procedures in place to ensure that the Bank complies with the applicable laws and regulations of Saudi Arabia, and that we follow international guidelines and recognised principles for ethical behaviour within the Bank. The SAIB Code of Conduct provides specific guidelines on how employees are expected to behave in a number of areas, including dealing with inside information, conflicts of interest and whistleblowing, Our whistle-blowing policy is designed to allow employees to report possible breaches of our Code of Conduct or other laws, rules, regulations and guidelines applicable to our operations, to the CEO or the General Manager – Human Resources in good faith, without fear that their action may have adverse personal consequences. Externally, the Bank has a portal on its website for external parties to report possible breaches of laws and regulations to the Company which are handled by the Bank’s Governance Department.

Notable activities during 2017

- Corporate Governance conducted revision of all Committee Charters, the Bank’s major policies and reporting and the key functions where the Board of Directors’ approval is are required.

- Ensured the completeness and compliance of all policies and committee’s charters to be in line with SAMA and CMA guidelines as well as the overall effectiveness of the process implemented.

- Tracked and initiated the review of policies and charters at Board and Management level.

- Conducted orientation sessions to senior management and Board Members on corporate governance and provided additional workshops for Directors on current issues.