Social and Environmental Capital

At SAIB we fervently believe that we have a social responsibility to contribute to preserving the environment. We strive to minimise our direct impact on the environment through our waste and emissions as well as our energy and water use. Beyond this, we also seek to minimise our indirect impact through our value chain. The Bank has adopted an Environmental Management System to give a formal structure to our environmental policies. Climate change is a major issue facing the global community today. As part of our CSR programmes we use social media to educate our stakeholders on the importance of climate change.

Environmental protection (Hifth), which entails the sustainable use of natural resources is one of the five pillars on which our sustainability framework rests. Our activities consume environmental resources and produce waste and emissions both directly through our operations and indirectly through our value chain. We believe that safeguarding the environment and conserving resources will lead to sustainable value creation in the long term. The Bank is committed to complying with or exceeding the environmental requirements of the Kingdom. The fact that we have included environmental protection as one of our core pillars demonstrates our commitment to supporting the Kingdom’s Vision 2030 programme. Vision 2030 enunciates the importance of preserving the environment and natural resources as part of our Islamic, human and moral duties. Doing so is part of our responsibility to future generations.

Beyond this, we are very conscious of the global threat of climate change. We, through our CSR awareness efforts using social media, actively educate all our stakeholders to promote the cause of combating climate change. Our commitment to combating climate change is further supported by our status as a signatory to the United National Global Compact and our Communication on Progress (COP) submission. The Bank's COP met all the minimum requirements and qualifies the Bank for the Global Compact Active Level. The COP and self-assessment is publicly available on the UN Global Com act website. https://www.unglobalcompact.org/what-is-gc/participants/61161

The specific environmental initiatives include monitoring and reducing energy use, greenhouse gas emissions, paper consumption and water consumption; managing and reducing waste by reduction, recycling; investing in energy efficient technologies; and giving consideration to environmental considerations in all aspects of our buildings.

Environmental management system

The Bank has adopted a systematic approach to environmental management by implementing an Environmental Management System (EMS). The EMS is aligned with the ISO14001 standard. The Bank has also developed a Standard Operating and Accounting Procedure (SOAP) detailing how the system is operationally managed. This framework is used as a tool for reducing and mitigating adverse impacts on the environment, assisting the Bank in fulfilment of compliance obligations and mitigating the potential impact of environmental conditions on the organisation. It is also crafted to realise the financial and operational benefits of sound environmental practices and communicate environmental information to related parties.

In 2017, the Bank was awarded the ISO14001:2015 for banking services including ATM services and operations. This accolade reaffirms the effectiveness of the incorporation of SAIB’s environmental policies into its core activities. By doing so, we not only fulfil our social responsibilities; it will also be a source of competitive advantage in the long term.

The mechanisms that the EMS adopts to achieve its objectives are ascertaining the needs and expectations of stakeholders regarding SAIB’s environmental impacts; identifying the environmental conditions that can affect the organisation; identifying the environmental impact of SAIB's activities, products and services; defining organisational risks and opportunities pertaining to the environment; providing a framework for implementing SAIB's environmental policies and deciding on KPIs for evaluating performance.

Environmental risks and opportunities need to be prioritised for the EMS to be implemented. The Bank maintains a complete documented inventory of environmental aspects, impacts, risks, and opportunities. A full environmental materiality assessment is conducted by using a risk assessment matrix. In the risk assessment matrix all environmental aspects are rated according to the likelihood and severity of associated risks. All aspects are classified as high, medium, low, or negligible risks. This classification is made taking into account both the likelihood and the consequences.

Roles of organisational units

The EMS also lays down the responsibilities of the respective organisational units.

The Management bears general responsibilities for endorsing the environmental policy and EMS, communicating the importance of EMS, assigning of key personnel for EMS, providing necessary resources, overseeing implementation, fulfilment of compliance obligations, and promoting continuous improvement. The roles that personnel have to play is further strengthened by the HR Department by identifying and implementing training needs connected with environmental management, integrating environmental performance into performance management and appraisal systems, promoting understanding of environmental policy and ensuring that individuals are aware of their roles and responsibilities throughout the organisation.

The Administration Department has several responsibilities including the following:

- Coordination of the establishment, implementation and review of the EMS;

- Developing environmental objectives, targets and processes as well as action plans for each objective;

- Preparing environmental budgets and training plans;

- Communications on environmental matters both internal and external;

- Tracking and reporting on performance;

- Identifying actual and potential non-conformities; correcting and preventing non- conformities.

The Finance Department tracks data on environmental management costs and conducts economic feasibility studies on environmental initiatives. The roles that the Procurement Department plays relate to aligning procurement policies with the environmental policies, drawing up environmental criteria for procurement and suppliers, and monitoring supplier environmental performance.

The Operational Risk Management Department is responsible for reviewing the SOAP from the operational risk angle, identifying operational risks and recommending solutions while the Compliance Department reviews the SOAP from a regulatory angle. The Fraud Prevention and Detection Department looks at the SOAP from a fraud vulnerability angle.

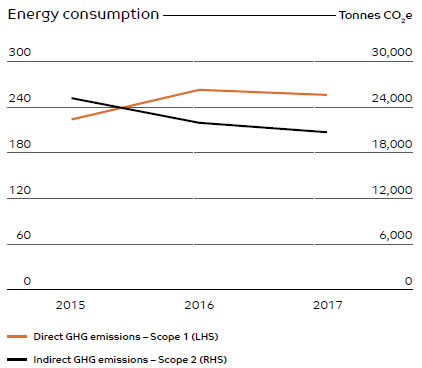

Energy usage and emissions

We need to preserve a habitable planet for our children and climate change is one of the major issues confronting mankind today. However, climate change provides commercial opportunities by way of green alternatives to industrial processes and energy generation. Although, as a financial organisation our direct impact is limited, we can and do strive to play a broader role through our value chain.

The Bank’s direct energy usage comes from:

- Energy usage in our service infrastructure which has to be at a level to provide a comfortable environment for our employees and customers.

- Usage in our technical infrastructure especially data centres, which supports our online and mobile banking facilities.

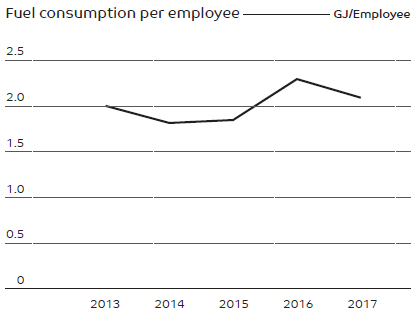

- Fuel consumption for inter-branch travelling.

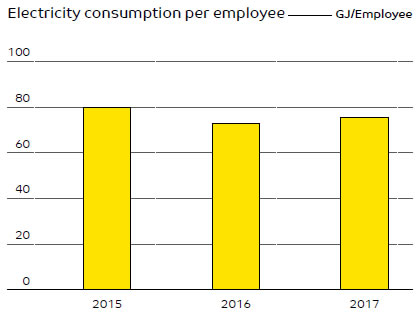

To quantify the impact SAIB began tracking its energy consumption (mwH) and energy expenditure (SAR) in 2014.

Energy consumption

| Item | Unit | 2017 | 2016 | 2015 | 2014 | 2013 |

| Electricity consumption | mwH | 32,596 | 33,541 | 38,610 | Not available | Not available |

| Electricity consumption | GJ | 122,687 | 120,748 | 138,996 | Not available | Not available |

| Electricity expenditure | SAR | 10,132,628 | 9,877,600 | 9,167,956 | 8,211,304 | 7,430,766 |

| Direct GHG emissions – Scope 1 (Electricity usage) | Tonnes CO2e | 257 | 264 | 223 | 197 | 195 |

| Indirect GHG emissions – Scope 2 (Electricity usage) | Tonnes CO2e | 20,673 | 21,936 | 25,251 | Not available | Not available |

| Petrol fuel consumption | litres | 107,310 | 110,005 | 93,011 | 82,264 | 81,269 |

| Petrol fuel consumption | GJ | 8,584 | 8,813 | 3,224 | 2,851 | 2,817 |

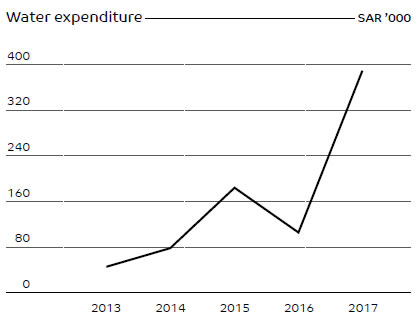

Water consumption

The climatic conditions and terrain of Saudi Arabia naturally make water a scarce commodity. We are therefore forced to rely on our limited ground water and costly desalinised water to meet our water requirements. To ensure our future sustainability we need to economise on our water consumption.

Given the size of our total workforce (numbering 1,625) there is a significant water consumption in our offices. Water consumption meters which have been installed across our entire Branch network give our water consumption accurately. Our monthly water consumption is logged into our Building Management System (BMS).

Water expenditure

| Year | Expenditure SAR ’000 |

| 2017 | 580 |

| 2016 | 174 |

| 2015 | 293 |

| 2014 | 112 |

| 2013 | 58 |

A steep increase in expenditure on water was experienced during the year due to revisions made to municipal charges on water.

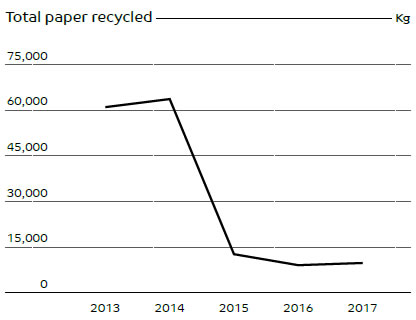

Paper consumption and recycling

Another area where SAIB is contributing to sustainability is by reducing its paper consumption. We have an ongoing programme of digitising our policies and processes, one example is that at our ATMs receipts are not printed unless requested and we exhort customers to minimise printing. In 2017, our paper consumption per employee was 49kgs. The Bank continues to ensures that usage of paper is optimal.

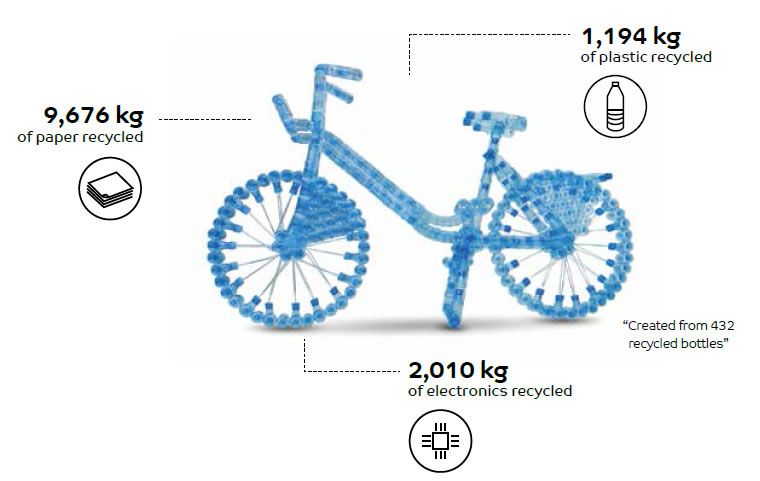

In addition to reducing paper consumption, waste paper is segregated, shredded and wherever possible recycled. In 2017 we recycled 9,676kgs of paper.

Paper consumption

| Unit | 2017 | 2016 | 2015 | 2014 | 2013 | |

| Paper consumption | kg | 73,995 | 64,187 | 73,372 | 67,098 | 62,644 |

| Paper consumption per employee | kg/Employee | 49 | 39 | 42 | 43 | 45 |

| Total paper recycled | kg | 9,676 | 8,852 | 12,480 | 63,745 | 60,990 |

SAIB participated in the World Earth Hour global day by turning off lights at its three head offices, on March 25th, from 8.30pm – 9.30pm. This was followed by a video published on social media in support of the cause to create a sustainable planet for all.

Another of SAIBs sustainability pillars is helping others (Awn). We fervently believe that being of service to the community enhances our own sustainability. We build long-term strategic relationships with community organisations and through our networks, partnerships and resources we both derive and deliver value. Our social interventions are carefully selected and targeted. We focus our programmes on priority areas defined in our corporate sponsorship policy: financial education, human and social development, environmental protection and community health. We also continuously monitor the effectiveness and efficiency of our social programmes and strive to improve the impact per Saudi Riyal spent.

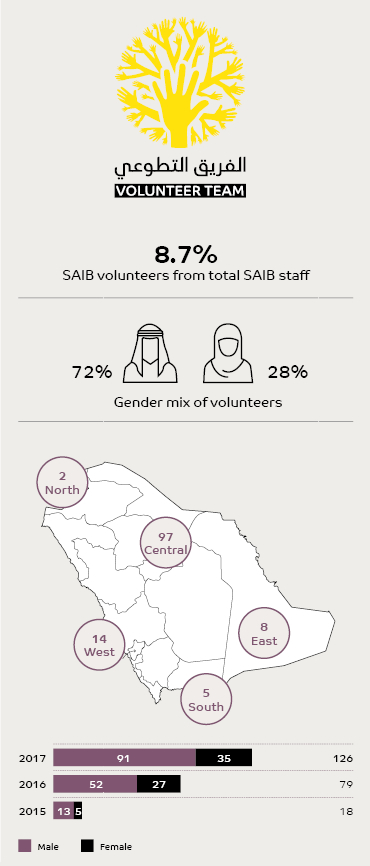

We also encourage our staff to make their own contribution by way of voluntary work for the community. 8.7% of our SAIB Bank staff are registered volunteers, 29% of the Volunteer Team are females.

Initiatives to help the differently abled

A major community-oriented initiative has been sponsored by SAIB in partnership with King Faisal Agricultural University. The University is running a farm which is also rehabilitating and training persons who are differently abled. A graduation ceremony was held for the first batch in September 2017.

A major community-oriented initiative has been sponsored by SAIB in partnership with King Faisal Agricultural University. The University is running a farm which is also rehabilitating and training persons who are differently abled. A graduation ceremony was held for the first batch in September 2017.

The project helped build a channel of communication between the University and local communities. It also facilitates the integration of persons with special needs with the community. The Agricultural and Veterinary Research and Training Station hosted the trainees for a six month period in cooperation with the Department of Community Partnership Development, the Special Education Department at the Faculty of Education and the Deanship of Student Affairs. The Association of Persons with Disabilities in Al-Ahsa selected the trainees and provided the University with the details of each trainee. It is now up to the local community institutions and local sectors to provide employment opportunities to the graduates of the programme so that they can become self-sufficient and productive individuals.

Two programmes were also conducted for the benefit of hearing-impaired persons. One was a lecture conducted in cooperation with the King Salman Centre for Disability Research to increase the awareness of deaf culture. In partnership with the same institution we also conducted a creative competition to promote interactive learning and awareness about sign language.

Combining banking with charity

SAIB has also combined its banking products with charitable initiatives. This also reflects our belief in combining our banking initiatives with our religious and cultural values. Our Woow Loyalty Programme awards customers with points for a wide range of transactions. The points are redeemable for numerous gifts and options. Woow AlKhair offers customers the option of donating their Woow points to a large number of charitable organisations and other not-for-profit associations. Woow AlKhair is the channel provided as part of the Woow Loyalty Programme for the points donation to charites, with over 407 million Woow points donated, by our customers, since the programme started in 2015. There are over 40 organisations participating in the Woow AlKhair Programme, with a 200% growth year on year in charities. The mandates of these organisations include health, assistance for disabled, support for women and children, sports and religion.

SAIB was also the official sponsor for a graduation ceremony for 360 Saudi students in the United States which was held in Washington, D.C. demonstrating our commitment to our talented youth. We look forward to the students returning and making their contribution to the future development of the Kingdom of Saudi Arabia.

Corporate social responsibility policy development and advocacy

Our contribution to corporate social responsibility is not limited to the Banks’s own CSR programmes. Beyond this we also play a policy making and advocacy role. The Bank was represented on a Corporate Practices Committee which was tasked with studying the ISO 26000 standard for CSR and customising a local standard. SAIB had the distinction of being the only Bank invited to sit on this Committee and being one of only two private sector companies which participated. The initiative lasted for 11 months and the standard was subsequently launched for public review and comment.

The King Salman Youth Centre also invited SAIB to make a presentation at a forum where the Bank represented the private sector. At this forum the Bank showcased its best practices in CSR and sustainability. Our presentation also gave insights to the participants as to how SAIB's practices could support in achieving the Vision 2030.

The Bank was also invited by the Ministry of Labour and Social Development to participate in a workshop about regulating volunteer work within corporates.

Promoting healthy living

FlexxBike is an innovative social responsibility initiative launched by SAIB. The programme aims to raise the awareness of the importance of health and fitness by encouraging the community to practice cycling in public areas. Members of the public can obtain FlexxBike membership electronically, rent a bike at any time for use from a FlexxBike station and then return it for a moderate fee. FlexxBike stations are solar powered and designed with colours that suit the climate.

Another health-oriented initiative was the partnership with KFU and the Saudi Cycling Federation in hosting the first cycling marathon in Al Hassa, where we also took the opportunity to promote FlexxBike. This also raised the visibility of SAIB in community activity in Al Hassa.

Developing the talents of our youth

Today there is tremendous emphasis on developing the talents of youth in the Kingdom, which is a priority in Vision 2030 and the Bank is seeking to make its contribution.

In line with this objective, we sponsored a SME competition in collaboration with MIT Saudi Arabia to support youth entrepreneurship projects in the Kingdom. The orientation day also created an opportunity to increase awareness of the SAIB Academy and the SAIB brand among the youth. A total of 2,269 projects participated in the programme with 45 projects qualifying for the final stage; SAIB volunteers were among the judges. Participants were also educated at two workshops about banking principles for SMEs. The SAIB brand was also featured in all printing materials at the final event.

Charitable activities

We strive to do whatever is practicable to help the less fortunate members of our society. SAIB volunteers distributed 2,500 school kits through charitable organisations to families in need. The same number of Winter Kits were also distributed similarly, and the beneficiaries included the sons of martyrs. Blood donation campaigns were also conducted quarterly where a total of 86,000 millilitres of blood were donated by SAIB staff.

Community investments

Some of the community activities which were sponsored by the Bank are given below with the related costs. The focus areas included financial literacy, needy children and orphans, needy families and sports:

| Event/List of sponsorships | SAR |

| Kids school kits for needy children | 206,375 |

| Minopolis sponsorship – children’s financial literacy | 250,000 |

| Kidzania sponsorship – children’s financial literacy | 1,600,000 |

| Ramadan Baskets for needy families | 319,280 |

| Winter Blankets for needy families | 72,500 |

| SAIB volunteers day | 10,000 |

| Prince Sultan University scholarships | 1,400,000 |

| Woow AlKhair programme | 1,027,150 |

| EasyPay SAIB T20 Cricket Tournament 2017 | 15,000 |

| Orphans event at Minopolis | 6,401 |

| Deaf week | 6,499 |

| Orphans event at Kidzania | 2,050 |

| Gifts for children at King Khalid University Hospital | 1,120 |

| King Faisal University – sustainable farm project for disabled persons | 1,000,000 |

| Total | 5,916,375 |

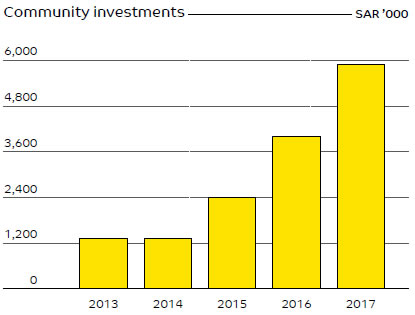

During the year Bank mounted a range of charitable initiatives which are listed above with the related cost. The total expenditure on community investments for the period 2013-17 are shown below:

Employee volunteerism

We encourage our employees to participate in social projects. While this will leverage the Bank’s social commitment it will also give them the satisfaction of helping others. We facilitate the process with our employee volunteering policy which permits employees to donate up to three working days a year towards a charitable cause. A planned volunteer activity is organised every month as part of the employee volunteer programme. The number of volunteers has seen a growth of 60% over the past two years, and of the current 126 volunteers 72% are male and 28% female.