Customer Capital

At SAIB we strive to offer our customers simple, accessible and reliable products and services which provide the best possible financial return. Banking today is a fast evolving and competitive industry. It is moving from traditional bricks and mortar banking to the digital mode. Increasingly customers wish to be able to perform their banking transactions wherever they are and at a click of a button. They also desire services to be available 24X7. We have to leverage the latest technology to cater to these needs. However we have to continue to provide traditional banking services to those of our clientele who still desire the face-to-face contact at a branch.

Banking with SAIB

At SAIB we believe in empowering our customers to grow financially by making investments in simple, accessible and reliable products and services. In the process they create growth for our shareholders and the citizens of the Kingdom. Nummow (growth) is one of our strategic sustainability pillars and we thereby realise value in the short, medium and long term. Another strategic sustainability pillar, Takleef (responsibility), underpins building customer relationships; by being responsible to our customers we in turn earn their trust and loyalty.

We strive to offer the best possible banking experience for our customers, as they are at the heart of our business, and are the drivers of our long-term growth and profitability and one of the key drivers of our sustainability. This means offering the simplest and most accessible products and services to each of our customers at every touchpoint in the most user-friendly manner.

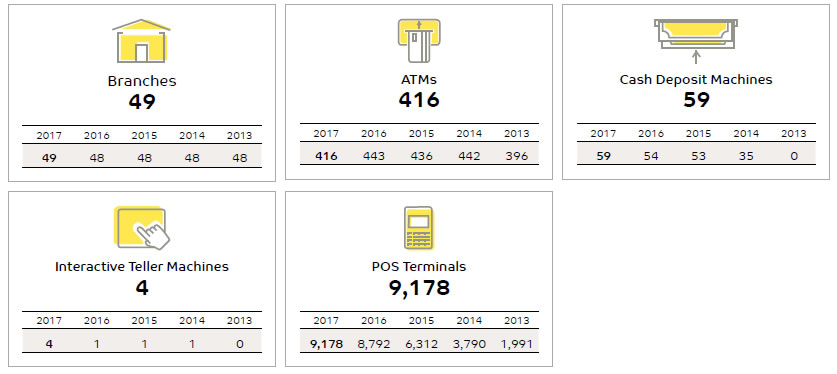

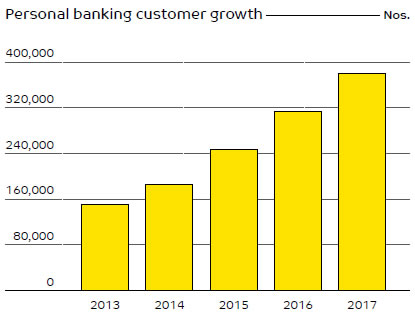

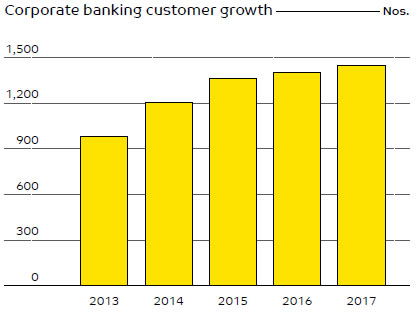

Our customer base includes over 381,571 retail customers, 1,450 large companies and over 15,936 small businesses. We seek to provide a diverse and accessible range of touchpoints to maximise convenience to our customers and to cater to their differing preferences.

Across the Kingdom we have 49 branches, of which 12 include Ladies Sections. In addition, we have 416 ATM’s, 59 cash deposit machines, and 4 interactive teller machines. The number of ATM transactions increased by 15.3% in 2017 over the previous year to 18,319,625. On the other hand, the number of Branch transactions declined by 13.4% to 284,414.

Our digital and mobile service platforms minimise the need for customers to visit bricks and mortar branches if they do not wish to do so. We also provide 24X7 service for those who so desire. Online transactions showed a remarkable increase of 46.7% recording a total of 4,711, 819.These figures confirm the trend of customer preferences. However, we do not neglect the customers who have traditional preferences who desire face-to-face contact at a branch.

E-channel penetration

| UNIT | 2017 | 2016 | 2015 | 2014 | 2013 | |

| SMS alerts | % | 98.00 | 98.25 | 97.53 | 96.22 | 93.00 |

| Flexx Call Phone banking services | % | 51.00 | 45.96 | 54.22 | 30.74 | 29.00 |

| Flexx Click Internet banking services | % | 68.00 | 61.02 | 39.45 | 43.25 | 37.00 |

SAIB’s growth has largely been driven by the unique service offerings and customer experience that SAIB’s ongoing sustainability-driven innovations have made possible. These innovations will continue to be the central showpieces of SAIB’s sustainability efforts and will demonstrate not only how sustainability can shape the core of a Bank, but can also drive its differentiation, top line revenue growth and profitability. Furthermore, the technology, especially automation of transactions, will increase efficiency and will have a positive impact on the bottom line.

Our products and services

We have established business units to cater to the needs of our different customer segments and the appropriate products and services for each segment. All of our main banking segments grew in 2017. Our personal banking customers increased by 21% to reach 381,571; our corporate customers by 30% to reach 1,450; and our small and medium enterprise customers by 16% to reach 15,936. Regarding our service quality, our payment accuracy reached 99.9% while our payment timeliness reached 99.9%.

Personal banking group

Our retail banking segment encompasses a wide spectrum of customers including individuals from both the Government and private sector entities. Customers are served through our widespread network of branches, internet banking channel, mobile banking channel, call centre and an extensive network of ATMs throughout the Kingdom. Our service offerings include a wide range of Shariah-compliant products, such as Murabaha as well as conventional banking.

Our personal banking group, which is the organisational unit of our retail banking, aggressively pushed to expand market share across all retail banking segments and in accordance with our vision and mission statement.

A total of 26 initiatives were initiated or implemented during the year to build our retail banking customer base as well as improve our products and services. Consumer lending and core deposits were aggressively pushed while enhanced offerings were made to our loyalty programmes, our suite of payment cards, payroll and money transfer products. We see much potential in developing the affluent banking segment; a value proposition for this was developed including providing special facilities for such customers at branches. New deposit products were also introduced and roll-out commenced at sales centres. New product units have been created while to streamline customer service and supporting operations, segment teams have been assigned to ladies, youth and affluent customer segments. Revised SAMA rules on dormant, old items and abandoned accounts have been implemented. All Bank forms and agreements have been standardised and rationalised which has resulted in significant cost savings.

New products and services

Among the new products that were launched during the year was the Flexx Transfer Service which provides instant money transfer facilities to six countries. Internet banking with remittance service was enabled for our EasyPay cardholders. We also initiated a zero-interest loan for Taif University students and a further personal finance product. Two home finance products, Madoom and Moyassar, were launched targeting low income Saudi nationals. They will provide finance on easy terms and at reduced cost.

Among the service improvements which were made during the year was an automated appointment system at the Branches which provide customers with a better service experience as well as reducing waiting times. The Interactive Teller Service, which allows, recorded, video-based interaction between a Bank teller and the customer, was expanded to four machines with centralised management via our contact centre. Our remittance services were enhanced with the addition of new foreign currencies.

Corporate banking business group

Our Corporate Banking Business Group (CBBG), caters to the full range of business establishments – large corporates, mid-corporates and of late the SME sector which has migrated from the personal banking group. CBBG develops its strategies to be aligned with Vision 2030 of the Kingdom. CBBG operates from three regional headquarters based in Riyadh, Jeddah and Al-Khobar and strives to provide a wide range of financial products catering to our clientele’s diverse needs and efficient customer services. We make the best use of cutting-edge technology to add value to our products and services. Among our product and service offerings, which span both conventional and Islamic banking, are

- Working Capital Financing

- Trade Finance Services/E-Trade

- Contract Financing

- Project Financing

- Islamic Financing

- Cash Management

- Financial Institutions

- Syndicated Loans

- Treasury Services for Corporates.

In the year under review the Group commenced or implemented 15 initiatives. The Group also continuously strived to increase efficiency by reengineering processes – doing more with less and improving turnaround times.

The Group’s performance during the year is highly commendable in view of the fact that the Bank faced major headwinds in the form of the general economic slowdown as a result of which the Kingdom is expected to register negative growth in 2017. There were also constraints in the form of high costs of labour and funds. On the positive side there was an improvement in liquidity in the Banking system compared to the previous year. The increased government focus on the SME sector, through the newly formed SME Authority was also favourable to us. CBBG have signed several agreements to support specific sectors, which are in line with the Government’s 2020 and 2030 directions and vision, with various government entities.

During the year our marketing strategies included expanding the mid-market segment, deepening client relationships and pushing our cash management services. A significant achievement in the large corporate sector was our participation in a syndicated financing deal for Saudi Arabian Airlines for the acquisition of 12 Airbus A330-300 aircraft. New risk assessment criteria were developed customised for specific segments; efforts were also made to diversify our portfolio and reduce risk concentration.

Among the initiatives we have mounted for the mid-corporate/SME sector have been introducing escrow accounts, moving customers from manual to online processing, payroll services, POS terminals, and SAIB-Amex co-branded corporate cards. These were included in our 2015-2019 Strategic Plan. Several Trade Finance and Cash Management products and services were also introduced. The credit approval process for SME customers was streamlined.

A new Trade Innovation (TI Plus) was successfully implemented with new features to support new products and online services. The Integrated Trade Service Offering with Aramco was enhanced as per their new requirements. A new pre-paid online Banking portal with beneficiary registration and online remittance for pre-paid customers was also implemented. An important innovation for the import trade was the introduction of the Marine Cargo Insurance programme for goods imported on Letters of Credit which will mitigate the risks associated with such imports while extending insurance options at very competitive rates. A mobile POS device has also been launched for the benefit of corporate and SME clients. With the implementation of VAT on January 1, 2018 all forms and agreements have been amended to be in line with the new requirements.

An enhancement to our internal processes was CRM360 which is a one stop solution providing in-depth insights into customer data. This will enable SAIB to assess its customer service and anticipate future customer needs.

Looking to the future, the unit aspires to improve its contribution to the overall performance of the Bank. We anticipate rapid progress in the Saudi economy, which we will reap the fruits of especially in view of several initiatives we have embarked on which are aligned with Vision 2030. These include customer segmentation, strategic partnerships, industry specific offerings and cash management. There are however several challenges we have to overcome especially in the operating and regulatory environment. We need find the right expertise for implementing Public-Private partnerships. Longterm funding needs to be planned with a time horizon of 20 years or more. We also need to deal with changes in the International Banking Regulations and Accounting Standards.

Treasury and investments group

Treasury and Investments Group are responsible for foreign exchange trading, funding and liquidity management, as well as the Bank’s investment securities portfolio and derivative products. It also manages the Bank's asset-liability structure and interest rate and market risks and liquidity. The Group plays a major role in the Bank’s governance as well as handling important aspects of the Bank's operations. Some of the developments during the year were planning for new regulations, system upgrades, introducing new treasury products and diversification into alternative products. Out of 11 initiatives that were commenced or implemented, 95% of activities were completed.

Some of the highlights of the Group’s achievements during the year were higher optimisation of the balance sheet by maintaining loan-to-deposit ratio; maintaining a liquidity ratio of 25% by prudent liquidity management; and concluding the first treasury structured trade with SAIB Syndication Department. In addition, we maintained the top 20 depositors’ concentration at 37.60% against a target of 45%. Two tranches of Tier I Sukuk programme of a total of SAR 785 million were closed which is the second such transaction in the Saudi market.

Closeness to the customer

Through frequent communication with customers we evaluate our customer service performance; the results help drive improvements at SAIB and influence the development of new products and services to meet customers’ evolving needs and expectations. We have set up several channels to receive and address customer queries and complaints so that we can understand and meet their expectations better. All customer complaints are handled and processed by the Customer Care Unit at our Head Office which has obtained the ISO 9001 standard certification.

Marketing and communications initiatives for 2017

A number of significant initiatives were embarked on in 2017 including the following:

- 45 Marketing Campaigns were launched in 2017 compared to 25 in 2016. A growth of 80%;

- 85 events were managed compared to 30 in 2016.

A growth of 185%; - External emails sent to customers increased to 95,000 from 65,000 the previous year;

- A total of 54 press releases were published compared with 40 in 2016. A growth of 35%;

- Launched the Budget Calculator in March 2017 –

Appearing as the top result in Google search. Averaging 6,000 page views per month; - e-forms were upgraded with the inclusion of all SAIB products and services;

- Digitalisation of the Alistithmar Magazine;

- Three Woow loyalty programme campaigns were launched;

- A social media campaign was launched to coincide with the ‘Deaf Week Programme’ with a 36% engagement rate.

- Revamping of SAIB’s website –

- 36% increase in unique visitors per month to the website compared to 2016.

- 28% increase in page views per month to the website compared to 2016.

- Restructured the website to make it more user friendly and more efficient in applying for a product or service.

- Updated the mobile app section to give option to users to download Al-Huda App.

- Optimised the homepage to include the SAIB Twitter feed.

- SAIB is the number one financial institution in the Kingdom with 2.2 million social media fans and followers –

- 13% increase in Twitter followers compared to last year.

- 3% increase in Facebook Fans: compared to last year.

- 27% increase in Instagram followers compared to last year.

- 66% increase in snapchat views.

- 35% increase in producing SAIB product, services and offers social media videos compared to last year.

SAIB avails itself of all possible channels, both traditional and modern (branches, website, ATMs, telephone banking and mobile banking) as well as public channels such as print, radio and TV to market its financial products. The Bank also leverages the potential of social media especially to keep the customer informed of current offers, campaigns and competitions. Social media affords clients the opportunity to be informed about others’ comments on products or services. We judiciously choose the mix of marketing channels according to the target segment. We strive to be absolutely accurate and transparent in our advertising. All our advertising clearly states the terms and conditions of our products. The Bank also provides the opportunity for customers to communicate and conduct transactions using the channel of their choice.

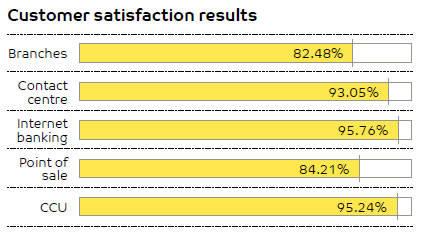

Customer satisfaction

We fervently believe in feeling the pulse of our customers and to this end a survey was conducted during 2017 through our Voice of Customer (VoC) function – a function that was developed to assess our customer service performance through frequent customer satisfaction surveys. The survey was intended to measure up customers’ experience with SAIB and understand the key drivers of customer retention. The survey was conducted by the Quality Assurance Team assisted by a specialised vendor. A systematic sampling methodology was used. The total size of the sample was approximately 1,000 and was randomly selected from SAIB’s data base. The satisfaction rate of survey participation was quantitatively measured, and this yielded a rate of 82.52% showing a marginal decrease over the previous year. The primary source of dissatisfaction was the Branch service. Concerns were expressed regarding slow service; the Central region was particularly affected by shortage of staff and resulting long waiting times. On the other hand, there was increased satisfaction expressed with Internet banking. A significant finding was the high rate of loyalty among female and customers over 55 years of age. The survey turned up several useful recommendations such as improving the rapport with customers by continuity of customer service staff in their branches; setting Arabic as the default language in SAIB ATMs; enhancing the product and service portfolio e.g. car lease; and creating a new segment for customers with drawing high remuneration.

| Data | Unit | 2017 | 2016 | 2015 | 2014 | 2013 | |

|

Overall satisfaction | % | 82.52 | 85.61 | 79.58 | 85.22 | 76.00 |

| On account opening | % | 90.84 | 90.45 | 94.00 | 92.00 | 88.00 | |

| On branch services | % | 99.12 | 99.17 | 99.00 | 99.00 | 99.00 | |

| On loan services | % | 88.16 | 89.80 | 92.00 | 91.00 | 92.00 | |

| On Flexx Click Internet Banking Service | % | 86.51 | 89.74 | 90.00 | 92.00 | 91.00 | |

|

|||||||

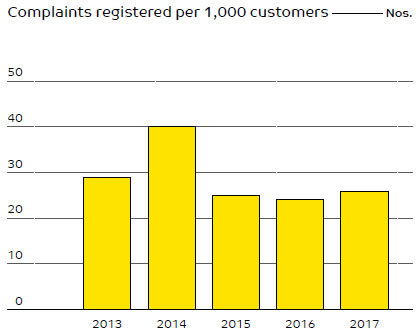

| Complaints registered | Nos. | 14,523 | 9,897 | 8,294 | 7,907 | 4,585 | |

| Complaints resolved within 5 days | % | 99.03 | 98.06 | 99.00 | 99.00 | 99.00 | |

The customer experience was also evaluated through our 8th Mystery Shopper Programme. Part time employees were specially hired to act as mystery shoppers. The programme was executed jointly with an outside consultant and it was conducted across our branches, contact centre, merchants who have a SAIB Point of Sale (POS) device, Customer Care Unit (CCU) and both Flexx Click and FlexxTouch Channels. A mystery shopper checklist was crafted by the Quality Assurance Division in consultation with other operating departments. The results of the branch visits are evaluated, and scores assigned from a customer perspective. They are analysed into three categories: premises, staff and products and services; given a weightage of 20%, 60% and 20% respectively. The results were encouraging; however, we are not resting on our laurels and realise improvement is necessary.

Of the three categories premises received the highest score; in the overall score region-wise the Western region scored the highest.

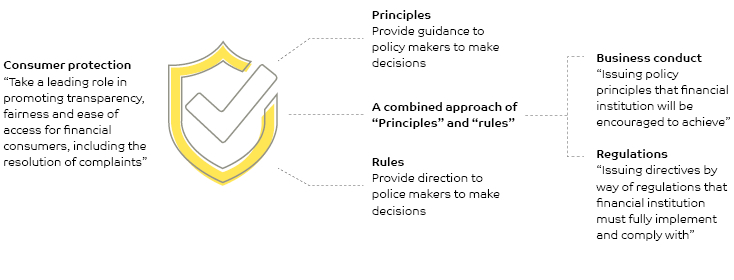

Building trust through being responsible

In line with our sustainability pillar Takleef (responsibility), SAIB has clearly documented policies for protecting customers’ interests. Fair and equitable treatment of all customers, including giving special attention to the vulnerable is a cornerstone of the process. The Bank seeks to communicate information about its products and services, in a concise, easily understandable and accurate form. We also seek to educate existing and potential customers about risks and opportunities in financial products.

All customer financial information, personal information and assets are safeguarded from unauthorised access, misuse and fraud through carefully designed control mechanisms. This includes accepting responsibility for the conduct of all agents. SAIB will only disclose any customer information without his or her consent, on a request by an authorised authority such as the Ministry of the Interior or the courts. We have a complaint handling mechanism to provide an independent, fair and accurate hearing to customers and to give appropriate redress where appropriate. Furthermore, if an error is discovered, quick refunds are given to all customers who have been affected by a similar error.

Just as SAIB scrupulously fulfils its responsibilities to its customers, we do our best to educate the customers on their responsibilities. These include always giving accurate information; asking for clarifications when necessary; procedure for making complaints; selecting products and services that suit one’s needs and according to one’s risk appetite; disclosure of sensitive personal information; and exercising due care when filling in documents. All new customers are provided with a copy of the Bank’s Consumer Protection Policy.

Saudi Arabian Monetary Authority (SAMA) launched a programme named Banking Consumer Protection Principal (BCCP) in support of banking customers. The programme was designed to create awareness amongst consumers on consumer protection when dealing with Banks in the Kingdom. SAIB Quality Assurance supported the initiative with a variety of activities of our own such as e-training, issuing brochures, providing information on the Bank’s website, classroom sessions for customer service staff, and banking awareness events to public and private institutions to reach institutional customers.

Rewarding loyalty

Maintaining customer loyalty is an important facet of our customer relationship programme. We have loyalty programmes which are built round brand image, quality of customer service, appropriate communication, understanding the customer and confidence that the Bank will keep its commitments. We strive to give our loyalty programmes a unique flavour which will make them stand out. While we welcome new customers, we consider retaining our existing customers to be paramount. The cost of attracting a new customer usually exceeds the cost of retaining an existing one. Being close to the customer, identifying and targeting their needs, and analysing their behaviour are all essential components of a successful loyalty programmes. In our products and services, we have to keep pace with changes in attitudes, perceptions, needs and aspirations among the younger generation. We also consider integrity and honesty to be essential to cementing our relationship with our customers.

Loyalty programmes

Loyalty programmes are an important facet of our customer retention strategy. SAIB currently has two loyalty programmes, Aseel and Woow.

Our customers are eligible for discounts and offers when they use their credit, Mada debit cards and prepaid cards at participating merchant partners under the Aseel Loyalty Programme.

The Woow Loyalty Programme is a points-based reward programme which rewards customers with points for various transactions performed via banking channels. The Woow points can then be redeemed by the customer for Woow Gift items which are available for redemption via the Woow e-catalogue, through the Bank's Flexx Click and Flexx Touch channels

Refer our Social and Environmental Capital subsection for details of how customers can make charitable donations using their Woow points to worthy causes through the Woow AlKhair Programme.

Improving efficiency to serve better

SAIB has a Quality Assurance Group in place to optimise the effectiveness and efficiency of processes through business transformation and foster an innovation culture. During the year 11 projects were completed to improve the Bank’s internal operations which resulted in SAR 1.9 million in cost savings. Furthermore, more than 10 Six Sigma process improvement projects were carried out which led to savings of SAR 0.6 million. The Quality Assurance Team conducted more than 10 workshops with around 150 participants to promote awareness of quality issues by training staff on quality improvement techniques.

The Customer Care Unit within Quality Assurance, is tasked with resolving customer complaints within the time frames agreed with SAMA. This has been achieved at a practically 100% level. The CCU team had the ISO 9001:2008 certificate renewed once again, for complaints management. This demonstrates our commitment to continuous improvement of processes which leads to excellence in customer service.