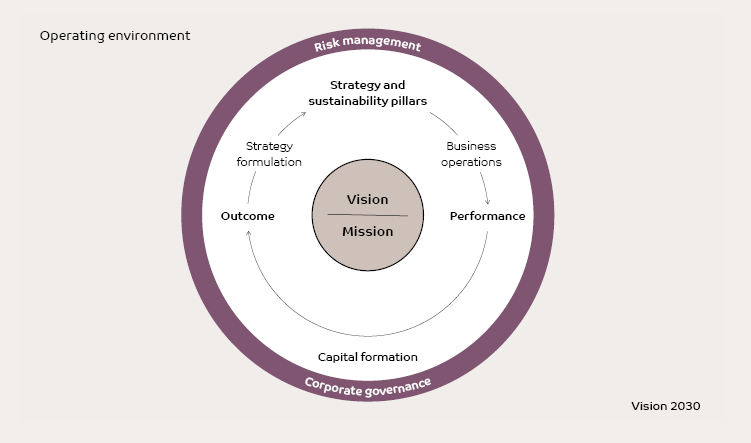

Strategic Framework

Strategy and sustainability pillars

A five-year Strategic Plan was developed by the Bank in 2014 for the period 2015-2019. It was crafted considering the outcomes and experience of the previous strategic plan for the period 2010-2014 with the theme “Building on Strength”. The plan was drawn up in the context of the broad economic, social, environmental and regulatory environment and the goals of the Vision 2030 Plan of the Kingdom.

A new Vision and Mission were decided on for the plan. New business initiatives which are required to build on the achievements of the 2010-2014 plan were identified. The goals of the plan were customer and business focused and each of the business units’ contributed initiatives. The supporting units complemented the objectives by developing initiatives accordingly. Growth opportunities by market segments were carefully considered for both personal and corporate banking.

Some of the specific strategies decided on include:

- Improving the percentage of demand deposits to improve profitability

- Improving fee generation to reduce risk

- Identifying and developing new market segments

- Strengthening affluent banking

- Direct offering to youth and women

- Developing joint calling by business units and

cross-selling with business partners. Cross-selling between personal banking and treasury is an attractive possibility - Exploiting synergies that can be realised across the Bank and with joint venture partners

- Improving efficiency and enhancing customer service by refining and automating the credit processing chain

- Closer control of costs

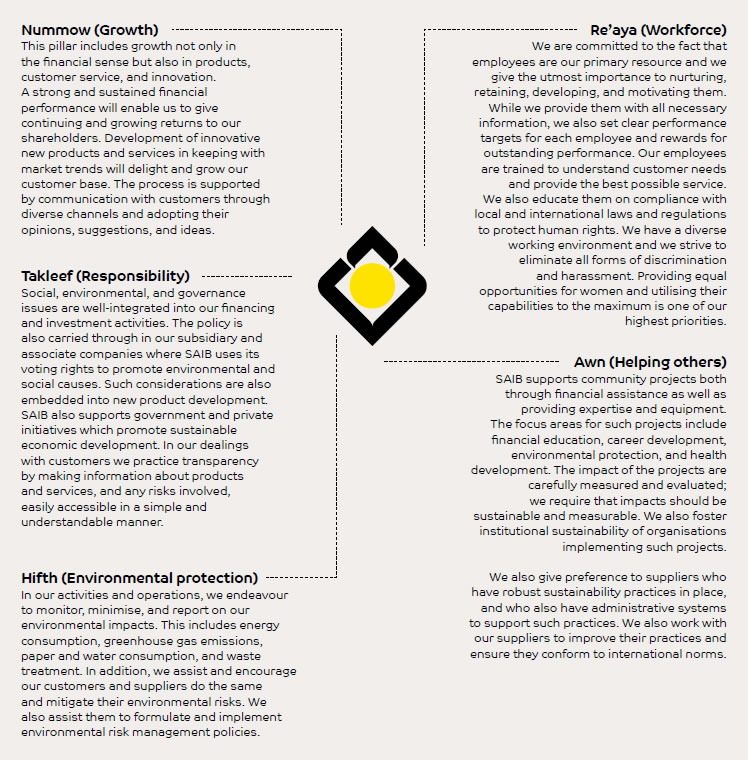

The cornerstone of our strategy is our five sustainability pillars: Nummow (growth), Takleef (responsibility), Hifth (environmental protection), Re’aya (workforce) and Awn (helping others)

Further details maybe found in the sub-section The Saudi Investment Bank.

Performance

Plans are formulated based on our strategies, which in turn are converted to business operations. Our business operations transform strategies into results, both financial and non-financial. This involves having in place the required measurement and monitoring systems to assess performance.

An electronic Sustainability Dashboard Management System (SDMS) has been developed to track the progress and report on initiatives at a high level of granularity. The dashboard provides timely and accurate information for decision-makers and enables efficiency improvement and cost reduction at branch level. Data can be entered, and information obtained on a monthly and quarterly basis; data is securely stored and easily accessible to authorised users.

Since sustainability is a cornerstone of SAIB’s strategy, performance is continuously assessed across the five sustainability themes we have identified which are described below. Our sustainability strategy is an integrated system that tracks economic, social, environmental, and governance performance and the consequent value delivered to all stakeholders.

The integration of the pillars with our activities is further described under appropriate sections in the Management Discussion and Analysis found on page 57.

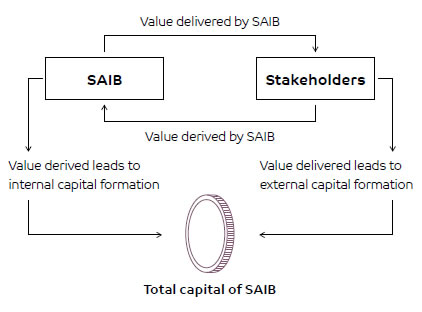

Value creation and capital formation

In the following section on Stakeholders (pages 50 to 54) we identify our key stakeholder groups and how we engage with them. In the section on Materiality (page 55) we distinguish between the Bank and its stakeholders, identify key issues that affect various stakeholder groups and assess the importance of these issues from the perspective of the Bank as well as the stakeholder. Such an analysis (materiality matrix, page 56) helps us to refine our business model and becomes the bedrock of our value creation process. Value creation is the philosophy that drives all what we do and is a two-way process. For the Bank to derive sustainable value for itself it must also deliver value to its stakeholders.

Outcomes

Capitals are stores of value in various forms which the Bank uses in its business processes.

Value creation leads to capital formation, which may be internal or external to the Bank.

The Bank derives value through the dynamic interaction between its external capital and its own internal capital over time. Our internal capital comprises financial capital and institutional capital. The former is what is reported in the Financial Statements, while the latter are intangibles such as integrity, corporate culture, specialised knowledge, systems, processes and brand image.

The Bank delivers value, both financial and non-financial, to its stakeholders. As stores of value, they comprise investor capital, customer capital, employee capital, business partner capital, and social and environmental capital.

Value creation is a dynamic process with flows taking place between the various forms of capital all the time. There can be trade-offs between the different forms of capital with a reduction in one resulting in an increase in the other. Although the Bank does not “own” any of its external forms of capital it has access to and uses them, and along with its own internal forms of capital, creates value for itself and for its stakeholders.

The dynamic relationship between strategy, performance, and outcomes which takes place within the framework of corporate governance and risk management is visually presented above. The Bank’s strategy, operations and performance result in changes in the various forms of capital discussed previously. The outcomes of the strategy and business processes are evaluated and provide the basis for refining the strategies going forward. The value creation process as described above drives our reporting, particularly the Management Discussion and Analysis.

Management approach

The materiality matrix defines the relative importance of a particular issue in the value creation process. The various forms of capital are dynamic the stores of each type change depending on strategies and business activities. The Bank uses the various forms of capital, whether internal or external to create value for its stakeholders and for itself.

In the Management Discussion and Analysis, we describe the assessment of materiality, the management and transformation of capitals, and the evaluation of the results. These are further elaborated with supporting performance indicators and measures wherever possible.

Looking ahead

Looking forward to 2018, the Bank remains committed to the implementation of the 2015-2019 Strategic Plan approved by the Board of Directors in November 2014, while focusing on maintaining adequate liquidity and capital levels in a challenging economic and operating environment.

Given the lower level of oil prices during 2017 and the changing cash flow model of the Government, the financial goals of the strategic plan are in process of being updated as part of the 2018 Profit Plan process. Additionally, the Bank is also in the process of implementing a cost control and revenue enhancement programme through the automation of FPC data capturing.