Materiality

In order to prioritise the issues pertaining to the Bank we address issues that are materially important to our stakeholder; those that substantively address the ability of the Bank to create value in the short, medium and long term. In determining materiality both the magnitude of the impact of the issue as well as the probability of occurrence are taken into account. Events that may have a high impact if they occur but have a very small probability of occurrence are not considered material. The basis on which a materiality analysis is carried out is the Bank’s stakeholder engagement process, which has been detailed elsewhere in this Report.

The engagement process has been covered in detail on pages 50 to 54 of this Report.

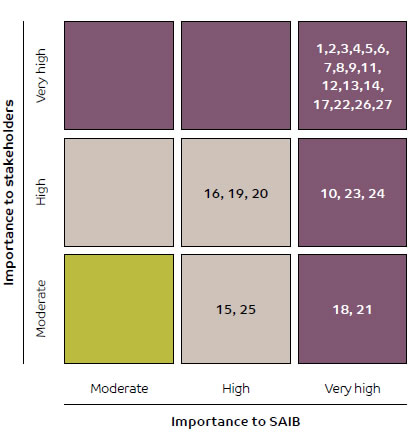

Materiality can be viewed from two different perspectives; that of the Bank and its stakeholders. A mapping was carried out for identified issues from the above two perspectives. The material issues identified are depicted in a two dimensional materiality matrix. Only issues that have at least a moderate importance to both the Bank and the stakeholders are included. The issues which have a high degree of importance to both the Bank and the stakeholders are assigned a high level of materiality; these issues are important for both organisational success and stakeholder satisfaction. The issues which it would be advisable for the Organisation to manage well are assigned a medium level of materiality. The issues which currently have a low level of strategic importance for the Organisation and the stakeholders, and so will not be subjects for immediate action are given a low level of materiality. Our Management approach towards all material issues is contained in this report under the appropriate sections.

Material issues are not static but evolve and change with time. We review the materiality analysis periodically to keep pace with the changes. The table and matrix below illustrate the issues that are material to us and the importance placed on each issue:

| No. | SAIB material issues | GRI Standards: Topic-specific Standards | Most concerned stakeholders | |

|

Customer Trust and Protection | 418 | Customer Privacy | Customers, Regulators |

|

Quality of Services and Customer Satisfaction |

102-43 | General Disclosures: Stakeholder Engagement | Customers, Regulators |

|

Compliance with Regulations | 307 | Environmental Compliance | Shareholders and Investors, Regulators |

| 419 | Socio-economic Compliance | |||

|

Accurate and Transparent Disclosure of Performance | 102-45 through | ||

| 102-56 | General Disclosures: Reporting Practice | Shareholders and Investors, Regulators | ||

|

Data Security | 418 | Customer Privacy | Customers, Regulators |

|

Financial Performance | 201 | Economic Performance | Shareholders and Investors, Customers, Regulators, Employees |

|

Governance and Accountability | 102-18 through 102-39 | General Disclosures: Governance | Employees, Shareholders and Investors, Regulators, Community |

|

Financial System Stability | 203 | Economic Performance | Customers, Employees, Regulators |

|

Business Ethics and Prevention of Financial Crime | 205 | Anti-Corruption | Shareholders and Investors, Regulators, Community, Employees, Suppliers |

|

Human and Labour Rights | 408 | Child Labour | Regulators, Employees, Community |

| 409 | Forced or Compulsory Labour | |||

|

Workforce Training and Education | 404 | Training and Education | Employees, Regulators |

|

Community Investment and Engagement | 413 | Local Communities | Community, Customers, Employees, Regulators |

|

Risk Management | 103 | Management Approach: all material topics |

Shareholders and Investors, Regulators |

|

Saudization | 202 | Market Presence | Employees, Shareholders and Investors, Regulators |

|

ESG Risks in Lending and Investment | 201 | Economic Performance | Customers, Shareholders and Investors, Community |

|

Equal Opportunity and Anti-Discrimination |

405 | Diversity and Equal Opportunity | Employees, Community |

|

Employee Satisfaction and Engagement | 401 | Employment | Employees |

| 403 | Occupational Health and Safety | |||

|

Sustainable Procurement | 204 | Procurement Practices | Suppliers, Community |

|

Infrastructure and Accessibility | 203 | Indirect Economic Impacts | Customers, Regulators, Employees |

|

Adherence to Islamic Banking Principles | – | – | Customers, Community, Regulators |

|

Reduction of Environmental Impact of Operations | 302 | Energy | Community, Employees |

| 303 | Water | |||

| 305 | Emissions | |||

| 306 | Effluents and Waste | |||

|

Operational Efficiency | – | – | Customers, Regulators |

|

Innovation and Product Development | – | – | Customers |

|

Engaging with Customers | – | – | Customers |

|

Strengthening Relationships with Business Partners | – | – | Suppliers |

|

Employee Retention | 401 | Employment | Employees |

|

Soft Skills Development of Employees | 404 | Training and Education | Employees |