The Bank’s 2020 strategy, first formulated in 2015, was designed to build new capabilities and ensure sustainable growth amidst a rapidly changing environment. It also contributes towards the Kingdom’s Vision 2030 objectives of creating a thriving financial sector.

Strategy overview

Al Rajhi Bank’s 2020 strategy was first formulated in 2015, following the appointment of the current management team. It aims to build new capabilities and ensure sustainable growth amidst a rapidly changing environment, while leveraging KSA’s Vision 2030 objectives of creating a thriving financial sector.

The banking environment in Saudi Arabia is in a state of rapid evolution: fiscal and monetary policy dynamics, increased regulatory activity, and most importantly, rapidly evolving technological innovations, increasing digitisation and heightened customer expectations.

In response to this dynamic environment, Al Rajhi Bank’s strategy has a relentless focus on business enabling and cost-efficient technological enhancements, as well as on the sustainability of our operations. The Bank is planning for the digital future now, and building the kind of bank that tomorrow’s digital customers will want to engage with.

A key enabler for Saudi Arabia’s Vision 2030 is the creation of a thriving financial sector that underpins and nurtures private sector growth, supports the formation of an advanced capital market, and promotes financial responsibility among its residents. Delivering these ambitions is a central objective of the strategy of Al Rajhi Bank.

This macro ambition enables the delivery of the 2020 strategy. The strategy is geared to expand the product and customer portfolio, diversify sources of funding, expand delivery channels, enhance customer and employee engagement, migrate customers to online channels and streamline internal processes.

The Bank aims to achieve these objectives through the execution of its “ABCDE – Back to Basics” strategic plan, which is composed of five key pillars: accelerate growth to outperform our competition, become the employer of choice in the industry, enhance customer focus, achieve digital leadership, and improve execution excellence:

|

|

|

|

|

|

|

|

|

Accelerate growth |

Become employer of choice |

Customer focus |

Digital leadership |

Execution excellence |

Grow mortgage, private sector, affluent, ladies and Tahweel |

Engaged workforce |

Update value propositions |

Smartly expand channels and formats |

World-class compliance |

Enhance SME and corporate capabilities |

Expand development and training programmes |

Empower frontline |

Digitise customer journeys |

Enhance IT infrastructure |

Enhance International presence |

Strengthen diversity |

Align organisation to customer advocacy |

Migrate customers to self-service channels |

Centralise and automate operations |

Improve yields |

Enhance employee value proposition |

Install and embed NPS across the Bank |

Innovate in payments |

Strengthen risk infrastructure |

Exceed industry |

Higher engagement |

Most recommended |

Best in class |

Deliver |

2018 strategy review

Accelerate growth

Several key initiatives are being executed to accelerate growth ahead of the industry:

- Grow the mortgage portfolio

- Increase exposure to the private sector

- Expand the customer base of female customers,

- Enhance SME and corporate capabilities

- Selectively enhance the international footprint

- Improve yields and enhance cross sell

In 2018, the Bank registered meaningful market share improvements across key product lines through the introduction of new innovative products and the selective expansion of its distribution network.

The mortgage portfolio grew by 27.4% and our market share grew to 27.9% at end of 2018, compared to 20.6% at the end of 2015. This was partially driven by the introduction of new products such as Self Construction, a financing solution targeting landowners willing to construct or owners of incomplete properties looking to complete construction Off Plan, is another financing solution to fund customers as they make payments towards the construction of their residential property currently owned by a real estate company which will further accelerate growth in 2019 and beyond.

Al Rajhi Bank has the largest distribution network in Saudi Arabia with 551 branches, over 5,000 ATMs, approximately 84 thousand POS terminals and 236 remittance centres. The Bank also operates 18 branches in Malaysia, 10 in Jordan and two in Kuwait. Over the past three years, the Bank also grew its female customers by 30% with the introduction of five additional dedicated ladies sections and branches bringing the total dedicated sections and branches for ladies to 157, further cementing the Bank’s distribution network as the largest in the Kingdom.

The Bank also expanded its corporate and SME offering, including Islamic FX forwards, Supply Chain Financing (SCF), facilities that are based on receivables purchase agreement on behalf of the Bank’s corporate clients’ suppliers; and POS Financing, offered to SME customers through an active point of sale terminal to cover their short-term and long-term needs.

Sophisticated cash and liquidity management is crucial for the modern corporate, and Al Rajhi launched a corporate liquidity management solution in 2018, providing centralised and automated cash management for corporate customers. Additionally, 2018 saw the successful launch of fully-fledged supply chain finance solutions (SCF) for its corporate customers. Al Rajhi Bank is the first bank in the Kingdom to offer a comprehensive SCF programme with a wide range of solutions backed by a strong technological platform available to the entire value chain of customers, both upstream and downstream.

The Bank’s focus on the SME sector remained a key initiative for the year. The Bank merged its SME business with its retail banking business, leveraging its retail branch network and enhancing customer service.

Internationally, 2018 was a year of advancement: the Bank opened three new branches in Jordan and one new branch in Kuwait. In Malaysia performance improved substantially.

Finally, the Bank has continued to improve yields during 2018 through effective balance sheet management in a rising rate environment and successful growth of 6% in non-profit bearing deposits, which now comprise 93.6% of total deposits. As a result, the Bank’s net profit margin improved by 26 basis points in 2018 to 4.36%.

Become employer of choice

The Bank’s commitment to remaining the employer of choice in the industry is a key pillar of its strategy, and 2018 saw continued efforts focused on promoting an engaged workforce, expanding development and training programmes, strengthening diversity, and enhancing the employee value proposition.

In November 2018, the Bank moved both its main office and operations centre to the new state of the art building in Riyadh.

In 2018, the Bank launched the Al Rajhi Bank Academy, which includes a School of Banking providing a series of domain and role specific certifications as well as running six graduate development programmes, for students in their final stages of graduation. The Academy also launched the School of Leadership. In total, more than 65,000 training days were delivered in 2018.

With the aim to strengthen diversity and grow the number of female employees, the Bank launched the first dedicated female graduate development programme and introduced a nursery allowance programme for female employees during 2018. The percentage of female employees grew by 6.2% in 2018, and today women represent approximately 14% of the total Bank’s employee workforce.

Customer focus

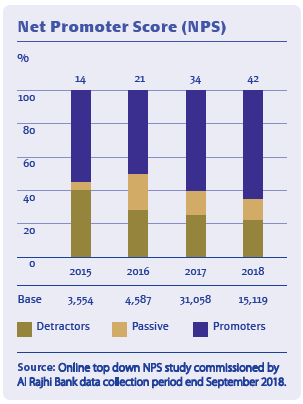

With the ambition to be recognised as the most recommended bank in Saudi Arabia, strong focus is placed on customer advocacy while embedding improvement in Net Promoter Score (NPS) into our balanced scorecards. In 2018, the Bank became the number two bank in the country based on NPS versus the number seven bank position in 2015.

Through the use of digital advancements and ongoing agent training and development, the Bank has further improved customer experiences to better address customer needs. During 2018, the Bank registered 10% growth in its NPS score, a biannual external study is commissioned by the Bank to measure progress relative to competition. We measure how satisfied and likely a customer is to promote the Bank to other friends and colleagues.

Digital Leadership

The banking industry is transforming into a digital industry, and Al Rajhi is at the forefront of this change. The Bank is committed to being the pioneer in digital banking by capitalising on the latest technologies to provide customers with the highest quality services. In this regard, the Bank remains focused on smartly expanding channels, digitising customer journeys, migrating customers to self-service channels, and exploring innovations in payment methods.

As part of this ongoing digital transformation journey, the Bank continues to accelerate its focus on mobile banking enhancements and customer journeys to both further grow its digital footprint and enhance the customer experience. Today 56% of customer transactions are performed digitally. In addition, the number of active retail users of the Bank’s “Al Mubashar” online platform grew by 64% during 2018 to 3.6 Mn., while active corporate users grew by 12.8% to almost 40,000. The integration of WhatsApp and Apple Pay with the Bank’s mobile application is one of the many innovations in 2018 that have enhanced customer experience and ease of use.

Other digital initiatives during 2018 included: new self-service kiosks were rolled-out and installed across remittance centres, a trial of artificial intelligence and voice recognition technologies was implemented across customer call centres. Robotics was further expanded to improve efficiency of back office transactions, secure cross-border money transfers using Ripple Blockchain technology were conducted with other financial institutions. We will continue to explore innovative opportunities and partnerships in the fintech industry in 2019 and beyond.

Execution Excellence

Execution excellence is a key enabler of the Bank, helping it deliver a strong performance to meet its operational objectives. It also helps achieve world-class compliance, enhanced IT infrastructure, automated operations and strengthened risk infrastructure.

We are one of the largest users of robotics in the Middle East. We have 253 bots processing around 22,000 transactions daily. This has significantly improved our processing leading to a much faster turnaround time and a better customer journey.

During 2018, the Bank finalised the construction of its Tier 4 data centre, granting the Bank the recognition of being the first bank in the GCC to have a Tier 4 certification. Full migration to the new data centre is scheduled for 2019 which will provide the Bank with world-class modern infrastructure ensuring resilient risk, security and compliance controls.

2019 Strategy

The Bank will continue to implement its ABCDE strategy during 2019 which is based on adopting artificial intelligence solutions, automation, block chain, cloud computing, big data analysis and internet of things similar to the past three years. It is focused on continuing to deliver superior returns, enhanced customer and employee engagement while accelerating digital execution.

Key strategic focus areas for 2019 include:

.svg)