The Bank

Vision, Mission, and Values

Our Vision

To be a trusted leader delivering innovative financial solutions to enhance the quality of life of people everywhere.

Our Mission

To be the most successful bank admired for its innovative service, people, technology, and Sharia compliant products, both locally and internationally.

Our Values

Everything the Bank does is built around its core values, which puts the customer at the heart of all its activities.

- Integrity and transparency

Being open and honest while maintaining the highest standards of corporate and personal ethics

- A passion to serve

Anticipating and addressing customer needs to deliver results that go beyond expectations

- Solution oriented

Helping the customers achieve their objectives through effective and efficient solutions

- Modesty and humility

Being humble in thought, word, and deed

- Innovativeness

Nurturing imagination and fostering creativity for better results

- Meritocracy

Defining, differentiating, and reinforcing excellence in people

- Care for society

Contributing towards a better tomorrow

History

Referred to as the “Bank” in this document, Al Rajhi Bank (ARB) received its current name in 2006 but was originally established in 1957 as an exchange house and converted to a bank under the name Al Rajhi Banking Corporation in 1987. The Bank is a Saudi joint stock company that was formed and licensed in accordance with Royal Decree No. M/59 and Article 6 of the Council of Ministers’ Resolution No. 245, both of June 1987. With its headquarters in Riyadh, Kingdom of Saudi Arabia, the Bank operates under Commercial Registration No. 1010000096 and is listed on the Saudi Stock Exchange (Tadawul) with the Ticker No. RJHI.

Objectives

The Bank’s objectives are to carry out banking and investment activities within the Kingdom of Saudi Arabia, and beyond, pursuant to the Bank’s Articles of Association and Bylaws, the Banking Control Law and the Council of Ministers’ Resolution (mentioned previously under History), and in compliance with Islamic Sharia legislations.

Operations and reach

The second largest Bank in the Kingdom in terms of assets and the largest Islamic bank in the world, Al Rajhi Bank (ARB) accounted for 16.1% of total assets and 17.3% of total deposits among banks in the Kingdom as of end 2018. The Bank’s market capitalisation as of 31 December 2018 was SAR 142.2 Bn. Total Group assets amounted to SAR 365 Bn. as of

31 December 2018.

The Bank delivers its services through diverse channels for the convenience of its customers. These consist of both traditional and modern channels, including an extensive network of 551 branches including 157 ladies branches and sections, 5,006 ATMs and 83,958 POS terminals that span the Kingdom, in addition to online banking and mobile banking services. While managing the largest branch network in the Middle East, the Bank also operates 10 branches in Jordan and two branches in Kuwait while its subsidiary in Malaysia operates 18 branches.

With over nine million customers, the Bank serves the largest customer base in the Kingdom, processing the payrolls of over 50% of government employees. Handling an average of 172 million transactions per month and over a million remittances, the Bank now partners with over 200 correspondent banks in around 50 countries. Its employee cadre numbered 12,732 at end 2018 making the Bank among the top 10 employers in the Kingdom and the largest employer in the financial sector.

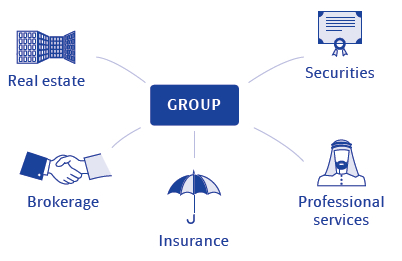

Al Rajhi Bank Group

Meticulous adherents of Islamic Banking principles, the members of the Al Rajhi Bank Group consist of seven subsidiaries in addition to the Bank. Four of these subsidiaries are situated within the Kingdom (refer Review of Subsidiaries) while three are located overseas. Together the Group provides clients with innovative financial and other products and services that combine Islamic values with modern commercial requirements.

Refer Review of Subsidiaries.

Products and services

In line with the rapidly

changing international

banking landscape

the Bank provides a range

of products and services

to meet the needs of its

varied customer groups.

Refer Review of Business Portfolio.

Together the Group provides additional services including: