At the Bank we focus on sustainable growth because our investors expect optimal returns. We also focus on providing timely and accurate performance results and strategic updates. Such proactive communications bolsters confidence and fidelity, providing us with an invaluable long lasting relationships with the investment community.

We are proud of our sound reputation for communicating with our investors in a consistent, comprehensive and precise manner, taking this responsibility way beyond the minimum regulatory requirements. Our stakeholders’ views are of paramount value to us. Investors feedback is always considered and incorporated into our department’s strategies for long-term value creation. We ensure providing maximum information to our investors by various disclosures through investor relations section of the website, investor presentations, quarterly disclosures and earning releases, earning calls and annual reports.

Performance of the share

Key Metrics

|

|

Ratings |

|

14.25 Times

Price/earnings

|

19.84%

Return on equity

|

|

A1

Moody’s

|

BBB+

S&P

|

|

2.74 Times

Price/book

|

2.94%

Return on assets

|

|

A-

Fitch

|

|

| 4.86%

Dividend yield |

|

| |

|

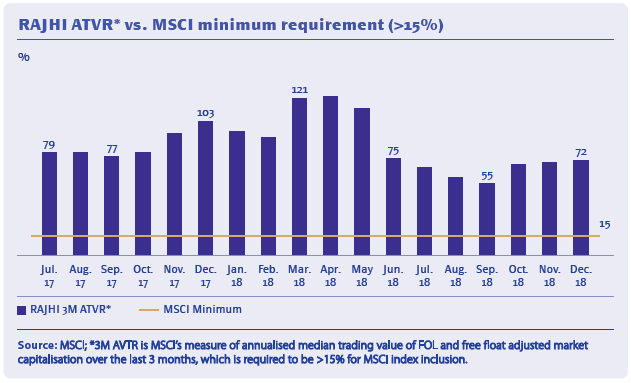

ARB has the highest weight in the MSCI GCC index.

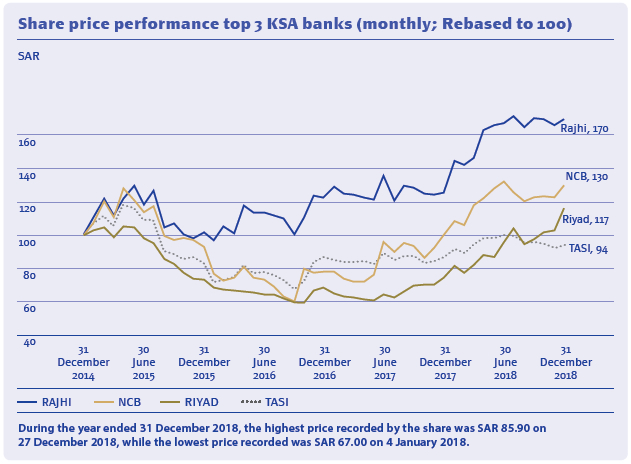

Share price

The market value of the Bank’s ordinary share was SAR 87.50 as of 31 December 2018, while it was SAR 64.62 as of 31 December 2017.