A true evaluation of the Bank’s performance and value delivery must, of course, take into account the sociopolitical and economic trends within which it operates. This section outlines the main forces that shaped the local, regional, and global landscape as well as the banking sector in general.

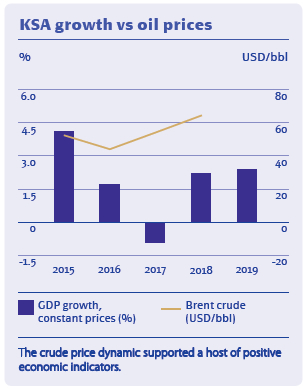

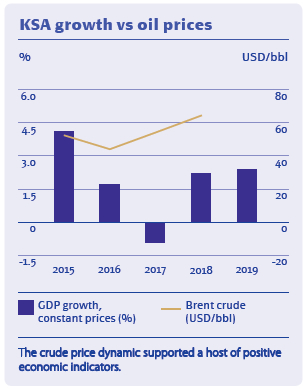

After several years of constrained economic activity, 2018 marked a return to growth for Saudi Arabia, driven by a steadily rising oil price for the first three quarters.

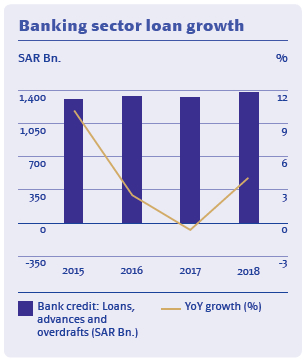

The crude price dynamic supported a host of positive economic indicators: GDP grew by 2.2%, up from -0.8% in 2017. Broad money supply (M3) expanded at 2.8%, up from 0.2% in 2017. Bank claims on the private sector grew 3.0% year-on-year, recovering from the prior year contraction of 0.8%. and overall credit grew by 2.8%, up from -1.0% in 2017.

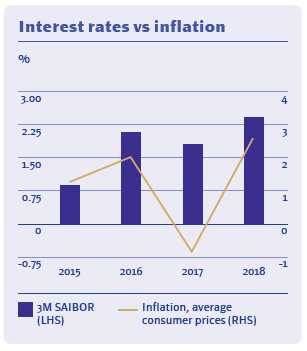

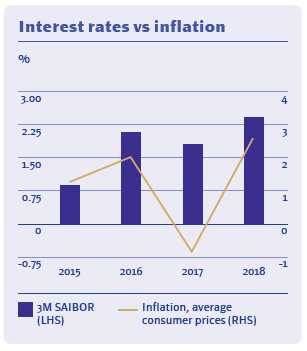

And against this backdrop, policy rate increases in the US were mirrored in the Kingdom, leading average 3M SAIBOR rate to increase by 60 bps to 2.41%.

But a supportive oil price was not the only driver of economic growth: the reforms initiated under the Vision 2030 strategy saw macro growth mirrored in the real economy: Real estate lending, retail credit and cards were all particularly strong.

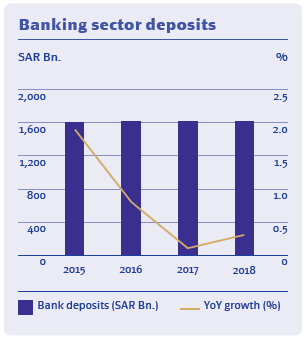

Also, real estate finance has been doubled comparing to the past years from SAR 3,993 Mn. to SAR 8,092 Mn. and auto finance grew 79% annually compared to -1% in 2017. In addition, deposits grew 2.6% comparing to 0.1% in 2017.

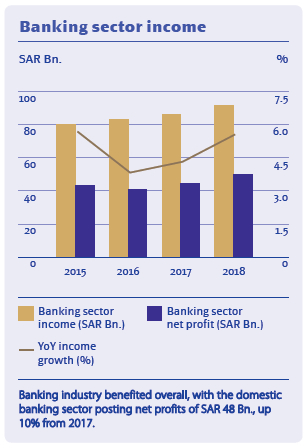

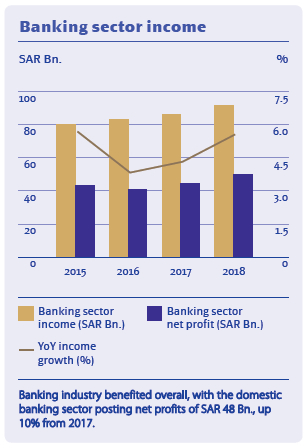

In these conditions, the banking industry benefited overall, with the domestic banking sector posting net profits of SAR 48 Bn., up 10% from 2017.

Comprising 12 listed banks and other non-listed banks, the Kingdom’s banking sector witness marginal growth in deposits, with demand deposits accounting for 61.8% while time and savings deposits accounted for 27.7%. Individuals held 76.4% of total deposits while government entities accounted for 21.6%. Together, National Commercial Bank, Al Rajhi Bank, Samba Bank, and Riyadh Bank – the Kingdom’s four largest banks – account for 55.3% of total assets.

Even at this early stage, just two years into the execution of Vision 2030, 2018 already seems like a milestone year.

Al Rajhi Bank’s own credit dynamics during the year reflected this new mood of growth in the Kingdom. As a predominantly retail oriented bank (72% of the business), Al Rajhi thrives when the Kingdom grows, and 2018 was proof of this. We experienced strong growth in mortgages (+27%) achieving a record market share of 27.9%. Our credit cards business also witnessed strong growth with 200,000 credit cards now in service, up from 50,000 last year.

And this growth was not delivered at a cost to margin: Partially driven by rate hikes, but also supported by strong management discipline, Al Rajhi Bank margins expanded by 26 bps during the year, to 4.34%.

The banking sector adoption of IFRS 9 accounting standard fundamentally changes the way banks account for provisions associated with financing activities. While the settlement reached between all banks and the General Authority for Zakat and Tax (GZAT), which will harmonise the treatment of Zakat for all banks in future, added to a sense of confidence for the sector.

In this context, 2018 was a particularly strong year for Al Rajhi Bank, delivering sector-leading achievements such as growth in operating profits, growth in net income, return on equity and return on assets.

What is particularly gratifying from a management point of view, though, was that we did not allow the positive macro-environment to lead to complacency. On the contrary, our ongoing ABCDE strategy and focus on our employees and customers mean that the Bank has never felt more dynamic.

We delivered 65,000 hours of training to our staff in 2018, double the 2015 figure. We continued to improve our customer service, further accelerated digitisation and product development. We launched 12 new products in 2018, including securitisation, supply chain financing, FX forwards, and point of sale financing for SMEs.

Our digital leadership is now well established in the sector due to significant and early adoption of robotic tools. We have now implemented 253 bots processing over 22,000 transactions daily. We have focused on improving our turnaround time and have received Tier 4 certification for our data centre – the first bank in the Middle East to achieve this.

In summary, all banks in the Kingdom benefited from macro tailwinds in 2018. Al Rajhi has not been complacent, and has rigorously pursued its journey to be The Blue-chip Islamic Bank, admired for its innovative service, people, technology and Sharia compliant products, both locally and internationally with more vigour than ever.