Bank achieved improved performance during the fiscal year 2018, recording growth in most of the key performance indicators.

Income statement

Al Rajhi Bank reported net income of SAR 10,297 Mn. for the full year 2018, reflecting strong momentum in the delivery of the strategy, and resulting in improved financial metrics.

|

FY 2018

SAR Mn.

|

FY 2017

SAR Mn.

|

YoY

%

|

|

Net financing and investment income

|

13,253

|

12,029

|

+10.2

|

|

Fees and other income

|

4,067

|

3,875

|

+4.9

|

|

Total operating income

|

17,320

|

15,905

|

+8.9

|

|

Operating expenses

|

(5,492)

|

(5,237)

|

+4.9

|

|

Total impairment charge

|

(1,531)

|

(1,548)

|

-1.1

|

|

Net income for the period

|

10,297

|

9,121

|

+12.9

|

|

Earnings per share (SAR)

|

6.34

|

5.61

|

+13

|

|

Dividends per share (SAR)

|

4.25

|

4.00

|

+6

|

|

Return on equity (%)

|

19.8

|

17.2

|

+15

|

|

Return on assets (%)

|

2.9

|

2.7

|

+10

|

|

Net financing and investment margin (%)

|

4.34

|

4.08

|

+6

|

|

Cost to income ratio (%)

|

31.7

|

32.9

|

-4

|

|

Cost of risk (%)

|

0.63

|

0.66

|

-3

|

Operating income

Total operating income for 2018 reached SAR 17,320 Mn., 8.9% higher than in 2017, reflecting strength across the board in all our main businesses.

Net financing and investment income totalled SAR 13,253 Mn., up 10.2% year-on-year. This was driven by a widening of the financing and investment margin, which reached 4.34%, as policy rates increased and our funding platform continued to deliver a world-class funding mix at the lowest industry cost.

Fees and other income grew 4.9% to SAR 4,067 Mn. as strong growth in Treasury and Al Rajhi Capital offset a more competitive fee environment in the Retail and Corporate segments.

Exchange income was SAR 755.8 Mn., down from SAR 841.8 Mn. in 2017, reflecting a more volatile market environment, while other income was SAR 209.7 Mn., down from SAR 336.4 Mn. last year, due to some non-recurring items.

Financial results comparison

|

Description

|

2018

SAR Mn.

|

2017

SAR Mn. |

2016

SAR Mn. |

2015

SAR Mn. |

2014

SAR Mn. |

|

Total operating income

|

17,320

|

15,905

|

15,341

|

13,746

|

13,667

|

|

Operating expenses

|

5,492

|

5,237

|

5,007

|

4,658

|

4,519

|

|

Net income for the period

|

10,297

|

9,121

|

8,126

|

7,130

|

6,836

|

Operating expenses

Total operating expenses for the year increased by 4.9% to reach SAR 5,492 Mn., largely reflecting the ongoing investment in our digital capabilities, as well as the introduction of VAT.

The cost-to-income ratio of 31.7% for the year represents a 120 basis point improvement against 2017.

Discrepancies in operational results for the previous year results:

|

Description

|

2018

SAR Mn.

|

2017

SAR Mn. |

Change

(+) or (-)

SAR Mn. |

Change

% |

|

Total operating income

|

17,320

|

15,905

|

1,415

|

8.89

|

|

Operating expenses

|

5,492

|

5,237

|

255

|

4.87

|

|

Net income for the period

|

10,297

|

9,121

|

1,176

|

12.90

|

Impairment charges

Total impairment charges for the year were 1.1% lower than in 2017 at SAR 1,531 Mn. The cost of risk was 0.63% against 0.66% last year.

Balance sheet

Total assets grew by 6.4% year-on-year as the Bank was able to offset a relatively flat financing landscape by optimising the balance sheet through a reduction of cash balances, and greater investments in securities and in the interbank market.

|

FY 2018

SAR Mn.

|

FY 2017

SAR Mn. |

YoY

% |

|

Cash and balances with SAMA and other central banks

|

43,246

|

48,282

|

-10.4

|

|

Due from banks and other financial Institutions

|

30,808

|

10,710

|

+187.7

|

|

Investments, net

|

43,063

|

36,401

|

+18.3

|

|

Financing, net

|

234,063

|

233,536

|

+0.2

|

| Total assets

|

365,004

|

343,117

|

+6.4

|

|

Due to banks and other financial institutions

|

7,290

|

5,523

|

+32.0

|

|

Customers’ deposits

|

293,909

|

273,056

|

+7.6

|

|

Total liabilities

|

316,450

|

287,366

|

+10.1

|

| Total shareholders’ equity

|

48,554

|

55,751

|

-12.9

|

|

Risk weighted assets

|

254,506

|

251,115

|

+1

|

|

Tier 1 capital ratio (%)

|

19.1

|

22.2

|

-14

|

|

Total capital adequacy ratio (%)

|

20.2

|

23.3

|

-13

|

|

Liquidity coverage ratio (LCR) (%)

|

196

|

199

|

-1

|

|

Basel III leverage ratio (%)

|

12.9

|

15.7

|

-18

|

|

Financing to customer deposits ratio (%)

|

80.8

|

85.5

|

-6

|

|

Non-performing financing ratio (%)

|

0.95

|

0.74

|

+28

|

|

Non-performing financing coverage ratio (%)

|

341.98

|

313.82

|

+9

|

Assets and liabilities comparison

|

Description

|

2018

SAR ’000

|

2017

SAR ’000 |

2016

SAR ’000 |

2015

SAR ’000 |

2014

SAR ’000 |

|

Cash in SAMA and other central banks

|

43,246,043

|

48,282,471

|

42,149,905

|

27,053,716

|

33,585,377

|

|

Dues from banks and other financial institutions

|

30,808,011

|

10,709,795

|

26,578,525

|

26,911,056

|

16,516,208

|

|

Investments, net

|

43,062,565

|

36,401,092

|

34,032,879

|

39,876,864

|

42,549,623

|

|

Financing, net

|

234,062,789

|

233,535,573

|

224,994,124

|

210,217,868

|

205,939,960

|

|

Property and equipment, net

|

8,897,587

|

7,858,127

|

6,485,162

|

5,578,931

|

4,813,941

|

|

Investment properties, net

|

1,297,590

|

1,314,006

|

1,330,868

|

1,350,000

|

–

|

|

Other assets, net

|

3,629,245

|

5,015,464

|

4,140,354

|

4,631,213

|

4,306,446

|

|

Total assets

|

365,003,830

|

343,116,528

|

339,711,817

|

315,619,648

|

307,711,555

|

|

Dues to banks and other financial institutions

|

7,289,624

|

5,522,567

|

8,916,970

|

4,558,224

|

2,135,237

|

|

Customers’ deposits

|

293,909,125

|

273,056,445

|

272,593,136

|

257,821,641

|

256,077,047

|

|

Other liabilities

|

15,251,063

|

8,786,598

|

6,254,839

|

6,600,729

|

7,603,077

|

| Total liabilities

|

316,449,812

|

287,365,610

|

287,764,945

|

268,980,594

|

265,815,361

|

Key performance indicators

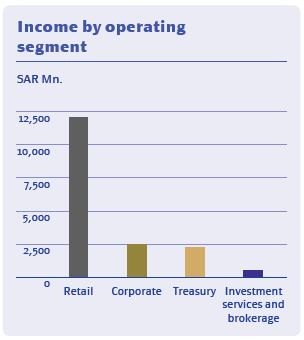

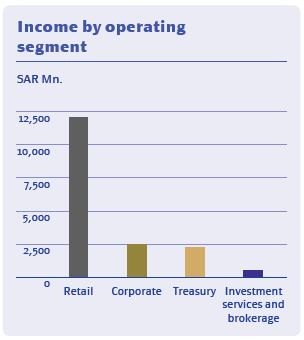

Analysis of income by operating segment

|

Indicator

|

Retail

|

Corporate

|

Treasury

|

Investment

services and

brokerage |

Total

|

|

Total operating income (SAR ‘000)

|

12,015,569

|

2,490,518

|

2,276,459

|

536,972

|

17,319,518

|

|

Total operating expenses (SAR ‘000)

|

(5,687,481)

|

(632,765)

|

(554,728)

|

(147,677)

|

(7,022,651)

|

|

Net income (SAR ‘000)

|

6,328,088

|

1,857,753

|

1,721,731

|

389,295

|

10,296,867

|

Investments

Net investments increased by 18.3% in 2018, to SAR 43,063 Mn., as the Bank increased its exposure to Sukuks, which, under the leadership of our Treasury segment, enhanced asset utilisation and yield.

Financing and advances

Net Financing was flat at SAR 234,063 Mn., as continued growth in Retail financing offset limited Corporate financing opportunities and some loan repayments. The overall financing mix remains predominantly Retail, with 71.7% of net exposure.

Customers’ deposits

Customer deposits increased by 7.6% in 2018 to SAR 293,909 Mn. as the Bank continued to grow non-profit bearing deposits, which represented 94% of total deposits at year-end 2018.

Credit quality

The non-performing financing ratio remains strong at 0.95%, an increase from 0.74% last year, reflecting certain classification changes in our portfolios and strong growth in the Retail financing book. The coverage of non-performing financing increased by 9% from 2017, to 342%.

Capital

Al Rajhi Bank continued to maintain a strong capitalisation profile with core equity Tier 1 and total capital adequacy ratios of 19.1% and 20.2%, respectively, for 2018. These ratios reflect a 1% increase in risk-weighted assets, and a decrease in equity driven by two significant industry-wide factors, namely (i) the adoption of IFRS 9, reflected in retained earnings (SAR 2.9 Bn.), (ii) the settlement agreement with the General Authority for Zakat & Income Tax (GZAT), reflected in reserves (20% of SAR 5.4 Bn. for previous years plus SAR 943.4 Mn. for 2018). Additionally, the Bank’s shareholders will see a significant capital distribution corresponding to 67% of net income.

Liquidity

The Bank’s liquidity position remained healthy with a liquidity coverage ratio of 196%, while the financing to customer deposits ratio declined by 470 basis points during the year, to 80.8%, from 31 December 2017.

Al Rajhi Bank’s retail business is the largest retail banking franchise in the Kingdom and offers a full range of financial products and banking services to individuals, such as current accounts, personal finance, and housing and auto financing.

Financial Performance of Business Units

|

Type of activity

|

Activity

revenues

(in thousand SAR) |

Percentage

%

|

|

Retail

|

Retail sector includes deposits of retail customers, credit facilities, debit current account (overdraft) and banking services, and remittances fees

|

12,015,569

|

70

|

|

Corporate

|

Corporate sector includes deposits of corporate, major customers, corporate credit facilities, and debit current accounts (overdraft)

|

2,490,518

|

14

|

|

Treasury

|

Treasury sector includes treasury services, Murabaha with SAMA, and international trading portfolio

|

2,276,459

|

13

|

|

Investment services and brokerage

|

Includes investments of individuals and corporates in mutual funds, local and international share trading services, and investment portfolios

|

536,972

|

3

|

|

Total

|

|

17,319,518

|

100

|

Retail Banking

The Retail segment saw continued growth in 2018, with financing reaching SAR 168 Bn., up 3.3% from 2017.

|

FY 2018

SAR Mn.

|

FY 2017

SAR Mn. |

YoY

% |

|

Net financing and investment income

|

9,998

|

9,139

|

+9.4%

|

|

Fees and other income

|

2,017

|

2,318

|

-13.0

|

| Total operating income

|

12,016

|

11,457

|

+4.9

|

|

Operating expenses

|

4,510

|

4,397

|

+2.6

|

|

Total impairment charge

|

1,177

|

1,191

|

-1.2

|

| Net income for the period

|

6,328

|

5,869

|

+7.8

|

|

Total assets

|

187,898

|

183,870

|

+2

|

|

Total liabilities

|

273,504

|

249,430

|

+10

|

The Retail segment delivered 4.9% total operating income growth in 2018 to reach SAR 12,016 Mn. Net financing and investment income grew 9.4% year-on-year to SAR 9,998 Mn., driven by a 2% increase in assets, while fees and other income decreased 13.0% to SAR 2,017 Mn.

Operating expenses totalled SAR 4,510 Mn. in 2018, a 2.6% increase year-on-year.

The impairment charge for Retail amounted to SAR 1,177 Mn. for 2018, a 1.2% improvement relative to 2017 due to better credit quality and recoveries during the year.

Net income for 2018 increased 7.8% to SAR 6,328 Mn.

A number of new products and initiatives were launched during 2018, supporting volume growth across our mortgage and personal financing segments. In mortgages, the success of our ongoing partnership with the Ministry of Housing as well as the Real Estate Development Financing has enabled us to further segment our product offering and reach a wider audience, supporting the government’s drive for higher home ownership. In Personal financing, we continue to strengthen our leadership by growing our distribution network capabilities. We now have the largest distribution network in Saudi Arabia with 551 branches, 5,006 ATMs, 83,958 POS terminals and 236 remittance centres. We also operate 18 branches in Malaysia, 10 in Jordan and 2 in Kuwait. Over the past 3 years, the Bank registered 4.6% market share growth in remittance centres and growth of 30% in female customers with the introduction of 5 additional dedicated ladies sections and branches bringing the total dedicated sections and branches for ladies to 157, further cementing the Bank’s distribution network as the largest in the Kingdom.

Comparison of SME Financial Results:

Financial data of SME during the current year.

|

As at 31 December 2018

|

Small

|

Medium

|

Total

|

|

Finance for small, medium and micro enterprises – on balance sheet (SAR Mn.)

|

837

|

4,113

|

4,950

|

|

Finance for small, medium and micro enterprises – off balance sheet (SAR Mn.)

|

172

|

756

|

928

|

|

Finance on balance sheet to small, medium and micro enterprises as a percentage of total finance on balance sheet (%)

|

0.36

|

1.76

|

2.11

|

|

Finance off balance sheet to small, medium and micro enterprises as a percentage of total finance off balance sheet (%)

|

1.34

|

5.90

|

7.24

|

|

Number of financings (on and off balance sheet)

|

3,494

|

1,655

|

5,149

|

|

Number of customers (on and off balance sheet) (SAR Mn.)

|

1,099

|

759

|

1,858

|

|

Finances number guaranteed by kafalah programme (on and off balance sheet) (SAR Mn.)

|

394

|

–

|

394

|

|

Finances total guaranteed by kafalah programme (on and off balance sheet) (SAR Mn.)

|

370

|

–

|

370

|

Financial data of SME during the previous year.

|

As at 31 December 2017

|

Small

|

Medium

|

Total

|

|

Finance for small, medium and micro enterprises – on balance sheet (SAR Mn.)

|

1,129

|

4,120

|

5,249

|

|

Finance for small, medium and micro enterprises – off balance sheet (SAR Mn.)

|

139

|

423

|

562

|

|

Finance on balance sheet to small, medium and micro enterprises as a percentage of total finance on balance sheet (%)

|

0.48

|

1.76

|

2.25

|

|

Finance off balance sheet to small, medium and micro enterprises as a percentage of total finance off balance sheet (%)

|

1.02

|

3.12

|

4.14

|

|

Number of financings (on and off balance sheet)

|

3,614

|

2,178

|

5,792

|

|

Number of customers (on and off balance sheet) (SAR Mn.)

|

1,046

|

1,327

|

2,373

|

|

Finances number guaranteed by kafalah programme (on and off balance sheet) (SAR Mn.)

|

288

|

–

|

288

|

|

Finances total guaranteed by kafalah programme (on and off balance sheet) (SAR Mn.)

|

461

|

–

|

461

|

Corporate Banking

Al Rajhi Bank’s corporate banking segment offers a comprehensive range of corporate financing facilities as well as trade finance, cash management and financial hedging and protection solutions to corporate customers.

|

FY 2018

SAR Mn.

|

FY 2017

SAR Mn. |

YoY

% |

|

Net financing and investment income

|

1,879

|

1,974

|

-4.8

|

|

Fees and other income

|

611

|

624

|

-2.1

|

| Total operating income

|

2,491

|

2,598

|

-4.1

|

|

Operating expenses

|

330

|

472

|

-30.0

|

|

Total impairment charge

|

303

|

356

|

-14.9

|

| Net income for the period

|

1,858

|

1,771

|

+4.9

|

|

Total assets

|

62,102

|

63,535

|

-2

|

|

Total liabilities

|

18,948

|

21,288

|

-11

|

The Corporate segment’s total operating income amounted to SAR 2,491 Mn. for 2018, a 4.1% decline over 2017. Net financing and investment income decreased 4.8% year-on-year at SAR 1,879 Mn. and fees and other income decreased by 2.1% to SAR 611 Mn.

Operating expenses totalled SAR 330 Mn. in 2018, 30% lower than in 2017. The impairment charge for Corporate Banking decreased by 14.9% to SAR 303 Mn. for 2018 compared with 2017.

Net income of SAR 1,858 Mn. for 2018 was 4.9% higher than in 2017.

During 2018, we introduced new products such as Supply Chain Financing (SCF), facilities that are based on receivables purchase agreement on behalf of the Bank’s corporate clients’ suppliers; and POS Financing, offered to SME customers through an active point of sale terminal to cover their short term and long term needs.

Treasury

The treasury segment is responsible for managing the Bank’s financial position to accomplish successful structuring of maturities and liquidity, investment efficiency and exchange rates and offers financial hedging and protection solutions to corporate customers.

|

FY 2018

SAR Mn.

|

FY 2017

SAR Mn. |

YoY

% |

|

Net financing and investment income

|

1,359

|

895

|

+51.9

|

|

Fees and other income

|

917

|

505

|

+81.6

|

|

Total operating income

|

2,276

|

1,400

|

+62.6

|

|

Operating expenses

|

504

|

231

|

+117.8

|

|

Total impairment charge

|

51

|

1

|

+9192.1

|

| Net income for the period

|

1,722

|

1,168

|

+47.4

|

|

Total assets

|

111,970

|

92,783

|

+21

|

|

Total liabilities

|

23,868

|

16,107

|

+48

|

Treasury and Investments reported a strong performance in 2018, with operating income rising 62.6% year-on-year to SAR 2,276 Mn. This was driven by both higher investment balances and increased net financing and investment yields causing a 51.9% rise in net financing and investment income to SAR 1,359 Mn.

Despite volume-related increases in both operating expenses, to SAR 504 Mn., and impairments, to SAR 51 Mn., the higher operating income translated to 47.4% year-on-year net income growth to SAR 1,722 Mn. for 2018.

2018 saw several new developments in the Treasury department, with new product launches at several desks including Money Markets and FX, a significant ramping up of the activities of our Investment Desk and at our Financial Institutions desk, the creation of entirely new units such as ALM and Structuring and Derivatives Desk. Our remittances business, Tahweel Al Rajhi, has been brought under the umbrella of the Treasury department to enhance synergies, as we continue to invest in our digital platform on this and other channels. Over 55% of all Tahweel transactions were done using electronic means last year.

On the technology front, we are excited that our FI desk played a significant role in the implementation of new technology using Ripple, a blockchain-based digital ledger algorithm, to settle trades with one of our banking correspondents.

Investment Services and Brokerage

The Bank’s investment services and brokerage business offers asset management and local and international share trading services.

|

FY 2018

SAR Mn.

|

FY 2017

SAR Mn. |

YoY

% |

|

Net financing and investment income

|

16

|

22

|

-27.1

|

|

Fees and other income

|

521

|

428

|

+21.7

|

| Total operating income

|

537

|

450

|

+19.3

|

|

Operating expenses

|

148

|

137

|

+8.0

|

|

Total impairment charge

|

0

|

0

|

|

| Net income for the period

|

389

|

313

|

+24.2

|

|

Total assets

|

3,033

|

2,928

|

+4

|

|

Total liabilities

|

130

|

540

|

-76

|

The Investment Services and Brokerage business grew 2018 operating income to SAR 537 Mn., a 19.3% increase over 2017, driven by brokerage and by investment, which resulted in 24.2% net income growth year-on-year to SAR 389 Mn.

Al Rajhi Capital retained its position as the leading broker on Tadawul, and expanded its market share to 20.3% from 19.6% in 2017. The Asset Management business also expanded significantly with total AUMs (assets under management) up 40% to SAR 38 Bn. In addition, the unit’s Real Estate business saw the milestone IPO of the Al Rajhi REIT Fund, which was oversubscribed by 174%. Lastly, our Proprietary Investments, benefited from several initiatives launched last year and contributed 24% of segment in 2018.

Al Rajhi Capital was named “Best Broker in Saudi Arabia’ by EMEA Finance and ‘Broker of the Year” by Euromoney Global Investor, “Best Provider of Sharia-compliant Funds – 2018’’ by Global Finance and ‘ Real Estate Investment Firm of the Year’ by Euromoney Global Investor.

Financial Performance of Subsidiaries

|

Type of activity

|

Activity revenues

(SAR ’000)

|

Percentage

%

|

|

Al Rajhi Bank Malaysia

|

An Islamic bank licensed under Islamic Financial Services Law issued in 2013, incorporated and practices its business in Malaysia.

|

183,982

|

-3.29

|

|

Al Rajhi Capital

|

A closed joint-stock company, registered in KSA to work as a main agent and/or provide financial brokerage services, insurance, management, consultancy, arrangements and keeping.

|

536,972

|

19.00

|

|

Al Rajhi Takaful Agency

|

A limited liability company, registered in KSA to work as an agent to practice insurance brokerage activities according to agency agreement with Al Rajhi Cooperative Insurance Company.

|

3,104

|

-68.00

|

|

Al Rajhi Development Co. Ltd.

|

A limited liability company registered in KSA to support real estate finance programmes of ARB by transferring and keeping real estate ownership documents in its name on behalf of the Bank; collect revenues of selling some properties sold by the Bank; provide consultancies in real estate and engineering field; register real estate contracts; and supervising real estate valuation.

|

31,830

|

58.00

|

|

Al Rajhi Services Co.

|

A limited liability company registered in KSA to provide recruitment services.

|

186,557

|

10.00

|

![]()

|

Year

|

Kingdom of

Saudi Arabia

SAR ‘000 |

East Asia

SAR ‘000 |

Total

SAR ‘000 |

|

2018

|

758,463

|

183,981

|

942,444

|

Financial Performance of International Branches

Al Rajhi Bank Kuwait

Operating income for 2018 increased to KD 1.55 Mn., primarily due to growth in retail financing portfolio to KD 122 Mn. by 14% YoY compared to average Kuwait market growth rate of 4%. Retail deposit portfolio grew by 75% YoY to reach KD 72.2 Mn.

Deposit concentration (top five deposits) improved from 82.4% in 2017 to 76.3% in 2018.

Retail non-performing loans ratio stood at 0.6% against the average market ratio of 2.0%

Al Rajhi Bank – Jordan

Income grew by 13% compared to 2017 to reach JOD 24.8 Mn. (SAR 130 Mn.) as a result of increase in financing income by 14% and commission and fees by 13%. Net profit before tax and provisions grew by 19% to reach JOD13.5 Mn. (SAR 71 Mn.). Total assets grew by 8% to JOD 502 Mn. (SAR 2.7 Bn.) compared to 2017. Financing portfolio grew by 5% in 2018 and reached JOD 348 Mn. (SAR 1.8 Bn.). Shareholders’ equity increased by 10% to JOD 68 Mn. (SAR 358 Mn.).

|

Year

|

Kingdom of

Saudi Arabia

SAR ‘000 |

Kuwait

SAR ‘000 |

Jordan

SAR ‘000 |

Total

SAR ‘000 |

|

2018

|

16,171,543

|

73,142

|

132,390

|

16,377,075

|

There are no loans on the Bank or its subsidiaries (whether payable on demand or others).

Applicable Accounting Standards:

The Bank prepares its unified financial statements in accordance with international accounting standards based on circular of CMA no. (2978/4) regarding applying international accounting standards. In addition, the Bank prepares its financial statements in compliance with Banking Control Law, Corporate Law in KSA, and the Bank’s Articles of Association.