Highlights for Retail Banking

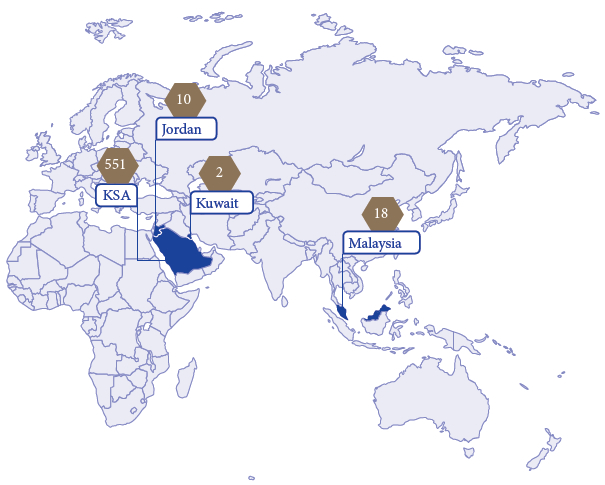

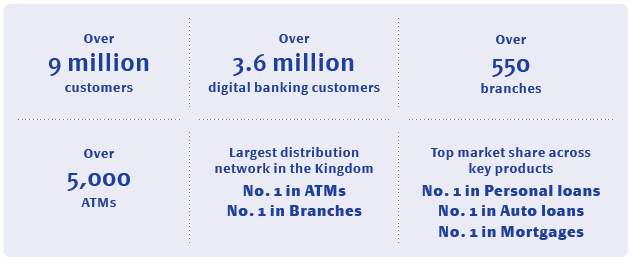

Operating the largest retail business in the Middle East, Al Rajhi Bank serves over nine million retail customers.

During the year, the Bank continued at its top position in terms of branch and ATM networks and remittance centers across the Kingdom, by focusing on increasing its market share in deposit. Through this wide network, ARB customers have access to the entire range of financial products and services from the Kingdom’s leader in current accounts, personal loans, auto loans, and mortgages.

Improved private centres and affluent lounges

Continuing to cater to the banking needs and aspirations of its private customers, the Bank extended working hours to 9.00pm at its Private Centres in Riyadh, Jeddah, Dammam, and Makah and at its dedicated Ladies Private Centre in Riyadh. The Bank also increased and enhanced a number of Affluent lounges with contemporary design to meet the expectations of our valued customers and ensure that their experience with us remains comfortable and convenient. The Bank’s Affluent lounges now number 300 and span the Kingdom. During the year, we also increased the number of relationship managers at our 60 dedicated Affluent Ladies Sections.

Introducing online account opening

In alignment with the Bank’s strategy and its contribution towards the Saudi 2030 vision to engage with technology and implement a cashless society we introduced customers to online account opening during the year under review. By fully automating the account opening process in line with regulations, we provided an attractive new option that enhanced the customer experience and service standards while enticing potential customers to sign up.

The Bank’s new retail expansion strategy was supplemented by a new layout for each branch that was designed to enhance the customer experience and entice them to try out and experience digital banking.

Developing the real estate mortgage market

Despite being one of the largest in the Gulf region, Saudi Arabia’s real estate market remains underdeveloped, with only an estimated 47% of Saudis owning their own home. Rising incomes, urbanisation, growing families and a young demographic, however, mean that the long-term outlook for the KSA real estate remains positive. A stimulus package of SAR 72 Bn., that supports housing construction and waives fees for small businesses and investors provides further incentive in this market. The government’s plans to launch large infrastructure projects, such as Neom City and Red Sea, to meet the goals of Vision 2030 and steer the Kingdom away from an oil-dependent economy means that the real estate market is one to watch in the coming years.

Capitalising on this situation, the Bank launched a real estate programme, in cooperation with the Real Estate Development Fund (REDF) and the Ministry of Housing (MOH) which has already resulted in a positive impact on the book size of our Real Estate financing for the Retail portfolio. The fund is based on the Murabaha principle and supports financing for customers who meet the Bank’s credit conditions. The Bank will purchase the property in full on behalf of the customer, with REDF paying the Bank an advance payment on behalf of the customer. This project is one example of the Bank’s contribution towards increasing home ownership in Saudi Arabia to 60% by 2020 in line with the Saudi Vision 2030.

During the year, the Bank launched 15 high-demand new products and features in the home financing space, such as self-construction and off-plan, which were supported by government initiatives including profit subsidy, down payment support, and military support. The launch of these products and features was augmented by marketing campaigns to ensure targeted and wider reach among potential and existing retail banking customers in segments as varied as salaried, near retirement, retired, and self-employed. With more such products and features in the pipeline to be launched from 2019 to 2025, the Bank is geared to meet market demand. We look forward to facing the challenges of 2019 head on as we continue to maintain the largest market share in this segment and offer best-in-class customer service while enhancing our relationship with REDF/MOH.

Customer spending behaviour and engagement continues to grow on digital platforms such as e-commerce and international transactions which significantly adds to portfolio profitability.

Retail expansion strategy

The Bank’s new retail expansion strategy was supplemented by a new layout for each branch that was designed to enhance the customer experience and entice them to try out and experience digital banking.

Retail expansion strategies implemented during 2018 include:

- More machines at self-service kiosks

At its 24-hour, self-service kiosks, known as ASRAA, the Bank installed a total of 230 machines during the year – considered a record even by global standards. These kiosks provide customer with 24x7 banking services.

- Draft cheque printing

For the first time in the market customers are now able to print draft cheques instantly at any self-service kiosk.

- Fingerprint technology

Customers can now update their personal information using fingerprint technology without having to visit the branch. This initiative is part of the Bank’s ongoing strategy to be the market leader in innovative products and services especially in self-service banking.

- Foreign currency exchange at ATMs

Another pioneering self-service banking solution introduced during the year was the facility for customers to exchange foreign currency at ATMs located at different international airports. Able to now withdraw and deposit foreign currency from their accounts utilising fingerprint technology, usage of this new service, especially among transit passengers, is very high.

- More interactive teller machines

The Bank also installed 20 interactive teller machines (ITMs), making ARB the proprietor of the largest such network in Saudi Arabia. ITMs allow customers to communicate with remote tellers through video and audio as they perform various banking transactions. This high-tech solution provides customers with easy and convenient banking options.

- Customer loyalty programme

The MOKAFA’A programme was launched during the year to reciprocate customer loyalty. This programme allows ARB customers to earn points every time they use the Bank’s many products and enhanced features. These points can be redeemed at a range of locations belonging to participating merchants or service providers.

- Electronic signatures

Signing a memorandum of understanding with the specialised companies at the Ministry of Communication and Information Technology, the Bank partnered with the National Centre for Digital Certification, to provide “Electronic Signature” service for customers. Instead of having to ask customers to sign documents in person, the new service allows them to add signatures to documents electronically. The new service provides convenience without compromising security. After registering at the National Centre for Digital Certification, MCIT through the Bank, customers are able to request for any new service using digital mediums.

Customer spending behaviour and engagement continues to grow on digital platforms such as e-commerce and international transactions which significantly adds to portfolio profitability.

Cards for convenience

The Al Rajhi Mada Infinite Debit Card was launched for customers with elite lifestyles. It provides access to over 1,000 airport lounges around the world through the Lounge Key Programme and global concierge services including for flight, hotel, and restaurant reservations. Using passwords and CHIP technology these debit cards have superior security features and provide customers with free instant messaging for all financial transactions.

The Al Fursan Card from Al Rajhi Bank was also launched during the year under review. Whenever customers make a payment with this card they receive free air miles on Saudi Arabian Airlines.

With the Kingdom’s recent moves to provide ladies with greater autonomy, the Bank launched the Selective Credit Card exclusively for women. The first of its kind in the Kingdom, this card offers our female customers distinction and privacy while providing special offers and discounts at retail outlets for the best in women’s goods and services.

The Bank has the third largest and fastest growing portfolio with a milestone of 200,000 revolving credit cards as at end 2018. The Bank continues to be the leader in the market in debit cards, with a market share of eight million cards in circulation, leading in spend volume as well.

The Bank has the third largest and fastest growing portfolio with a milestone of 200,000 revolving credit cards as at end 2018. The Bank continues to be the leader in the market in debit cards, with a market share of eight million cards in circulation, leading in spend volume as well.

Responsible lending principles

In May, of the year under review, the Responsible Lending Principles were issued by SAMA under Circular Number (46538/99). The main objective of these regulations is to shift consumer behaviour towards savings and mortgage finance and away from consumer finance.

The regulation calls for tighter DBR (Debt Burden Ratio) restrictions across all products, especially auto leasing, in addition to the introduction of an affordability module which includes the consideration of external obligations.

Personal finance

The Bank continued to advance its Personal Finance offering, launching the largest buyout programme which allowed customers to transfer their salaries to Al Rajhi Bank in exchange for the settlement of their financing in other Saudi banks.

Watani Flex Finance, the Bank’s fully Sharia-compliant personal financing solution and its most profitable retail banking product, was further enhanced during the year. Processes were streamlined to cater to the needs and aspirations of internal as well as external stakeholders.

Growing the auto finance business

The auto market in general has been witnessing a gradual slump since mid 2016, a trend which continued into 2018 owing particularly to the introduction of SAMA’s Responsible Lending framework. Despite this, the Bank’s Auto Finance arm managed to increase its yield.

Issue resolution and improved customer service was a priority for the Bank’s auto finance team. To this end, one of our customers’ top complaints regarding missing duplicate keys was revisited and a more streamlined solution introduced. In addition, the Sub Dealer Rebate programme, a new revenue stream initiative was introduced.