Becoming the employer of choice is one of the pathways of the Bank’s 2020 ABCDE strategy.

Employer of choice

Becoming an employer of choice is one of the Bank’s key strategies as it is keenly aware of the positive impact of an engaged workforce. With this goal in view, HR has transformed itself as it worked towards building a motivated, competent and engaged workforce over the past few years; one that is capable of surmounting the current and future challenges of the Bank.

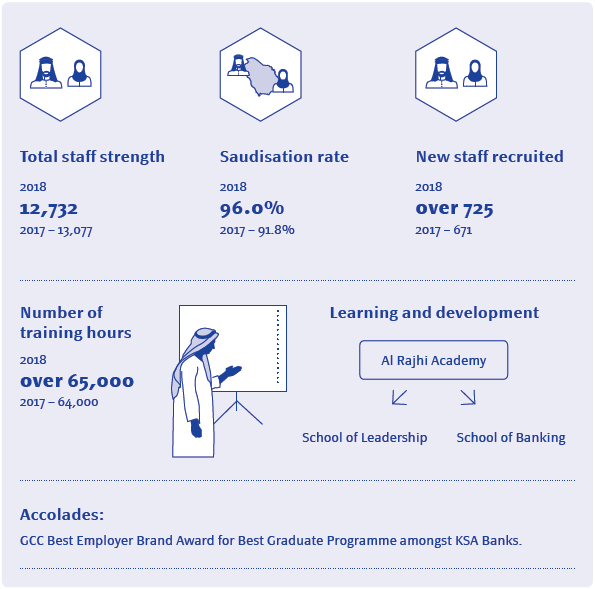

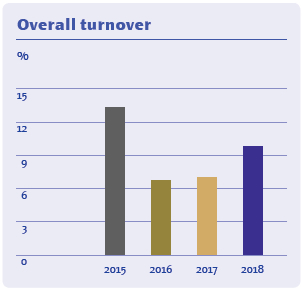

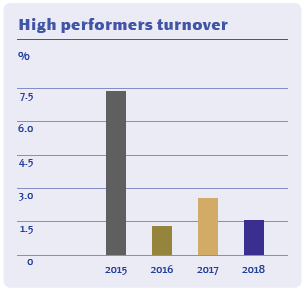

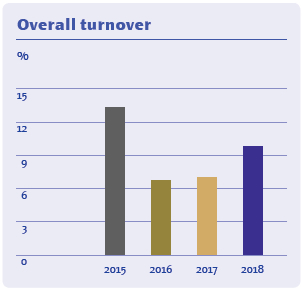

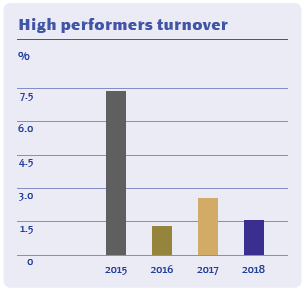

HR has successfully achieved several key milestones already, recording significantly lower attrition in the high performer category.

The Bank has been recognised for the third consecutive year as the Best GCC Employer Brand by Employer Branding Institute and the Most Preferred Banking Employer in KSA for Saudi graduates by UNIVERSUM for the second year in a low.

Given below are some of the key strategic initiatives that HR Group has implemented successfully in order to deliver on the broader sustainability objectives.

Recruiting the best

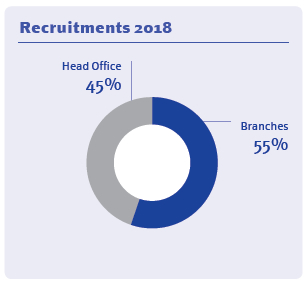

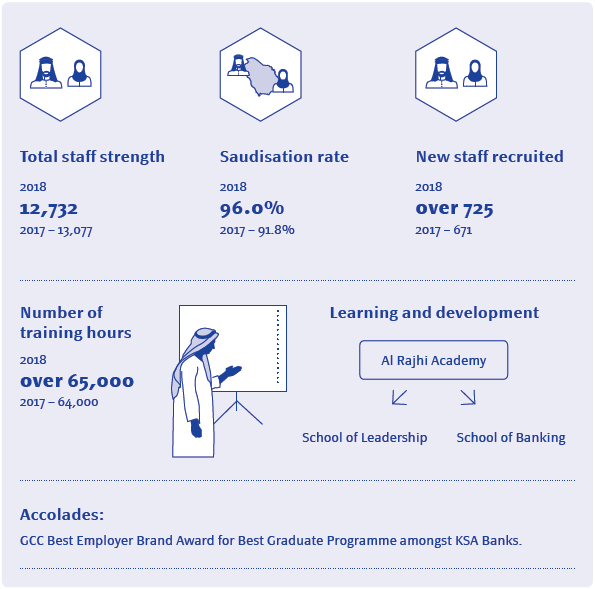

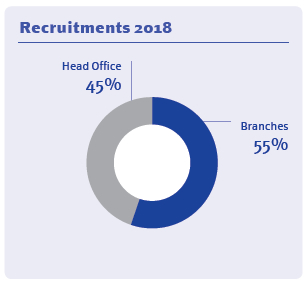

Being the largest banking employer in KSA, we recruited over 725 new employees during 2018. To do so we implemented best-in-class selection tools that include:

- Ability tests

- Psychometric assessments

- Criteria-based interviews

- Fully-fledged assessment centres

The Bank’s graduate programmes are also designed to provide the necessary knowledge foundation and resilience for young Saudi female talent to navigate across the current complex banking environment.

To ensure a smooth and effective recruitment process across all regions of the Kingdom we partnered with and depended on:

- Recruitment specialists

- The on-boarding team

- The automated on-boarding process

Developing and managing talent

Once on board, new recruits are carefully cultivated by the Talent Council to ensure that they have the best experience with us and that we create an environment that brings out their latent talents.

Establishing sustainable core talent management practices is an integral part of the 2020 HR Strategy and a key driver for achieving our strategic aspirations towards becoming Employer of Choice. With this intent, we have set up the ARB Talent Council, under the patronage of our CEO to reflect our commitment in developing strong Saudi leadership. The Talent Council plays a critical role in identifying, developing, nurturing and mobilising the Bank’s Saudi talent. It prioritises talent under the following categories for the purpose of succession planning for critical roles across the Bank:

- Senior leaders – Tier 1

- Junior leaders – Tier 2

- Emerging leaders – Tier 3

Catering to graduates

The Bank’s graduate programme has been rated as the best among all the financial institutions in the Kingdom for the second consecutive year by UNIVERSUM. We adopt best in class selection methodology, including an online ability test and a motivational interview approach to select the best Saudi graduates from different national and international universities.

The Bank’s graduate programmes are also designed to provide the necessary knowledge foundation and resilience for young Saudi female talent to navigate across the current complex banking environment.

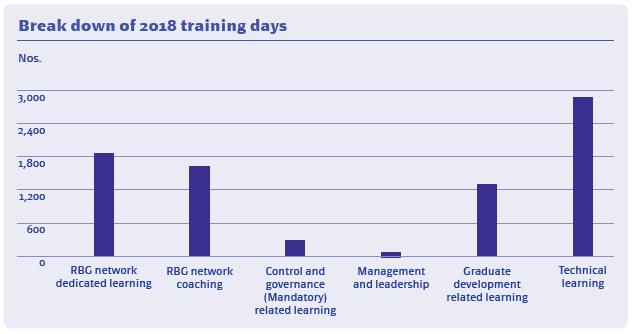

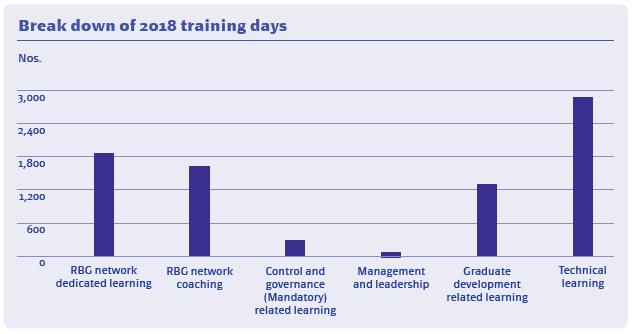

During 2018, more than 65,000 training hours were delivered to ARB employees covering different domains such as technical, regulatory, leadership, and personal effectiveness.

To date, we have inducted over 150 graduates within the Bank since the programme began in 2015. There are primarily two types of Graduate programmes:

- Graduate development programme:

The graduate development programme is an 18-month journey that includes classroom learning, rotation with business and control functions, attachment with Groups on live projects, mentoring and coaching, and contribution to our CSR initiatives. During the year, we launched the Bank’s first dedicated female graduate development programme, the sixth such graduate programme since its inception four years before. So far, three batches have graduated, and three are currently undergoing training.

- Thematic development programme:

The thematic graduate development programme is a 12-month journey and is focused on building domain specific capabilities. To date, we have implemented four such programmes, dedicated to Corporate Banking, SME, IT and Transformation and Change Management. Upon graduation, the participants will take up roles within their respective business or functional areas.

Planning for succession

Succession Planning at Al Rajhi Bank is undertaken with the following objectives in mind:

- Identifying critical positions within the Bank which have a significant impact on its financial and control functions

- Identifying the status of these positions (filled/vacant) and the availability of in-house successors and their preparedness for identified roles

- Developing proactive strategies with respect to succession planning

The identified successors undergo a variety of development initiatives engineered and launched by the HR team in 2018/19 to make sure that the Bank is investing in bridging the gaps between the identified successor and his/her future targeted role.

Building strong business leaders

The Bank has embarked on a mission to establish the Al Rajhi Bank Academy to develop the business and leadership capabilities of its employees and meet the goals of its 2025 strategy to be the Employer of Choice. The Academy consists of two key pillars, the School of Leadership and the School of Banking. During 2018, more than 65,000 training hours were delivered to ARB employees covering different domains such as technical, regulatory, leadership, and personal effectives.

School of leadership

For Al Rajhi Bank to grow sustainably, it is imperative that the leadership pipeline is strong and vibrant. The following leadership programmes have been launched to address the current and emerging development needs of senior leaders at the Bank:

- Executive leadership programme: Facilitates leadership development, enabling experienced leaders to better manage their current responsibilities while making a greater contribution in an increasingly complex environment

- The leadership development programme: Addresses leadership capabilities needed to develop the next generation of leaders at Al Rajhi Bank and support effective ongoing implementation of our business strategy

- Transition management programme: Empowers individuals during their career progression journey, supporting individuals with focused development and preparing them at each transition stage of their career

- Management development curriculum: Builds confidence and efficiency in employees with people management responsibilities

School of banking

The primary focus of the school of banking is to build role specific capabilities and domain expertise across different businesses and functions of the Bank. This is delivered through a structured development and certification approach. Examples of these structured developments include:

- Treasury and FI Certification

- Corporate Banking Credit Risk Certifications

- SME Credit Risk Certification

- Retail Branch Manager Certification

- Certified Compliance Officer Certification

- Certified Auditor Certification

A blended approach of learning has been adopted in the design of these structured interventions in order to ensure learning effectiveness and drive greater efficiency.

Championing a performance-driven culture

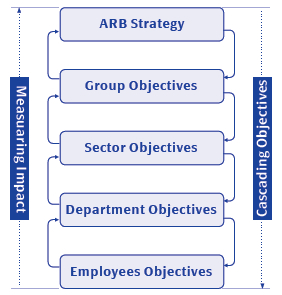

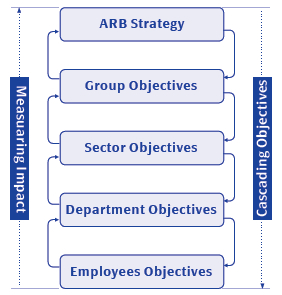

In line with our Vision, Mission, and Values each business unit and support function is required to develop its own strategy which is in alignment with the overall strategies of the Bank.

Achieving the plan of each department depends on the efforts of the employees. To ensure that each employee clearly understands their role in realising the Bank’s goals, the Bank’s strategic plan is cascaded to each department. Then, working as part of a team, each employee identifies and agrees to the objectives, targets and deadlines they must meet in order to contribute towards the goals of their department and ultimately the Bank itself.

Cascading the strategy to all groups and departments and ultimately to individuals is a critical success factor for the Bank.

Cascading and Cause & Effect

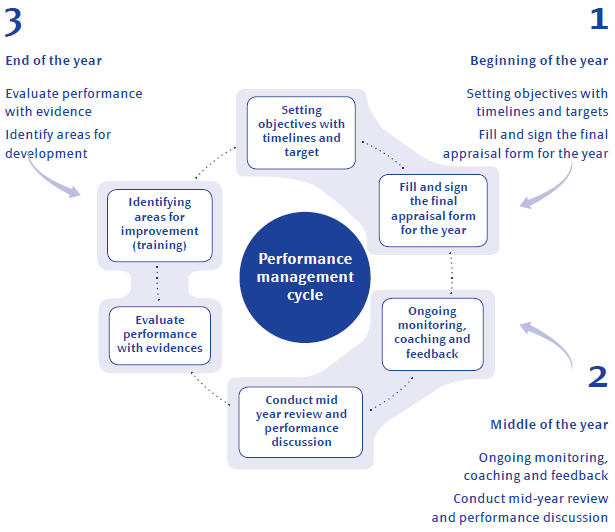

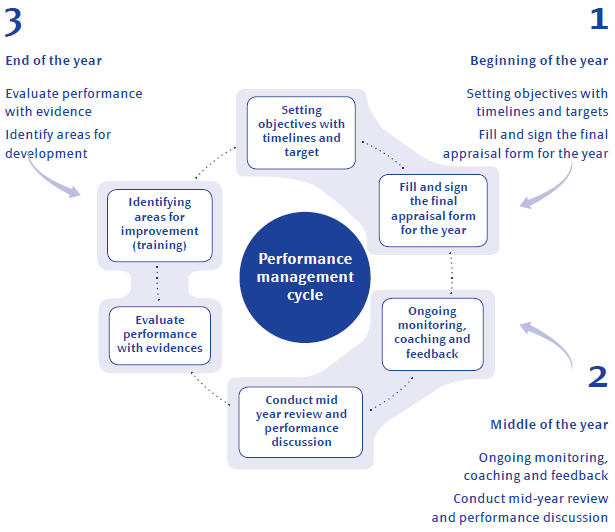

These key performance indicators are met through the Performance Management System, which helps document each employee’s progress.

These key performance indicators are met through the Performance Management System, which helps document each employee’s progress. It consists of three main phases as shown below:

- Pay for Performance Rewards Culture

To ensure consistency and comparability, the Bank has developed its Employee Value Proposition and Compensation policies and practices on a differentiated, pay-for-performance-and-potential model that is linked to the Bank’s and the individual’s performance and market pay position.

The Bank’s rewards strategy and policies are in complete alignment with SAMA’s requirements. In February 2018, the Human Resources Group completed a self-assessment review of the Bank’s Compensation Incentive Schemes against SAMA rules and FSB standards.

The key pillars of the Bank’s compensation framework are:

1. Governance – Board of Directors oversight

2. Policies and procedures

3. Compensation structure and incentive schemes

Risk factors are an integral part of the balanced scorecard for performance management of Senior Executives. The Bank’s total compensation approach comprises fixed and variable compensation. The variable components are in alignment with good corporate governance and include claw back and holdback arrangements.

The Bank promotes a culture of strong open communication with all employees to assess engagement levels and identify areas that require further attention.

Digitised HR services

In line with the Bank’s ABCDE Roadmap and the HR Strategy to Become an Employer of Choice, the Human Resources Group launched “SAHL”, a new generation HR Services application. “SAHL” is a mobile application that is compatible with IOS and Android and is integrated with HR systems that provide employees with the ability to execute their HR Services anywhere, anytime. It improves the convenience, efficiency and reliability of HR services.

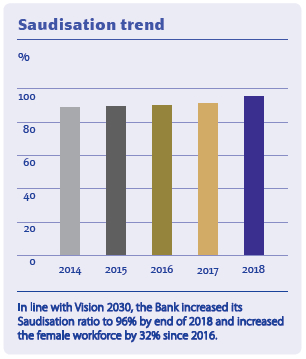

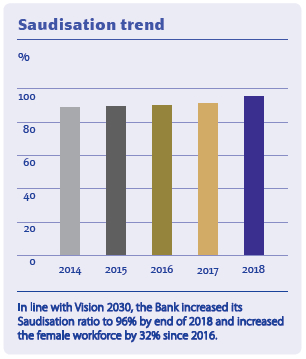

Embracing the Kingdom’s Vision 2030

HR Governance

A dedicated Governance Unit has been established within HR covering audit, risk, compliance and SAMA-related matters. As one of the largest banking workforces in the Kingdom, it is of critical importance that HR maintains strict control and adherence to all policies, procedures and regulatory guidelines. Standardised Control and Risk Governance KPIs are included in all relevant employees’ scorecards.

Employee engagement and communication

The Bank promotes a culture of strong open communication with all employees to assess engagement levels and identify areas that require further attention. Communication channels include:

- Pulse surveys

- Focus group discussions

- HR Newsletter

- Online employee communication portal TAWASUL

- Annual roadshows and town halls

- Ramadan family activities

The overall engagement score significantly improved in 2018 and we continue to enhance HR solutions and deliverables to meet employee expectations.

As part of the multi-year transformation journey, Internet and Mobile banking continues to be a key focus of our Digital Agenda.