Corporate Governance

Constructed on a sound philosophy, ethics, policies, values, accountability and sincerity of action, AEL’s corporate governance ethos works within a culture of performance that emphasizes a framework of conformance and compliance. To us, corporate governance goes beyond the tenets of conformance and compliance into a milieu where our business is grown and nurtured into a sustainable and equitable one, presenting all our stakeholders with a future to grow with us. Maximizing shareholder wealth on a sustainable basis while safeguarding the rights of multiple stakeholders are fundamentals which are permeated through all levels of our management and staff, who in turn work on the trusses of truth, trust, principles and honesty to ensure that the end justifies the means and remain strategically aligned to the core principles of our corporate governance practice.

Our governance and operating model facilitates efficient and timely decision-making coupled with pragmatic resource allocations, which in turn are integrated into a transparent, accountable and ethical framework that are compliant not only with the laws of the country but also with self-imposed codes of ethics, standards and regulations that position us on a platform of critical governance features to ensure a culture that goes beyond compliance. This is thus manifested in the composition of the corporate management team, division of powers and duties and the promotion of sound corporate ethics across the Company.

The Company’s vision and mission remain firmly embedded in our future journey with the Board of Directors and Executive Management providing the necessary stewardship to our team and other stakeholders to achieve our objectives. Evaluating and setting the direction of the Company’s strategic initiatives, performance objectives and targets also remain entrenched within the Board of Directors, in addition to strengthening the overarching Company principle of protecting the interests of all stakeholders and consolidation of business activities to ensure continuity and sustainability.

The Board of Directors of AEL endeavours to provide entrepreneurial leadership through effective formulation and execution of policies and procedures to attain the objectives of the Company. The Board comprises of ten Directors out of which five are Executive Directors and five are Non-Executive Directors. There is no female representation on the Board. Chairman of the Company who acts in an Executive Capacity is mainly responsible for directing the affairs of the Board while maintaining effective external relationships. Day-to-day affairs of the Company are headed by the Managing Director who is supported by the Director/Chief Operating Officer (COO). Three of the Non-Executive Directors are independent in respect of criteria laid down by the regulatory authorities and have no interests or relationships in relation to the affairs of the Company. This composition has encouraged the Company to demonstrate more transparency and independent judgment in the decision-making process. Decisions regarding new Board appointments are taken by the Board collectively and the qualifications and experience of Board members are decided based on the nature of the business of the Company and the value addition the member is expected to bring to the Board and the Company.

The Company also adopts the main corporate governance committees under the highest governance body; Audit Committee and Remuneration Committee to strengthen its commitment on corporate governance. Beyond the mandatory requirements, the Company also has in place a Strategic Planning and a Compliance Committee to ensure adherence to best practices.

The Board carries out a self-evaluation of its performance both individually as well as collectively against economic, environmental and social targets/goals set at the beginning of each year. Results of these evaluations are properly minuted by the Company Secretary who is responsible for maintaining the same. The Executive Directors are required to adhere with the provisions of the ‘Company Policy on Disciplinary Management’ to avoid any potential conflict of interest. Implementation of the said policy is periodically monitored by a six-member committee. The Non-Executive Directors are required to confirm the existence or non-existence of conflict of interest in the dated declaration submitted to the Board.

Shareholders being the primary stakeholder group, the Company has in place a clear mechanism for facilitating their recommendations. Shareholders could meet the members of the Board on prior appointment or via the Company Secretary who keeps a record of their concerns. These concerns are promptly replied either directly or via the Company Secretary as the case maybe.

Access Engineering’s Corporate Management Team is committed to achieving sustained value creation for the benefit of all stakeholders through adherence to a set of well-defined corporate governance principles, coupled with maintaining effective structures and processes within the Company. The team, which comprises the Managing Director, Chief Operating Officer, Board Members and Senior Management, meet at regular intervals to discuss the management of business activities. Project implementation is carried out by the Project Management Divisions wherein General Managers and Deputy General Managers work on plans and targets, matching those to realistic time frames and ensuring any shortfalls or delays are speedily rectified. Authority is exercised within an ethical framework of business practices established by the Board, which demands compliance with existing laws and regulations as well as best practices in dealing with employees, customers, suppliers and the community at large.

We have also infused a milieu of increased participation by middle management to permeate the need for a more responsible, transparent and accountable administration, which in turn will strengthen the financial discipline of the Company. The culture of high authority tied-up with high accountability has given us the freedom to respond to customer needs faster than most of the competitors which has been the cornerstone of our competitive advantage. The permeation of authority and accountability right down to the shop floor level and the front-line has freed up the top management to dwell on the more strategic and conceptual inputs.

Driving a team branded on excellence, people remain centric to our entire operational capabilities and engineering competencies. The experience and professionalism within our team has been the catalyst in integrating our core competencies into strategic partnerships. Maintaining a healthy work-life balance with an environment of superior human resource development via a comprehensive Quality Management System and Occupational Health and Safety Management System inculcate the culture of meritocracy and performance-oriented individuals who make-up for an excellent team, driven to achieve ambitious goals. Part of the compensation of staff including Executive Directors and the Corporate Management is performance based and the distribution of the same is decided by the Board and the Management after the evaluation of multiple factors including but not limited to performance of the Company and the individual concerned. Employees are encouraged to make recommendations to the Board via their respective Department Heads.

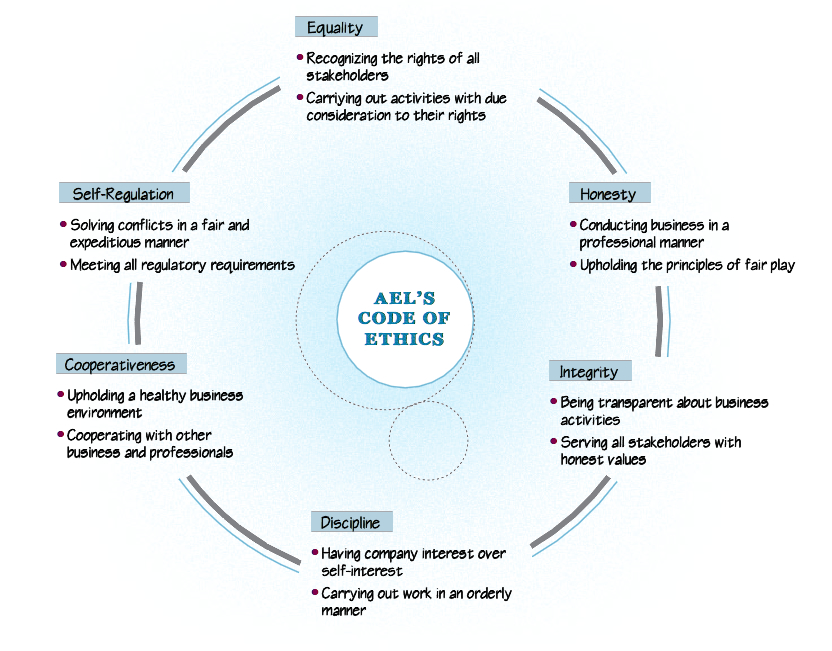

Business Ethics

Our code of ethics has been devised with the objective of developing and maintaining long term relationships with all stakeholders while satisfying the requirements of our valuable customers. It is our belief that upholding these values will result in the Company being profitable. Thus every employee at Access including the new recruits are firmly guided to abide by the following ethics.

Internal Control

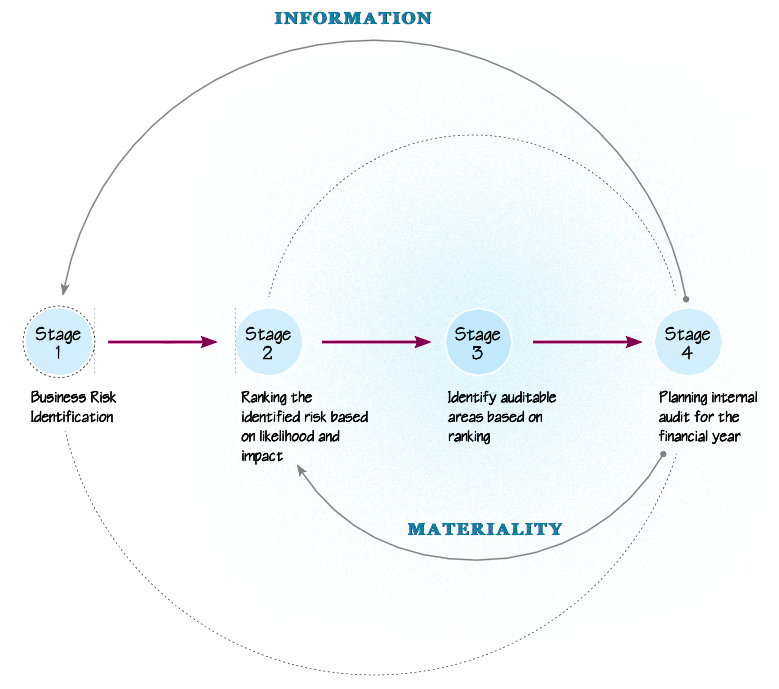

The Company adopts a Risk Assessment-based approach with regard to its Internal Audit functions with the objective of Maintaining Safety, Reliability, Profitability and Integrity of the organization and to overlook key operational and regulatory deficiencies. The risk-based approach considers both high risk areas as well as core organizational processes.

Key functions of the Internal Audit Department include the following:

- Objectively evaluating current risks and the internal control framework

- Systematically analyzing business process and associated controls

- Reviewing the existence and value of assets

- Providing information on major frauds and irregularities

- Ad hoc review of other areas of concern, including unacceptable levels of risk

- Reviewing the compliance framework and specific compliance issues

- Reviewing operational and financial performance

- Making recommendations for more effective and efficient use of resources

- Assessing the accomplishment of corporate goals and objectives

- Providing feedback on adherence to organizational values and code of conduct/code of ethics

- Monitoring compliance with Company’s policies and procedures

- Reviewing systems for ensuring legislative or regulatory issues impacting the Company are recognized and addressed properly

- Conducting special investigative reviews at the request of Management/Board

Based on a thorough evaluation and previous audit findings the department’s key focus areas for the financial year 2014/15 were identified to be Fixed Asset Management and the Asset Utilization processes. The evaluation process of identifying key focus areas consists of a four stages approach.

Company Policies

Quality Policy

AEL has always been concerned about its multifaceted stakeholders ranging from customers, its dedicated and committed staff, principals, subcontractors, suppliers and the society at large. This concern is driven by the Company’s commitment to satisfy customer needs by providing high quality civil construction services with effective, efficient and innovative solutions. This commitment is met by continually improving the quality management system whilst adhering to the ISO 9001:2008 and other applicable regulatory requirements through cost effective, profitable, safe and sound environmental friendly operations.

Environment Policy

AEL recognizes that in carrying out its activities it has a responsibility to customers, employees and the general public to minimize environmental impacts. The Company’s environmental policy has been devised around this motive to:

- Ensure compliance with all applicable legal and other requirements, which relate to its environmental aspects.

- Promote environmental awareness and commitment to the policy amongst all employees and stakeholders through training and communications to encourage suppliers and subcontractors to apply sound environmental principles.

- Avoid the wastage of materials, water and energy by paying careful attention to their use.

- Prevent pollution and minimize environmental disturbance from its activities.

- Promote continual improvement by reviewing the environmental aspects related to Company activities by setting appropriate targets and objectives for improving performance.

This commitment is met by continually improving the environmental management system whilst adhering to the ISO 14001:2004 and other applicable regulatory requirements.

Health and Safety Policy

AEL is committed to uplift the living standards and the well-being of everyone who is affected by its operations. This commitment is strictly embedded in the Company’s affairs via the Health and Safety Policy which focuses on preventing injury and ill health of employees and others affected by its operations and complying with all legal and other requirements to which it has subscribed.

AEL is firmly dedicated to promote awareness of health and safety and continuously improve the Health and Safety Management System and performance by periodically reviewing and making modifications of the same.

This commitment is met by continually improving the Health and Safety Management System whilst adhering to the OHSAS 18001 and other applicable regulatory requirements.

The above policies are enforced and implemented company-wide on a continuous basis. Effectiveness of their implementation is measured from time to time via periodic audits conducted both internally and externally.

Board Committees

Audit Committee

Appointed by the Board of Directors, the Committee comprises three (03) Independent Non-Executive Directors and One (01) Non-Executive Director of the Board.

Members of the Audit Committee

| Niroshan Dakshina Gunaratne (Chairman) | Independent Non-Executive Director | |

| Alexis Indrajit Lovell | Independent Non-Executive Director | |

| Prof. Kulatilleke Arthanayake Malik Kumar Ranasinghe | Independent Non-Executive Director | |

| Suresh Dilan Perera (Appointed w.e.f. 1st January 2014) | Non-Executive Director | |

| Ranjan John Suriyakumar Gomez (Resigned w.e.f. 1st January 2014) | Non-Executive Director |

The Audit Committee Charter formalizes the authority, responsibilities and specific duties pertaining to the Committee as follows:

- Overseeing preparation, presentation and adequacy of disclosures in the Financial Statements of the Company, in accordance with Sri Lanka Accounting Standards.

- Ensuring compliance with financial reporting requirements, information requirements of the Companies Act and other relevant financial-related regulations and requirements.

- Ascertaining that the Company’s internal controls and risk management processes are adequate and meet the Sri Lanka Auditing Standards requirements.

- Assessing the independence and performance of the Company’s External Auditors.

- Making recommendations to the Board pertaining to appointment, reappointment and removal of External Auditors and to approve remuneration and terms of engagement of the External Auditors.

Remuneration Committee

Comprising two (02) Independent Non-Executive Directors and one (01) Non-Executive Director of the Board, this Committee is appointed by the Board.

Members of the Remuneration Committee

| Prof. Kulatilleke Arthanayake Malik Kumar Ranasinghe (Chairman) (Appointed as Chairman w.e.f. 1st January 2014) | Independent Non-Executive Director | |

| Niroshan Dakshina Gunaratne | Independent Non-Executive Director | |

| Suresh Dilan Perera (Appointed w.e.f. 1st January 2014) | Non-Executive Director | |

| Ranjan John Suriyakumar Gomez (Resigned w.e.f. 1st January 2014) | Non-Executive Director |

With the primary objective of the Company’s remuneration policy being effective enough to attract and retain the best human capital to sustain operations while rewarding performance, the Remuneration Committee is tasked with recommending the remuneration payable to the Executive Directors and Chief Executive Officer of the Company and/or equivalent position thereof. This recommendation is made to the Board, which is responsible for the final determination upon consideration of such recommendations.

Strategic Planning Committee

Essentially focusing on assessing existing and new investments, this Committee is responsible for identifying, appraising and monitoring the investment purview, in order to ensure optimum resource allocation by the Company.

Members of the Strategic Planning Committee

| Sumal Joseph Sanjiva Perera (Chairman) | Chairman | |

| Joseph Christopher Joshua | Managing Director | |

| Dalpadoruge Anton Rohana Fernando | Executive Director/ Chief Operating Officer | |

| Alexis Indrajit Lovell | Independent Non-Executive Director | |

| Prof. Kulatilleke Arthanayake Malik Kumar Ranasinghe | Independent Non-Executive Director |

The Committee’s mandate includes:

- Formulating criteria and guidelines for assessing existing and new investments.

- Planning investments periodically, targeting at optimum utilization of resources.

- Reviewing existing investments.

- Assessing new investments for strategic fit, risk profile, profitability and future potential.

- Making recommendations to the Board on investment portfolio, contingency planning and desired future corporate goals.

Compliance Committee

The Compliance Committee is appointed by the Chief Operating Officer and is set up to further strengthen good governance at Corporate Management Level. This mechanism will bridge the gap between the Senior Management and the Board of Directors when important decisions are to be made on operational issues. The Board oversees the performance of the Company against the triple bottom line objectives and codes of conduct based on the recommendations made by the Compliance Committee via the COO.

Members of the Compliance Committee

| Rohana Fernando (Chairman) | Chief Operating Officer/ Executive Director | |

| V K Manatunge (Convener) | Senior General Manager | |

| Palitha Wanigasundara | General Manager (Project Management Division III) | |

| Manoaj Jayahsuriya | General Manager (Project Management Division I) | |

| Kosala Wickramasinghe | Deputy General Manager (Project Management Division II) | |

| A A Fernando | Deputy General Manager (Project Co-ordinating) | |

| Niroshan Thilakaratne | Deputy General Manager (Commercial) |

The Committee’s mandate includes:

- Establish and monitor if the organization’s objectives are met.

- Evaluate Company policies, formulate new policies, advise and take the initiative to revise existing policies.

- Ensure that policies are in compliance with laws and regulations.

- Ensure that project management, accounting, procurement, stores and human resource functions are carried out according to established processes and procedures.

- Ensure that control systems are laid down and operated to promote the most economic, efficient and effective use of resources as well as safeguard assets.

Company’s adherence to the requirements stipulated in Section 7.10 on ‘Corporate Governance’ of the Continuing Listing Requirements of the Colombo Stock Exchange

| Principle | Description | Comment | Status of Compliance | ||||||

7.10.1 Non-Executive Directors |

|||||||||

|

The Board compromises of ten (10) Directors of which five (05) are Executive Directors and five (05) are Non-Executive Directors. |

Complied |

|||||||

7.10.2 Independent Directors |

|||||||||

|

The Board compromises of five (05) Non-Executive Directors out of which three (03) are independent. Each NED signs and submits an annual declaration to the Board of his independence against the criteria specified in Appendix 7A of the Listing Rules. |

Complied |

|||||||

7.10.3 Disclosure Relating to Directors |

|||||||||

|

The Company annually reviews the independence or non-independence of each of the Non-Executive Directors and the names of Directors determined to be independent are disclosed in Annual Report of the Board of Directors on the Affairs of the Company. Brief résumés of all Directors are found in Board of Directors. Upon Mr. S D Perera being appointed to the Board, a brief résumé was forwarded to the exchange for public dissemination. |

Complied |

|||||||

7.10.4 Criteria for defining ‘Independence’ |

|||||||||

|

Subject to Rule 7.10.3 (a) and (b), a Non-Executive Director shall not be considered independent if he/she -

|

In determining the Independence/Non-Independence of the NEDs the Company takes into account criteria specified in Section 7.10.4. |

Complied |

|||||||

7.10.5 Remuneration Committee |

|||||||||

A listed entity shall have a Remuneration Committee in conformity with the following: |

|||||||||

(a) CompositionThe Remuneration Committee shall comprise; of a minimum of two Independent Non-Executive Directors (in instances where an entity has only two Directors on its Board); or of Non-Executive Directors a majority of whom shall be independent, whichever shall be higher. |

The Remuneration Committee of the Company consists of three (03) Non-Executive Directors out of which two (02) are independent. |

Complied |

|||||||

(b) FunctionsThe Remuneration Committee shall recommend the remuneration payable to the Executive Directors and Chief Executive Officer of the listed entity and/or equivalent position thereof, to the Board of the listed entity which will make the final determination upon consideration of such recommendations. |

The Remuneration Committee operates with the primary objective of ensuring that the remuneration policy of the Company is effective enough to attract and retain the best human capital. The Committee holds the responsibility of recommending the remuneration payable to the Executive Directors of the Company. The recommendation is made to the Board, which is responsible for the final determination upon consideration of such recommendations. |

Complied |

|||||||

(c) Disclosure in the Annual ReportThe Annual Report should set out the names of Directors (or persons in the Parent Company’s Committee in the case of a Group Company) comprising the Remuneration Committee, contain a statement of the remuneration policy and set out the aggregate remuneration paid to Executive and |

Details with regard to the Remuneration Committee and the remuneration policy of the Company are disclosed in Board Committees. Refer Note 36.4 of ‘Notes to the Financial Statements’ for a disclosure of the aggregate remuneration paid to Executive and Non-Executive Directors. |

Complied |

|||||||

7.10.6 Audit Committee |

|||||||||

A Listed entity shall have an Audit Committee in conformity with the following: |

|||||||||

(a) CompositionThe Audit Committee shall compromise: - Of a minimum of two Independent Non-Executive Directors (in instances where a entity has only two Directors on its Board); or - Of Non-Executive Directors a majority of whom shall be independent, whichever shall be higher. |

The Audit Committee of the Company compromises of three (03) Independent Non-Executive Directors and one (01) Non-Executive Director of the Board. Two (02) members of the Committee are members of professional accounting bodies. |

Complied |

|||||||

(b) FunctionsShall include -

|

The Charter of the Audit Committee of the Company includes the following:

|

Complied |

|||||||

(c) Disclosure in the Annual ReportThe names of the Directors (or persons in the Parent Company’s Committee in the case of a Group Company) comprising the Audit Committee should be disclosed in the Annual Report. The Committee shall make a determination of the independence of the Auditors and shall disclose the basis for such determination in the Annual Report. The Annual Report shall contain a report by the Audit Committee, setting out the manner of compliance by the entity in relation to the above, during the period to which the Annual Report relates. |

Composition of the Audit Committee is disclosed in the Report of the Audit Committee. Independence of the Auditors is disclosed in the Annual Report of the Board of Directors on the Affairs of the Company. Audit Committee Report is found in Stewardship. |

Complied |

|||||||

Company’s adherence to Code of Best Practices on Corporate Governance issued jointly by The Institute of Chartered Accountants of Sri Lanka and the Securities and Exchange Commission of Sri Lanka

Section 01: The Company

| Principle | Description | Comment | Extent of Compliance | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A. Directors |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.1 The Board |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.1 |

Every public company should be headed by an Effective Board, which should direct, lead and control the Company. |

The Company is headed by a Board comprising of ten (10) members. Primary objective of the Board is to provide necessary stewardship in achieving the vision of the Company. Composition of the Board is as follows:

|

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.1.1 |

The Board should meet regularly. Board meetings should be held at least once in every quarter of a financial year, in order to effectively execute Board’s responsibilities, while providing information to the Board on a structured and regular basis. |

During the year five (05) Board meetings were conducted the attendance of which was as follows: Note -

|

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.1.2 |

The Board’s role is to provide entrepreneurial leadership of the Company within a framework of prudent and effective controls which enables risk to be assessed and managed. |

The Board of Directors provides the entrepreneurial leadership through effective formulation and execution of strategies. The system of internal controls which is based on a ‘Risk Assessment Approach’ ensures safety, reliability, profitability and integrity of the organization within a broader framework of enterprise risk management. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.1.3 |

The Board collectively, and Directors individually, |

The Board complies with the sound framework of business practices in place which ensures compliance with existing laws and regulations as well as best practices. In matters of strategic importance to the Company, the Board obtains independent professional advice if it deems necessary. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.1.4 |

All Directors should have access to the advice and services of the Company Secretary, who is responsible to the Board in ensuring that Board procedures are followed and that applicable rules and regulations are complied with. Any questions of the removal of the Company Secretary should be a matter for the Board as a whole. |

All Directors had access to the services of a professional secretarial company which ensured that the Board received information on a timely manner for the effective conduct of meetings. The firm also provided the Board with advice on matters relating to compliance with rules and regulations. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.1.5 |

All Directors should bring independent judgment to bear on issues of strategy, performance, resources (including key appointments) and standards of business conduct. |

All Directors are encouraged to bring independent judgment on matter relating to strategic direction of the Company, effective utilization of resources and performance. Transparency of the judgments is further enhanced with the existence of three (03) Independent Non-Executive Directors who |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.1.6 |

Every Director should dedicate adequate time and effort to matters of the Board and the Company, to ensure that the duties and responsibilities owed to the Company are satisfactorily discharged. It must be recognized that Directors have to dedicate sufficient time before a meeting to review Board papers and call for additional information and clarification, and after a meeting to follow up on issues consequent to the meeting. This should be supplemented by a time allocation for familiarization with business changes, operations, risks and controls. |

All Directors dedicated an adequate amount of time on matters relating to the Company and the Board. Their contribution to the Company was evident in the participation at Board meetings, Board Subcommittee meetings and in the decisions passed via circular resolution. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.1.7 |

Every Director should receive appropriate training when first appointed to the Board of a company, and subsequently as necessary. Training curricula should encompass both general aspects of directorship and matters specific to the particular industry/company concerned. A Director must recognize that there is a need for continuous training and an expansion of the knowledge and skills required to effectively perform his duties as a Director. The Board should regularly review and agree the training and development needs of the Directors. |

The Board of Directors attend training programmes which are required for the effective execution of their duties as and when necessary. Engineering professionals on the Board attended workshops and professional events that were organized by National Engineering Institutions. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.2 Chairman and Chief Executive Officer (CEO) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.2 |

There are two key tasks at the top of every public company - conducting of the business of the Board, and facilitating executive responsibility for management of the Company’s business. There should be a clear division of responsibilities at the head of the Company, which will ensure a balance of power and authority, such that no one individual has unfettered powers of decision. |

Decision-making at the highest level happens by adopting the rule of simple majority. No one individual is vested with unfettered powers of decision-making. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.2.1 |

A decision to combine the posts of Chairman and CEO in one person should be justified and highlighted in the Annual Report. |

The Chairman is mainly responsible for directing the affairs of the Board while maintaining effective external relationships. Day-to-day affairs of the Company are headed by the Managing Director who is supported by the Director/Chief Operating Officer (COO). |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.3 Chairman’s Role |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.3 |

The Chairman’s role in preserving good corporate governance is crucial. As the person responsible for running the Board, the Chairman should preserve order and facilitate the effective discharge of Board functions. |

As the highest member of the organization, the Chairman is committed to the practice of good corporate governance. As the head at the Board meetings, the Chairman ensures that the objectives of the meeting are achieved and adequately discussed among the members. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.3.1 |

The Chairman should conduct Board proceedings in a proper manner. |

The Chairman is responsible for making sure that the agenda, minutes of prior meetings, Board papers are circulated among the members in advance giving sufficient time for preparation. He encourages active and effective participation of all Board members facilitating productive discussions. The Chairman is also responsible for making the Board members aware of the importance of creating value to all stakeholders of the Company. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.4 Financial Acumen |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.4 |

The Board should ensure the availability within it of those with sufficient financial acumen and knowledge to offer guidance on matters of finance. |

The Board comprises of four (04) members with extensive knowledge and experience in financial matters and who are professionally qualified in finance. This is further strengthened since three (03) of these members operate in a non-executive capacity. In addition, rest of the Board members sufficiently possess knowledge on financial |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.5 Board Balance |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.5 |

It is preferable for the Board to have a balance of Executive and Non-Executive Directors such that no individual or small group of individuals can dominate the Board’s decision-taking. |

The Board comprises of ten (10) Directors of |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.5.1 |

The Board should include Non-Executive Directors of sufficient calibre and number for their views to carry significant weight in the Board’s decisions. The Board should include at least two Non-Executive Directors or such number of Non-Executive Directors equivalent to one-third of total number of Directors, whichever is higher. In the event the Chairman and CEO is the same person, Non-Executive Directors should comprise a majority of the Board. |

50% of the Board of Directors of the Company operates in a non-executive capacity. Every NED on the Board has excelled in either engineering or finance disciplines. Thus their contribution to the decision-making of the Board was noteworthy during the year. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.5.2 |

Where the constitution of the Board of Directors includes only two Non-Executive Directors, both such Non-Executive Directors should be ‘independent’. In all other instances two or one-third of Non-Executive Directors appointed to the Board of Directors whichever is higher should be ‘independent’. |

The Board of Directors of the Company comprises of five (05) Non-Executive Directors out of which three (03) are Independent. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.5.3 |

For a Director to be deemed ‘independent’ such Director should be independent of management and free of any business or other relationship that could materially interfere with or could reasonably be perceived to materially interfere with the exercise of their unfettered and independent judgment. |

Three (03) Non-Executive Directors on the Board are not involved in day-to-day affairs of the Company and they do not have any business or other relationship that could materially interfere with the exercise of their unfettered and independent judgment. Additionally each Independent NED submits a written declaration of his independence to the Board on an annual basis. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.5.4 |

Each Non-Executive Director should submit a signed and dated declaration annually of his/her independence or non-independence against the specified criteria set out in the specimen in Schedule H of the Code. |

During the year each Non-Executive Director submitted a dated and signed declaration regarding their independence against the specified criteria set out in Schedule H of the Code. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.5.5 |

The Board should make a determination annually as to the independence or non-independence of each Non-Executive Director based on such a declaration made of decided criteria and other information available to the Board. The Board should determine whether the Director is independent in character and judgment and whether there are relationships or circumstances which are likely to affect, or could appear to affect, the Director’s judgment. The Board should specify the criteria not met and the basis for its determination in the Annual Report, if it determines that a Director is independent notwithstanding the existence of relationships or circumstances which indicate the contrary and should set-out in the Annual Report the names of Directors determined to be ‘independent’. |

Based on the declarations submitted to the Board and other information available, the following NEDs’ of the Board were decided to be independent:

|

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.5.6 |

If an alternate Director is appointed by a Non-Executive Director such alternate Director should not be an executive of the Company. If an alternate Director is appointed by an independent Director, the person who is appointed also should meet the criteria of independence and the provision on minimum number of Independent Directors also should be satisfied. |

This is not applicable as there are no alternate Directors in the Company. |

Not Applicable |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.5.7 |

In the event the Chairman and CEO is the same person, the Board should appoint one of the Independent |

This is not applicable as the Chairman of the Company is not the CEO. |

Not Applicable |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.5.8 |

The Senior Independent Director should make himself available for confidential discussions with other Directors who may have concerns which they believe have not been properly considered by the Board as a whole and which pertain to significant issues that are detrimental to the Company. |

Not Applicable |

Not Applicable |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.5.9 |

The Chairman should hold meetings with the |

The Chairman holds meetings with the NEDs’ without the presence of Executive Directors as and when necessary. During the year three (03) such meetings were held. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.5.10 |

Where Directors have concerns about the matters of the Company which cannot be unanimously resolved, |

Matters of the Company that the BOD was unable to resolve unanimously were recorded by the Company Secretary in detail in the Board minutes. These minutes were circulated among the Board members prior to the next meeting. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.6 Supply of Information |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.6 |

The Board should be provided with timely information in a form and of a quality appropriate to enable it to discharge its duties. |

The Board was provided with timely information by way of Management Reports and Board Papers during the year. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.6.1 |

Management has an obligation to provide the Board with appropriate and timely information, but information volunteered by management may not be enough in all circumstances and Directors should make further inquiries where necessary. The Chairman should ensure |

Members of the Board (mainly executive) are provided with Management Reports and Project Performance Reports on a monthly basis. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.6.2 |

The minutes, agenda and papers required for a Board meeting should ordinarily be provided to Directors at least seven (07) days before the meeting, to facilitate its effective conduct. |

Effective conduct of the Board meetings was facilitated through the proper circulation of agenda, Board minutes and other papers among the Directors by the Company Secretary seven (07) days before the meeting. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.7 Appointments to the Board |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.7 |

There should be a formal and transparent procedure for the appointment of new Directors to the Board. |

All Board appointments are based on the capacity of the individual concerned to pass the ‘fit & proper’ test which in turn is based on the qualifications, experience and the value that can be added by the individual to the Board as well as to the Company. Existing Directors are vested with the autonomy to critically evaluate the potential candidate in the above test and a final decision is taken by the |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.7.1 |

Nomination Committee should be established to make recommendations to the Board on all new Board appointments. Terms of Reference for Nomination Committees are set out in Schedule A. The Chairman and members of the Nomination Committee should be identified in the Annual Report. |

The Company does not have a Nomination Committee in place. However the existing Board members function in a manner that is similar to a formally appointed Nomination Committee in matters concerning new appointments to the Board. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.7.2 |

The Nomination Committee or in the absence of a Nomination Committee, the Board as a whole should annually assess Board-composition to ascertain whether the combined knowledge and experience of the Board matches the strategic demands facing the Company. The findings of such assessment should be taken into account when new Board appointments are considered and when incumbent Directors come up for re-election. |

During the year the Board critically evaluated the ‘quality’ of the Board in terms of their qualifications, experience and the value that can be added to the Company to effectively meet the demands of the Company. The results of this assessment were utilized by the Board in appointing Mr. S D Perera as a NED. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.7.3 |

Upon the appointment of a new Director to the Board, the Company should forthwith disclose to shareholders -

|

Upon Mr. S D Perera being appointed to the Board during the year, a brief résumé containing all information requirements were submitted to the CSE for public dissemination. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.8 Re-Election |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.8 |

All Directors should be required to submit themselves for re-election at regular intervals and at least once in every three years. |

Directors are Re-elected with the sanction of the shareholders at the Annual General Meeting of the Company. 2013 saw the re-election of Prof. K A M K Ranasinghe who retired by rotation in terms of the Articles of Association of the Company. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.8.1 |

Non-Executive Directors should be appointed for specified terms subject to re-election and to the provisions in the Companies Act relating to the removal of a Director, and their reappointment should not be automatic. |

In terms of the Articles of Association of the Company one NED is required to retire by rotation every year. The re-election of NEDs’ is sanctioned by the shareholders at the AGM of the Company. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.8.2 |

All Directors including the Chairman of the Board, should be subject to election by shareholders at the first opportunity after their appointment, and to re-election thereafter at intervals of no more than three years. The names of Directors submitted for election or re-election should be accompanied by a résumé minimally as set out in paragraph A.7.3 above, to enable shareholders to make an informed decision on their election. |

Mr. S D Perera who was appointed to the Board during the year will stand for election at the AGM. A brief résumé of him is found in Board of Directors. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.9 Appraisal of Board Performance |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.9 |

Boards should periodically appraise their own performance in order to ensure that Board responsibilities are satisfactorily discharged. |

Performance of the Board is evaluated from time to time with at least once a year to ensure that responsibilities are satisfactorily discharged. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.9.1 |

The Board should annually appraise itself on its performance in the discharge of its key responsibilities. |

Performance of the Board for the FY 2013/14 was assessed at the first Board meeting conducted for the FY 2014/15. The evaluation was done against the targets and goals set at the beginning of the |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.9.2 |

The Board should also undertake an annual self-evaluation of its own performance and that of its committees. |

Members of the Board and Board Committees carried out self-assessments of their performance for the FY 2013/14 against targets set at the beginning. Minutes of the results of these assessments were recorded by the Company Secretary. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.9.3 |

The Board should state how such performance evaluations have been conducted in the Annual Report. |

Refer A.9.2 above |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.10 Disclosure of Information in Respect of Directors |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.10 |

Shareholders should be kept advised of relevant details in respect of Directors. |

Shareholders are informed as and when necessary about changes to the Board, interest in the shares of the Company and other relevant details via disclosures and financial results released to the CSE for public dissemination. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.10.1 |

The Annual Report of the Company should set out the relevant information in relation to each Director. |

Profiles of Directors of the Board, attendance at Board meetings and Board Committee meetings are given in Stewardship sction. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.11 Appraisal of Chief Executive Officer |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.11 |

The Board should be required at least annually to assess the performance of the CEO. |

Not applicable as the Company doesn’t have a CEO. |

Not Applicable |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.11.1 |

At the commencement of every fiscal year, the Board in consultation with the CEO, should set, in line with the short, medium and long term objectives of the Company, reasonable financial and non-financial targets that should be met by the CEO during the year. |

Not applicable as the Company doesn’t have a CEO. |

Not Applicable |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A.11.2 |

The performance of the CEO should be evaluated by the Board at the end of each fiscal year to ascertain whether the targets set by the Board have been achieved and if not, whether the failure to meet such targets was reasonable in the circumstances. |

Not applicable as the Company doesn’t have a CEO. |

Not Applicable |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B. Directors’ Remuneration |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.1 Remuneration Procedure |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.1 |

Companies should establish a formal and transparent procedure for developing policy on executive remuneration and for fixing the remuneration packages of individual Directors. No Director should be involved in deciding his/her own remuneration. |

Remuneration payable to the Executive Directors of the Company is recommended by the Remuneration Committee. Remuneration payable to the Non-Executive Directors of the Company is recommended by the Board as a whole. No Director is involved in deciding his own remuneration. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.1.1 |

To avoid potential conflicts of interest, the Board of Directors should set up a Remuneration Committee to make recommendations to the Board, within agreed Terms of Reference, on the Company’s framework of remunerating Executive Directors. (These also include Post-Employment Benefits as well as Terminal Benefits.) |

The Remuneration Committee is responsible for recommending the remuneration payable to the Executive Directors. The Committee makes recommendations to the Board which is responsible for the final determination. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.1.2 |

Remuneration Committees should consist exclusively of Non-Executive Directors, and should have a Chairman, who should be appointed by the Board. |

The Remuneration Committee appointed by the Board consisted of three (03) Non-Executive Directors. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.1.3 |

The Chairman and the members of the Remuneration Committee should be listed in the Annual Report |

Details of the Remuneration Committee are given in Board Committees. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.1.4 |

The Board as a whole, or where required by the Articles of Association the shareholders, should determine the remuneration of Non-Executive Directors, including members of the Remuneration Committee, within the limits set in the Articles of Association. Where permitted by the Articles, the Board may delegate this responsibility to a sub-committee of the Board, which might include the CEO. |

Remuneration payable to the Non-Executive Directors is decided by the Board as a whole. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.1.5 |

The Remuneration Committee should consult the Chairman and/or CEO about its proposals relating to the remuneration of other Executive Directors and have access to professional advice from within and outside the Company, in discharging their responsibilities. |

The Remuneration Committee consulted the Chairman and the Managing Director in providing recommendations regarding the remuneration of other Executive Directors. The Chairman or the MD is not remunerated by the Company. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.2 The Level and Make Up of Remuneration |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.2 |

Levels of remuneration of both Executive and Non-Executive Directors should be sufficient to attract and retain the Directors needed to run the Company successfully. A proportion of Executive Directors’ remuneration should be structured to link rewards to corporate and individual performance. |

The remuneration package of both Executive and Non-Executive Directors is based on a variety of factors including their contribution to the Company, market rates of remuneration and their expectation. Portion of the remuneration of the Executive Directors’ is linked to their performance. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.2.1 |

The Remuneration Committee should provide packages needed to attract, retain and motivate Executive Directors of the quality requires but should avoid paying more than is necessary for this purpose. |

The Remuneration Committee considers the value addition of Executive Directors in structuring their remuneration packages so as to ensure that nothing is paid more than necessary. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.2.2 |

The Remuneration Committee should judge where to position levels of remuneration of the Company, relative to other companies. It should be aware what comparable companies are paying and should take account of relative performance, but should use such comparisons with caution, mindful of the risk that they can result in an increase of remuneration levels with no corresponding improvement in performance. |

The Committee conducts an analysis of |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.2.3 |

The Remuneration Committee should be sensitive to remuneration and employment conditions elsewhere in the Company or Group of which it is a part, especially when determining the annual salary increases. |

Companies within the Group operate in different industry and market sectors where the remuneration and employment conditions are substantially different to those of the Company. |

Not Applicable |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.2.4 |

The performance related elements of remuneration of Executive Directors should be designed and tailored to align their interest with those of the Company and main stakeholders and to give these Directors appropriate incentives to perform at the highest level. |

The extent of contribution and value addition towards achieving the set targets and objectives of a particular year is the key determinant in deciding the performance related element of the remuneration of the Executive Directors. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.2.5 |

Executive share options should not be offered at a discount (i.e less than market price prevailing at the time the exercise price is determined), save as permitted by the Listing Rules of the Colombo Stock Exchange. |

Not applicable as there are no Executive share options in the Company. |

Not Applicable |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.2.6 |

In designing schemes of performance related remuneration, Remuneration Committee should follow the provisions set out in Schedule E. |

Provisions of Schedule E of the Code were |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.2.7 |

Remuneration Committee should consider what compensation commitments (including pension contributions) their Directors contracts of service, if any, entail in the event of early termination. Remuneration Committees should in particular, consider the advantages of providing explicitly for such compensation commitments to apply other than in the case of removal for misconduct, in initial contracts. |

There are no compensation commitments |

Not Applicable |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.2.8 |

Where the initial contract does not explicitly provide for compensation commitments, Remuneration Committees should, within legal constraints tailor their approach in early termination cases to the relevant circumstances. The Board’s aim should be, to avoid rewarding poor performance while dealing fairly with case where departure is not due to poor performance. |

Not applicable as the Company’s objective is to avoid early termination by all means. |

Not Applicable |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.2.9 |

Levels of remuneration for Non-Executive Directors should reflect the time commitment and responsibilities of their role taking in to consideration market practices. Remuneration for Non-Executive Directors should not normally include share options. If exceptionally options are granted, shareholder approval should be sought in advance and any shares acquired by exercise of the options should be held until at least one year after the Non-Executive Director leaves the Board. Holding share options could be relevant to the determination of a Non-Executive Directors independence. |

The remuneration of Non-Executive Directors reflects the degree of responsibilities and the level of time commitment extended by them in contributing to the Company’s decision-making. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.3 Disclosure of Remuneration |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.3 |

The Company Annual Report should contain a Statement of Remuneration Policy and details of the Board as a whole. |

Compensation paid to Key Management Personnel is given in Note 36.4 in Notes to the Financial Statements. |

Partly Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B.3.1 |

The Annual Report should set out the names of Directors (or persons in the Parent Company’s committee in the case of a Group Company) comprising the Remuneration Committee, contain a statement of remuneration policy and set-out the aggregate remuneration paid to Executive and Non-Executive Directors. |

Names of the members of the Remuneration Committee and the remuneration policy of the Company are found in Board Committees. The compensation paid to Key Management Personnel is given in Note 36.4. |

Partly Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C. Relations with Shareholders |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.1 Constructive use of the Annual General Meeting (AGM) and Conduct of General Meetings |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.1 |

Boards should use the AGM to communicate with shareholders and should encourage their participation. |

The Company considers the AGM as the key tool of communication with shareholders. The Notice of Meeting inviting all shareholders is given on page 196 of the printed Annual Report. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.1.1 |

Companies should count all proxy votes and should indicate the level of proxies lodged on each resolution and the balance for and against the resolution and withheld after it has been dealt with on a show of hands, except where poll is called. |

Secretaries of the Company records and counts all Proxy Forms lodged on each resolution. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.1.2 |

Companies should propose a separate resolution at the AGM on each substantially separate issue and should in particular propose a resolution at the AGM relating to the adoption of the report and accounts. |

To receive and consider the Annual Report and Accounts is the first resolution adopted at every AGM. Further, the Company proposes separate resolutions on each substantially separate issue. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.1.3 |

The Chairman of the Board should arrange for the Chairmen of the Audit, Remuneration and Nomination Committees to be available to answer questions at the AGM relating to the adoption of the report and accounts. |

The Chairmen of Audit and Remuneration Committees attended the 2nd AGM of the Company and answered questions as directed. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.1.4 |

Companies should arrange for the Notice of the AGM and related papers to be sent to shareholders as determined by statue, before the meeting. |

All related papers and the Notice of Meeting are sent to the shareholders 15 days before the AGM. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.1.5 |

Companies should circulate with every Notice of General Meeting a summary of the procedures governing voting at General Meetings. |

Summary of procedures governing voting at |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.2 Communication with Shareholders |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.2 |

The Board should implement effective communication with shareholders. |

The AGM and the Annual Report are the primary means of communication with shareholders. Additionally, the Company makes disclosures on material and price sensitive matters from time to time to the CSE for dissemination among the public. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.2.1 |

There should be a channel to reach all shareholders of the Company in order to disseminate timely information. |

The AGM and the Annual Report are the primary means of reaching all shareholders. Additionally, the Company makes disclosures on material and price sensitive matters from time to time to the CSE for timely dissemination of information. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.2.2 |

The Company should disclose the policy and methodology for communication with shareholders. |

Same as above |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.2.3 |

The Company should disclose how they implement the above policy and methodology. |

The Company held its 2nd AGM on 12th September 2012 and disseminated the circular to shareholders, Proxy Form, the Notice of Meeting and the CD containing the Annual Report fifteen (15) days before. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.2.4 |

The Company should disclose the contact person for such communication. |

The point of contact is rohana@accessengsl.com |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.2.5 |

There should be a process to make all Directors aware of major issues and concerns of shareholders, and this process has to be disclosed by the Company. |

The shareholders are free to correspond with the Board either directly or through the Company Secretary as they wish. The Directors can also be met by the shareholders on appointment. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.2.6 |

The Company should decide the person to contact in relation to shareholder matters. The relevant person with statutory responsibilities to contact in relation to shareholder matters is the Company Secretary or his/her absence should be a member of the Board of Directors. |

Both the Company Secretary as well as Members of the Board act as contact points in relation to shareholder matters. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.2.7 |

The process for responding to shareholder matters should be formulated by the Board and disclosed. |

Responses for shareholder queries directly sent to individual members of the Board are sent by the respective members. Queries directed to the Company Secretary are responded by the Directors via the Company Secretary. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.3 Major and Material Transactions |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.3 |

Further to complying with the requirements under the Companies Act, Securities and Exchange Commission Law and Colombo Stock Exchange regulations; as applicable, Directors should disclose to shareholders all proposed material transactions, which if entered in to, would materially alter/vary the Company’s net assets base or in the case of a Company with subsidiaries, the consolidated group net asset base. |

No material transactions were entered into by the Company during the financial year. |

Not Applicable |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C.3.1 |

Prior to a Company engaging in or committing to a ‘Major related party involving the acquisition, sale or disposition of greater than one-third of the value of the Company’s assets or that of a subsidiary which has a material bearing on the Company and/or consolidated net assets of the Company, or a transaction which has or is likely to have the effect of the Company acquiring obligations and liabilities, of greater than one-third of the value of the Company’s assets, Directors should disclose to shareholders the purpose and material facts of such transactions and obtain shareholders’ approval by ordinary resolution at an Extraordinary General Meeting. It also applies to transactions which have the purpose or effect of substantially altering the nature of the business carried on by the Company. |

No major related party transactions were carried out by the Company during the financial yea |

Not Applicable |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D. Accountability and Audit |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.1 Financial Reporting |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.1 |

The Board should present a balanced and understandable assessment of the Company’s financial position, performance and prospects. |

Annual Report containing the Audited Financial Statements, performance, prospects and Interim Financial Reports were released to the CSE within the period stipulated by the CSE and other regulatory authorities. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.1.1 |

The Board’s responsibility to present a balanced and understandable assessment extends to interim and other price-sensitive public reports and reports to regulators, as well as to information required to be presented by statutory requirements. |

Audited Financial Statements giving a true and fair view of the operations of the Company, Interim Financial Statements and other price-sensitive disclosures are made by the Company periodically and as and when required in accordance with the applicable rules and regulations. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.1.2 |

The Directors’ Report, which forms part of the Annual Report, should contain declarations by the Directors. |

The Annual Report of the Board of Directors on the Affairs of the Company making the relevant declarations is given in the Financial Reports |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.1.3 |

The Annual Report should contain a statement setting out the responsibilities of the Board for the preparation and presentation of Financial Statements, together with a statement by the Auditors about their reporting responsibilities. Further, the Annual Report should contain a Report/Statement on Internal Control. |

‘Directors responsibility for Financial Reporting’ and ‘Statement of Auditors’ are given in Financial Reports. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.1.4 |

The Annual Report should contain a ‘Management Discussion and Analysis’. |

‘MD & A’ is given as a separate section of this Annual Report. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.1.5 |

The Directors should report that the business is a going concern, with supporting assumptions or qualifications as necessary. |

Refer Note 2.2 ‘Basis of Measurement’ of ‘Notes to the Financial Statements’. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.1.6 |

In the event the net assets of the Company fall below 50% of the value of the Company’s shareholders’ funds, the Directors shall forthwith summon an Extraordinary General Meeting of the Company to notify shareholders of the position and of remedial action being taken. |

Not applicable as there was no serious loss of capital during the year. |

Not Applicable |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.1.7 |

The Board should adequately and accurately disclose the related party transactions in its Annual Report. |

Refer Note 36 of ‘Notes to the Financial Statements’. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.2 Internal Control |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.2 |

The Board should have a process of risk management and a sound system of internal control to safeguard shareholders’ investments and the Company’s assets. Broadly, risk management and internal control is a process, affected by a company’s Board of Directors and management, designed to provide reasonable assurance regarding the achievement of Company’s objectives. |

The Company operates with a sound system of internal control within an integrated risk management framework that is formulated and ratified by the Board. The Board is responsible for effective operation of the system of internal controls to ensure the achievement of objectives. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.2.1 |

The Directors should, at least annually, conduct a review of the risks facing the Company and the effectiveness of the system of internal controls, so as to be able to report to shareholders as required in D.1.3. This could be made the responsibility of the Audit Committee. |

Annual review of risks faced by the Company is conducted by the Directors. The Audit Committee Charter of the Company authorizes the Audit Committee to ascertain the adequacy of internal controls and risk management processes. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.2.2 |

Companies should have an internal audit function. |

The Company has an Internal Audit Function headed by the ‘Chief Internal Auditor’. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.2.3 |

The Board should require the Audit Committee to carry out reviews of the process and effectiveness of Risk Management and internal controls, and to document to the Board and Board takes the responsibility for the disclosures on internal controls. |

Operation and review of internal controls is done by the Internal Audit function as a continuous and on-going process. These reports are forwarded to the Audit Committee which in turn presents it to the Board. The Board is responsible for making disclosures on internal controls. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.2.4 |

The responsibilities of Directors in maintaining a sound system of internal control and the contents of the Statement of Internal Control should be in accordance with the Schedule K. |

Complied |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.3 Audit Committee |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.3 |

The Board should establish formal and transparent arrangements for considering how they should select and apply accounting policies, financial reporting and internal control principles and maintaining an appropriate relationship with the Company’s Auditors. |

Accounting policies and financial reporting principles of the Company are formulated so as to ensure compliance with all applicable standards, rules and other regulations. At times the guidance of the External Auditors is also sought in this process. The Board maintains cordial relationships with the External Auditors. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.3.1 |

The Audit Committee should be comprised of a minimum of two (02) Independent Non-Executive Directors |

The Audit Committee compromises of three (03) Independent Non-Executive Directors and one (01) Non-Executive Director of the Board. The Chairman of the Committee is an Independent Non-Executive Director. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.3.2 |

The duties of the Audit Committee should include keeping under review the scope and results of the audit and its effectiveness, and the independence and objectivity of the Auditors. Where the Auditors also supply a substantial volume of non-audit services to the Company, the Committee should keep the nature and extent of such services under review, seeking to balance objectivity, independence and value for money. |

Charter of the Audit Committee specifies |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.3.3 |

The Audit Committee should have a written Terms of Reference, dealing clearly with its authority and duties. The Audit Committee’s written Terms of Reference must address -

|

The Audit Committee Charter specifies the Committee’s purpose, duties and responsibilities |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.3.4 Disclosures |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.3.4 |

The names of Directors (persons in the Parent Company’s Committee in the case of a Group Company) comprising the Audit Committee should be disclosed in the Annual Report. The Committee should also make a determination of the Independence of the Auditors and should disclose the basis of such determination in the Annual Report. The Annual Report should contain a report by the Audit Committee, setting out the manner of compliance by the Company, in relation to the above, during the period to which the Annual Report relates. |

The composition of the Audit Committee is given in the Report of the Audit Committee. A statement on the ‘Independence of Auditors’ is given in the ‘Annual Report of the Board of Directors’. |

Complied |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.4 Code of Business Conduct and Ethics |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D.4 |

Companies must adopt a Code of Business Conduct and Ethics for Directors and Key Management Personnel and must promptly disclose any waivers of the Code for Directors or others. |

Directors and Key Management Personnel are expected to comply with the ‘Code of Ethics’ of the Company which is outlined in this Report. Said individuals have not violated or waived from the said ‘Code of Ethics’ during the year. |

Complied |