Internal Capital Formation

FINANCIAL CAPITAL

Financial Review

Access Engineering, together with its subsidiaries, returned another year of solid financial performance in 2013/14, delivering on the promises made to stakeholders. The Company improved its performance across all counters on profitability, efficiency, liquidity and gearing while generating substantial returns to its investors.

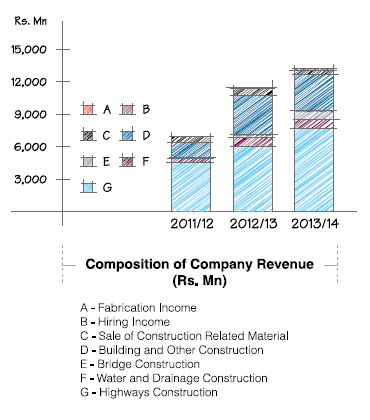

The Company has recorded the highest ever revenue which is Rs. 16.4 Bn at the Group level. Turnover at the Company level stood at Rs. 13.2 Bn, towards which the highways construction sector contributed 58% followed by 25% from building construction and piling and 7% from water and drainage construction. A noteworthy improvement was made in 2013/14 in the bridge construction sector compared to 2012/13 with a 6% contribution to the top line mainly on account of Veyangoda Railway Crossing Flyover and Polduwa Bridge.

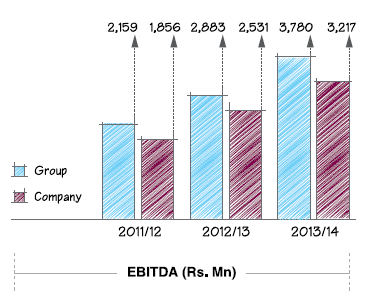

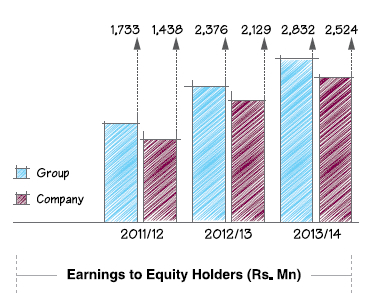

During the period under review, earnings before tax increased by approximately 25% and 22% at Group and Company level stemming from the top line growth and the rise in gross profit. Growth in gross profit of 37% and 26% at Group and Company respectively is also noteworthy. The effective tax rates at Group and Company level were approximately 13% and 10% respectively due to the Company and its fully owned subsidiary - Access Realties (Private) Limited being on concessionary tax rates of 12% on construction income and 2% on revenue. This resulted in a growth in profit after tax of 20% and 19% respectively at Group and Company levels compared to the previous year to register at Rs. 2,899 Mn and Rs. 2,524 Mn. After tax profit attributable to shareholders of Rs. 2,832 Mn and Rs. 2,524 Mn respectively at Group and Company levels, recording growth of 19% and 19% over the corresponding period. Based on reported results, net profit margins were approximately 18% and 20% at Group and Company levels, which are well beyond standard margins of the construction industry the world over. Earnings per share were Rs. 2.83 and Rs. 2.52 at Group and Company levels.

Healthy gross profit margins of approximately 26% and 24% were achieved both at Group and Company levels, well above industry average. This can be attributed to the Company’s ability to offer fully integrated value engineering services and turnkey engineering solutions to clients, thereby maintaining our cost base at low levels. The low cost base is also attributable to the level of control we have over the supply chain as a result of backward integration strategies pursued in the previous years via the acquisition and commissioning of quarries, asphalt plants, crusher plants and concrete batching plants. Most of raw material inputs required for major projects carried out by the Company are now sourced from our own plants, which helps keep costs low while ensuring continuous supplies that enable timely delivery of projects.

The administrative expenses increased by approximately 60% and 36% respectively at Group and Company levels mainly on account of increase in staff costs and depreciation & amortization costs.

The Company made investments in Property, Plant and Equipment amounting to approximately Rs. 391 Mn. Investment in capacity building was low in 2013/14 compared to the last two financial years since the Company believes that it has built sufficient capacity to sustain growth at double digit levels in the short to medium term. At present the Company possesses one of the most technically advanced and up-to-date fleets of heavy construction equipment and machinery in Sri Lanka. In addition to successfully consolidating the Company’s multidisciplinary activities and supply chain, they have also contributed to the turnover and the overall profitability of the Company. The total production income during the year accounted for approximately 4% of the total turnover at Company level. This contribution is a drop compared to the previous financial year since the majority of the output of plants was utilized for Company’s major projects.

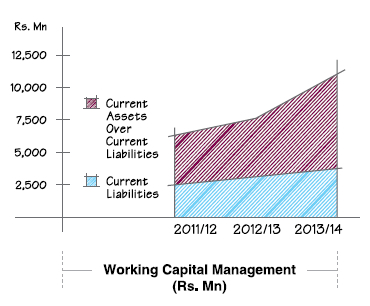

The liquidity position remains strong with approximately Rs. 2.7 Bn and Rs. 2.6 Bn held in short term deposits and cash at the Group and Company level. This is a year on year increase of 28% and 35% respectively. The strong liquidity position is also reflected in the above average current ratio and quick ratio of 2.9 and 2.6 at the Company level, demonstrating sound working capital management practices. Access Engineering is debt free at both the Group and Company levels with interest-bearing borrowings amounting to almost 0% of total assets.

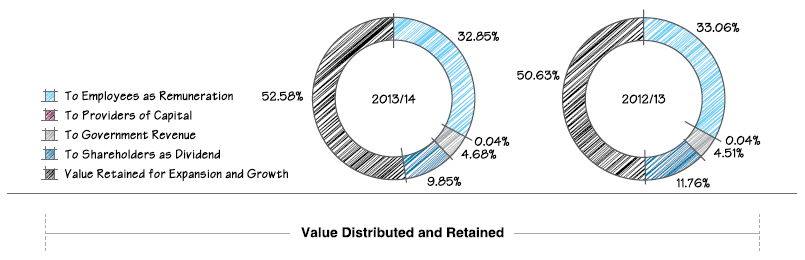

Value Addition and Distribution

| 2013/14 | 2012/13 | |||||||||||||||

| Rs. | Rs. | % | Rs. | Rs. | % | |||||||||||

| Value Added | ||||||||||||||||

| Revenue | 13,426,749,520 | 11,695,248,562 | ||||||||||||||

| Cost of materials and services bought-in | (8,349,711,487) | (7,444,716,981) | ||||||||||||||

| 5,077,038,033 | 4,250,531,581 | |||||||||||||||

| Value Distributed | ||||||||||||||||

| To employees as remuneration | 1,667,587,386 | 32.85 | 1,405,274,916 | 33.06 | ||||||||||||

| To providers of capital | 1,972,226 | 0.04 | 1,531,588 | 0.04 | ||||||||||||

| To Government revenue | 237,932,779 | 4.68 | 191,494,519 | 4.51 | ||||||||||||

| To shareholders as dividend | 500,000,000 | 9.85 | 500,000,000 | 11.76 | ||||||||||||

| Value Retained for Expansion and Growth | ||||||||||||||||

| Depreciation | 551,874,844 | 449,572,762 | ||||||||||||||

| Profit retained | 2,117,670,798 | 2,669,545,642 | 52.58 | 1,702,657,796 | 2,152,230,558 | 50.63 | ||||||||||

| 5,077,038,033 | 100.00 | 4,250,531,581 | 100.00 | |||||||||||||

Subsidiary Performance

Access Realties (Private) Limited (ARL)

Incorporated with the objective of developing and managing high rise buildings, ARL is the owner and managing agent of Access Towers, a 12 storey modern office complex located in the heart of Colombo. The Company, which is a fully-owned subsidiary of Access Engineering is also a BOI-approved establishment. At present the Company is on a concessionary tax rate of 2% on turnover for a period of 15 years commencing 2010/11.

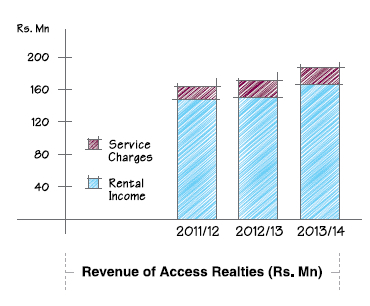

During the year under review the Company generated revenue through renting of office space to a wide clientele and through service charges, which together amounted to Rs. 187 Mn, a 10% increase over the corresponding period last year. The after tax profit of the Company was Rs. 136 Mn, which translated to a net profit margin of 73% on revenue.

Access Realties 2 (Private) Limited which is a fully-owned subsidiary of Access Realties (Private) Limited is engaged in the development of Access Tower II, a state-of-the art office complex. The Company which is a BOI undertaking commenced piling work in February 2014 and construction is expected to complete in the latter part of 2016. Upon completion the tower will consist of 29 floors with a total floor area of approximately 390,000 sq.ft. with a rentable area of approximately 190,000 sq.ft.

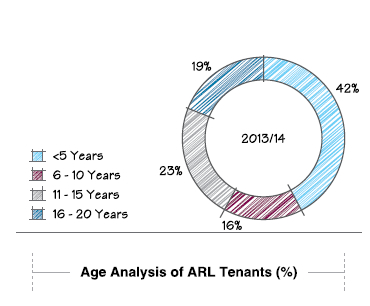

Access Towers enjoyed 100% occupancy throughout the year and 50% of the tenants have been with the Company for more than 10 years.

Sathosa Motors PLC (SML)

A Public Quoted Company, SML holds the franchise in Sri Lanka for Isuzu motor vehicles and spare parts manufactured by Isuzu Motors Limited of Japan. The Company became a subsidiary of AEL in February 2012 and as of date; AEL holds approximately 84.4% of SML. 2013/14 is the second full year of consolidation of SML results with AEL since the acquisition.

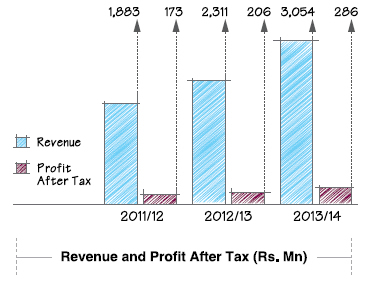

The investment in SML has paid off as demonstrated by the improved performance of SML during the year under review. Turnover for the year was recorded at approximately Rs. 3,054 Mn driven mainly by new vehicle sales, sale of spare parts, workshop revenue and agency commission. This was a growth of 32% over the corresponding period. The bottom line of the Company recorded at Rs. 286 Mn is a 39% growth compared to the previous year. This growth is partly attributed the new entry to the luxury automobile segment of the market via its 50% owned entity SML Frontier Automotive (Private) Limited. With effect from 1st April 2013, SML Frontier Automotive (Private) Limited operates as the authorized distributor for Land Rover/ Range Rover automobiles in Sri Lanka.

Institutional Capital

Institutional capital consists of non-financial components that are, like financial capital, internal to AEL. They are largely intangibles and can comprise of such factors as intellectual property, organizational knowledge, systems, processes, brand value, corporate culture, business ethics, integrity and so on. In the case of AEL, we report on the under mentioned areas which are most relevant to our business.

Organizational Knowledge and Expertise

As a knowledge-based organization, our knowledge and human capital is the major value driver of our business. We are fortunate to have some of the best human resources available in the country. Their composite knowledge and expertise in the fields of engineering and management are defining elements in the delivery of innovative and value enhanced engineering solutions. Our human capital of over 2,500 people includes over 130 engineering professionals.

Brand Value

In our business, we believe that brand value is derived from consumer choices made at the many ‘areas of impact’ or ‘meeting points’ the Company’s products, services and personnel have with the stakeholder community. Such interfaces allow the consumer to arrive at a crucial choice...AEL or any other option. Ultimately, your work speaks for itself. At Access Engineering, we strive for that ‘wow’ factor, by delivering beyond expectations. This, we believe has culminated today in our being at the forefront of the construction industry, maintaining our position as a preferred partner for our local customers, international partners and as a preferred employer.

The listing of our business in the Colombo Stock Exchange has contributed towards further enhancing our brand value, through engagement of more stakeholders and an ongoing commitment to good governance and transparency.

Systems and Processes

We have developed our own internal engineering designs office with strong focus on innovation. With our strong supply chain and backward integration across our service portfolio, we offer an unmatched internal management system with focus on value addition at every level. We are the first construction company in Sri Lanka to implement a SAP ERP system for our process improvement.

Corporate Culture and Ethics

Our corporate culture and ethics are derived from our Vision ‘to be the foremost Sri Lankan business enterprise in value engineering’ where innovation is encouraged at every level. We provide a vibrant workplace where people are encouraged to reach out towards excellence in their respective roles. We challenge our own selves and continuously raise the bar of excellence across every endeavour.

In enacting all of the above, we scrupulously follow our fundamental Code of Ethics within which are enshrined qualities such as equality, honesty, integrity, discipline, co-operation and self-regulation.