Value Creation and Stakeholder Capital Formation

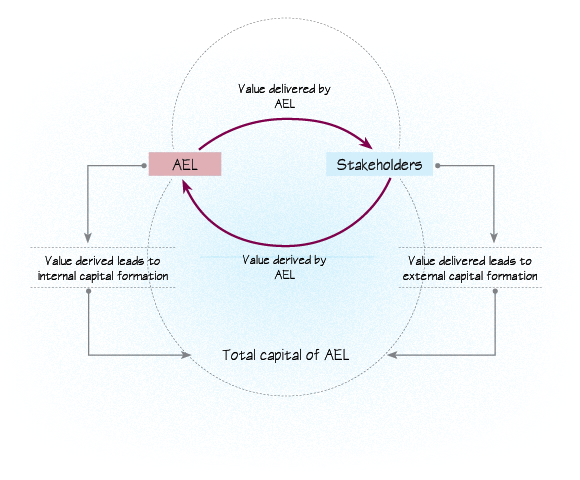

Access Engineering delivers value to its stakeholders in the context of the economic, social and environmental aspects in which it operates. Based on materiality, we engage with our stakeholders, build long term and mutually beneficial relationships and nurture them, as they are of value to us in driving future earnings. As stores of value, they constitute our stakeholder capital that are external to the Company. The key constituents being our investors, customers, business partners, employees and society and environment.

In turn we derive value through the dynamic interaction between our external capital and our own internal capital over the short, medium and long term. The capital internal to AEL comprises financial capital and institutional capital. The latter includes integrity and business ethics, corporate culture, knowledge and expertise, intellectual capital including patents and copyrights, our capacity to innovate, brand image, reputation and the like.

Capital Formation

Value creation is a dynamic process with flows taking place between the various forms of capital. We have access to and make use of these internal and external forms of capital in creating value for AEL (deriving value) and its stakeholders (delivering value) through our business model.

The discussion that follows reviews our performance during the year and next steps in this context - the two sides of value creation that of deriving and delivering value that leads to capital formation.