Effective risk management is fundamental to the success and resilience of Alinma Bank. The Bank evaluates its risk management framework on an ongoing basis, to ensure appropriateness and relevance of the framework in an environment of increasing intensity of regulatory supervision and numerous emerging developments.

Risk Management Governance Structure

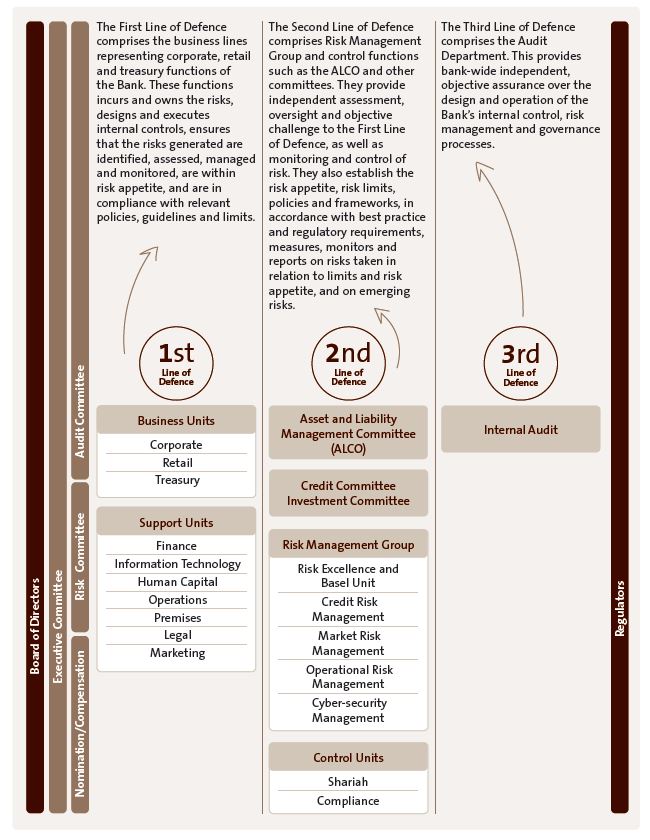

Alinma Bank has a well-established risk governance structure, with an active and engaged Board of Directors and Risk Committee supported by an experienced Executive Management team. Decision-making is centralized through a number of executive and senior risk management committees.

Risk Governance

The Bank’s risk management framework is founded on the Three Lines of Defence Model.

Risk Appetite

Risk appetite articulates the amount and types of risk the Bank is willing to take, in pursuit of business to achieve its strategic and financial objectives. A clearly articulated and effectively embedded risk appetite supports a strong risk culture and finding an optimal balance between risk and return whilst ensuring that the Bank stays within the established risk boundaries of the prevalent regulatory framework.

Risk Identification and Management

A comprehensive process to identify risks and assess their materiality is essential for effective risk management. Risk is defined as the potential impact of deviations from expected outcomes on the Bank’s earnings, capital, liquidity, reputation and resilience caused by internal and external vulnerabilities.

Principal Types of Risk

During the normal course of business, the Bank is exposed to numerous risks. Effective systems and procedures are in place to identify, control, and report major risks that could have a significant impact on the Bank. The principal risks are those risks which are considered of primary importance as having a significant impact or influence on the Bank’s primary business and revenue generating activities (Financial Risks), or inherent in the Bank’s business and can have significant adverse strategic, business, financial and/or reputational consequences (Non-Financial Risks).

The principal risks of the Bank are given below:

Credit Risk

Credit risk is the risk that a counterparty may fail to meet its obligations towards the Bank and, therefore, could result in a financial loss for the Bank. The Bank actively manages its credit risk exposure through the establishment of credit risk policies and procedures, which provide guidance, among others, on target market, risk acceptance criteria, minimum disclosure from customers, review and approval process, and concentration limits in addition to the day-to-day account management.

Market Risk

Market risk is the risk that the fair value or the future cash flows of the financial instruments will fluctuate due to changes in market variables such as equity prices, profit rates, foreign exchange rates, and commodity prices. The Bank has a Market Risk Management team under the Risk Management Group that regularly monitors market risks including liquidity risk of the Bank.

Liquidity Risk

Liquidity risk is the risk that the Bank will encounter due to difficulty in meeting obligations associated with its financial liabilities that are settled by delivering cash or other financial assets. Liquidity risk can be caused by market disruptions or downgrading of the Bank’s credit rating, which may dry up certain sources of funding immediately. To mitigate this risk, the Management has diversified funding sources, assets are managed taking liquidity into consideration and by maintaining an adequate balance of cash and cash equivalents. In accordance with Banking Control Law and the Regulations issued by SAMA, the Bank maintains a statutory deposit with SAMA equal to 11% of total demand deposits and 4% of customers’ time investments. The Bank also maintains liquid reserves not less than 20% of its deposit liabilities, in the form of cash and assets, which can be converted into cash within a period not exceeding 30 days.

Operational Risk

Operational risk is the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events. Operational risk arises throughout the Bank and from almost any activity. The Bank’s operational risk is monitored and controlled by the Operational Risk Team on a regular basis, and the Bank has successfully tested its operational disaster recovery site and documented its business continuity plan. To systematize the assessment and mitigation of operational risks, the Bank has established the Business Environment and Internal Control Framework Indicators (KPIs) for all business and support units, which are monitored proactively.

Shariah Non-Compliance Risk

Being an Islamic bank, the Bank is exposed to the risk of Sharia non-compliance. To mitigate such risk, extensive Sharia policies and procedures are in place. Further, the Bank has established a Sharia Board and a Sharia Compliance Audit Unit to monitor such risk.

Reputational Risk

Reputational risk covers the potential adverse effects resulting from negative publicity about the Bank’s products, services, competence, integrity and reliability. As an Islamic bank, one of the major aspects of reputational risk is non-compliance to Shariah principles. In addition, negative publicity could arise from major frauds, customer complaints, regulatory actions and negative perceptions about the Bank’s financial condition. The Bank has established controls to mitigate and avoid such risks and adopted a scorecard-based approach to measures the reputational risk to derive the Bank’s overall risk indicators.

Risk Performance of Alinma Bank

| Risk category and parameter | Key risk indicator |

Policy parameter (by SAMA or by Bank) |

Actual position | |

| As at 31 December 2021 |

As at

31 December 2020 |

|||

| Credit Risk | ||||

|

Quality of financing portfolio |

Gross Non-Performing Financing ratio |

1.75% | 2.49% | |

|

Net Non-Performing Financing ratio |

0.68% | 1.21% | ||

| Impairment as a percentage over total Non-Performing Financing | 177.07% | 114.47% | ||

| Weighted average rating score of the overall financing portfolio | 6 | 6 | ||

| Concentration | Financing portfolio by product – Highest exposure to be maintained as a percentage of the total financing portfolio | 57% | 51% | |

| Advances by economic subsector (using HHI-Herfindahl-Hirschman index or other methodology) | 1,024 |

1,039 Above HHI reflects the current Alinma sector |

||

| Aggregate of exposures exceeding 15% of the eligible capital | Under group connected obligor basis 4,743,722,712 | 8,112,236,104 | ||

| Cross border exposure | Rating of the highest exposure of the portfolio on Fitch Investment Grade | BB+ | BBB- | |

| Market Risk | ||||

| Interest rate risk | The “Earnings Approach” is defined by the impact of changes in profit rates on the Bank’s earnings. This is measured by the changes in the Net Income before Investments and Financing (NIIF) which is the difference between the total revenues and the costs of funding. | -10% | -7.04%/12.75% | -8.29%/8.92% |

| Using the “Economic Value Approach” in analyzing the impact of profit rates on the Bank’s economic value or market value, which can be viewed as the present value of the future cash flows of assets and liabilities. | -15% | -8.35% | -6.28% | |

| Liquidit y risk | SAMA Liquidity Ratio (SLR) | 20% | 26.84% | 28.62% |

| Liquidity Coverage Ratio (LCR) | 100% | 134.10% | 188.19% | |

| Net Stable Funding Ratio (NSFR) | 100% | 111.70% | 110.19% | |

| Operational Risk | ||||

| Operational losses | Operational loss tolerance limit (as a pecentage of last three years’ average gross income or any other base used by the Bank) | 35M | 6,258/35,000 = 18% | 7,306/35,000 = 21% |

| Systems availability | Critical systems uptime | T24 System | 100% | 99.99% |

| Strategic Risk | ||||

| Capital adequacy ratios: CET 1% Tier I and Tier II capital | 14.25% | 18.79% | 16.79% | |

| ROE (%) | 8% | 10.54% | 8.39% | |

| Creditworthiness – Fitch rating | BBB+ | BBB+ | BBB+ | |