Despite the slowdown in the global and domestic economy due to the pandemic, Alinma Bank recorded a strong performance in FY 2021.

Adel Saleh Abalkhail

Chief Financial Officer

The COVID-19 pandemic continued to disrupt economies, as many geographies experienced multiple waves of infections despite having controlled the outbreak through aggressive precautionary measures such as imposing travel restrictions, lockdowns and strict social distancing measures. Despite the slowdown in the global and domestic economy due to the pandemic, Alinma Bank recorded a strong performance in FY 2021.

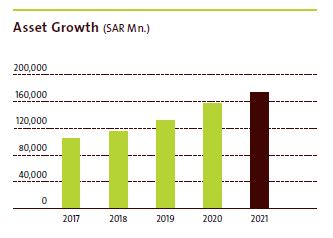

The Bank continued to effectively manage its business operations amid the challenging operating conditions whilst offering the support measures announced by the Saudi Government to its customers affected by the pandemic. The Bank recorded a net income of SAR 2,709 Mn. in FY 2021 compared to SAR 1,966 Mn. recorded in 2020, reflecting a growth of 38% year-on-year (YoY). Total assets increased by 10.6% to SAR 173,476 Mn. as of 31 December 2021 compared to SAR 156,877 Mn. in the previous comparable year.

Given below is a detailed review of the Bank’s results of operations and financial position.

Income Statement

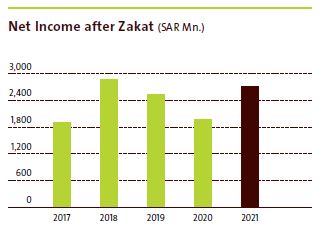

The Bank recorded a 38% growth in net income, from SAR 1,966 Mn. in 2020 to SAR 2,709 Mn. in 2021. The growth was mainly driven by the increase in operating income due to higher yield income over the year, reflecting the increase in average balances in investment and financing, in addition to the growth in banking services fees, gains on investments and other operating income.

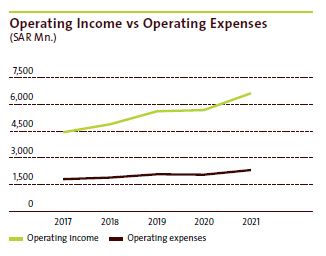

Accordingly, total operating income increased by 17.3% from SAR 5,682 Mn. in 2020 to SAR 6,667 Mn. in 2021 mainly due to the growth in the financing and investment portfolios and the increase in Bank’s core operations and activities. Consequently, net income from investment and financing reached SAR 5,137 Mn. in 2021 compared to SAR 4,648 Mn. in the previous year. Bank’s non-yield income including fee income, gain on investments and other income also increased by 48% to reach SAR 1,530 Mn. compared to SAR 1,034 Mn. in 2020. The Bank continued to invest in the execution of business strategic initiatives throughout 2021. Bank’s net financing recorded a solid growth of 14% YoY. The gross funded income for 2021 increased by 4% to SAR 5,674 Mn., investment income by 15%. Despite the average lower interest rates during 2021 compared to 2020, Alinma Bank managed to lower the impact by efficiently managing the cost of funding and increasing the average profit-earning assets. The Bank’s net profit margin stood at 3.42% as of 31 December 2021. Non-funded income for 2021 increased 48% to SAR 1,530 Mn. fueled by a 16% growth in banking services fees and a 204% increase in investment gains.

Operating expenses increased by 14% to SAR 2,365 Mn. mainly due to the increase in the VAT rate in the KSA from 5% to 15% from 1 July 2020, and the increases in communication expenses, POS terminal costs, software maintenance and subscriptions. Despite the increase in operating expenses, the higher income growth resulted in a 90bps improvement in the cost to income ratio which amounted to 35.5%. in 2021.

Five-Year Summary of the Income Statement

| SAR Mn. | 2021 | 2020 | 2019 | 2018 | 2017 |

| Operating Results | |||||

| Income from investment and financing, net | 5,137 | 4,648 | 4,323 | 3,798 | 3,493 |

| Fee, exchange and other income | 1,530 | 1,034 | 1,287 | 1,047 | 880 |

| Total operating income | 6,667 | 5,682 | 5,610 | 4,845 | 4,373 |

| Operating expenses* | (2,380) | (2,061) | (2,087) | (1,861) | (1,751) |

| Net income before provisions | 4,287 | 3,620 | 3,523 | 2,984 | 2,622 |

| Provision for financing and other assets | (1,266) | (1,418) | (706) | (467) | (611) |

| Net Income before Zakat | 3,022 | 2,202 | 2,817 | 2,517 | 2,011 |

| Zakat** | (312) | (236) | (282) | 340 | (104) |

| Net Income after Zakat | 2,709 | 1,966 | 2,535 | 2,857 | 1,907 |

* Share on Profit and Loss from associates and joint ventures is included

** For the year 2018, Zakat surplus due to settlement with ZATCA

Impairment Charges

The Bank continued to strengthen its financial position and increased the provisions for credit losses by SAR 1,266 Mn. to reach SAR 4,401 Mn. at the end of financial year 2021 compared to SAR 3,626 Mn. as at end of 2020. In Q4 2020, the Bank has revised certain inputs and assumptions (including but not limited to macroeconomic factors and scenario probabilities) which are the same factors and weightings used in 2021. As a result, for the period ended 31 December 2021, no additional ECL was recorded related to the macroeconomic factors.

Credit quality has improved as evidenced by an overall improvement in both NPL and NPL coverage ratios. The cost of risk for 2021 declined by 32bps to 1.02%. The NPL ratio declined by 74bps to 1.75% as of 31 December 2021. NPL coverage improved by 63bps to 177.1% as of 31 December 2021.

Net Income and Profitability

The Bank’s net income before Zakat increased by 37.2% to SAR 3,022 Mn. for the financial year 2021 compared to SAR 2,202 Mn. in 2020. The Zakat expense for 2021 was SAR 312 Mn.

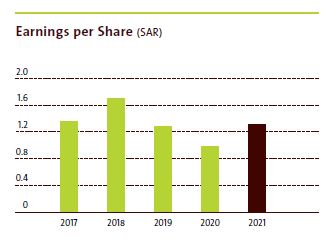

Bank’s financial matrices improved during the year as a result of the growth in net profit after Zakat. Earnings per share reached SAR 1.31 in 2021 compared to SAR 0.99 in the previous year. ROA and ROE reached 1.6% and 10.8% respectively in 2021 compared to 1.4% and 8.4% in the previous year.

Statement of Financial Position

Alinma Bank recorded a strong growth in assets and liabilities during the year 2021.

Five-year summary of the Statement of Financial Position.

| SAR Mn. | 2021 | 2020 | 2019 | 2018 | 2017 |

| Financial Position | |||||

| Financing, net | 126,271 | 111,196 | 94,801 | 79,063 | 70,312 |

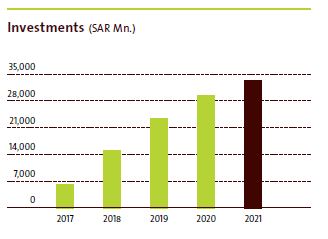

| Investments | 33,278 | 29,526 | 23,478 | 15,066 | 6,157 |

| Total assets | 173,476 | 156,877 | 131,839 | 114,752 | 104,730 |

| Customers’ deposits | 121,061 | 119,454 | 102,063 | 89,065 | 80,612 |

| Total liabilities | 142,765 | 132,448 | 109,395 | 94,408 | 85,551 |

| Total equity* | 30,711 | 24,429 | 22,445 | 21,298 | 20,344 |

* Equity includes SAR 5 Bn. Tier 1 Sukuk issued in July 2021

Investments

Investments increased by 13% YoY to SAR 33,278 Mn. and the net financing increased by 14% to SAR 126,271 Mn. while the total assets recorded an overall growth of 10.6% to SAR 173,476 Mn. as of 31 December 2021, compared to SAR 156,877 Mn. in the previous year.

Net Financing

Net financing grew by 14% in 2021 as compared to 2020. Mortgage Financing increased by 23.4%, Retail Personal Financing by 9%, SME Financing by 13% and Corporate Financing by 13% YoY.

Stability

Alinma Bank remained well-capitalized as indicated by the capital adequacy ratio of 22.8% as of 31 December 2021, which was well above the minimum regulatory requirements. The ratio recorded an increase of 18% YoY reflecting the Tier 1 (T1) Sukuk issued by the Bank in July 2021. Total equity increased by 24% to SAR 33.1 Bn. in 2021.

Liquidity

The Bank maintained a healthy liquidity position throughout 2021 with the loans to deposits ratio (LDR) at 85.8%, which was below the regulatory maximum. The Liquidity Coverage Ratio (LCR) stood at 134.1% and, the Net Stable Funding Ratio (NSFR) at 111.7% which were well above the regulatory minima.

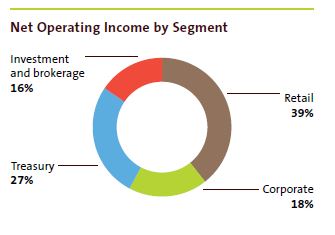

Segmental Performance

| SAR Mn. | |||||

| Segments | Retail | Corporate | Treasury |

Investment and brokerage |

Total |

| Total assets | 26,602,261 | 98,764,556 | 45,725,528 | 2,383,739 | 173,476,084 |

| Total liabilities | 81,503,711 | 23,727,274 | 36,924,221 | 609,851 | 142,765,057 |

| Yield income | 2,265,163 | 2,104,778 | 675,001 | 92,057 | 5,136,999 |

| Non-yield income | 443,749 | 166,412 | 375,976 | 544,232 | 1,530,189 |

| Operating income | 2,708,912 | 2,271,190 | 1,050,797 | 636,289 | 6,667,188 |

| Operating expenses | 1,638,401 | 336,155 | 237,320 | 153,286 | 2,365,162 |

| Provision charges | (124,789) | 1,375,931 | 2,576 | 12,613 | 1,266,331 |

| Net operating income | 1,195,300 | 559,104 | 810,901 | 470,390 | 3,035,695 |

| Gain/loss from associate and joint venture | -14,140 | ||||

| Net income before Zakat | 1,195,300 | 559,104 | 796,761 | 470,390 | 3,021,555 |

Future Outlook

Going forward, Alinma Bank will continue its journey towards being celebrated as the fastest and most convenient bank in the KSA. The Bank will continue focusing on elevating the customer experience by offering differentiated products and services and ongoing investments in its digital capabilities and resources.