Global Context

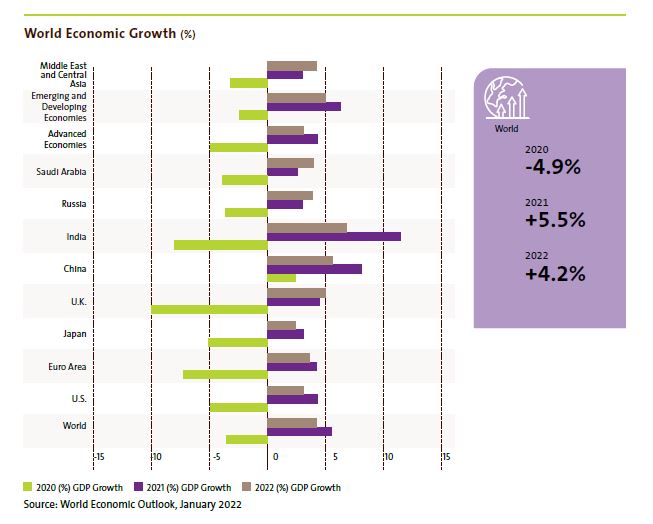

Reflecting the stronger-than-projected recovery on average across regions in the second half of the year, the global economy is projected to grow 5.5% in 2021 and 4.2% in 2022. The strength of the recovery is expected to be highly divergent across nations, due to access to medical interventions, effectiveness of policy support, exposure to cross-country spillovers, and structural characteristics entering the crisis. However, the multiple vaccine approvals and the launch of vaccination in some countries provides a stronger starting point for the 2021–22 global outlook forecast. Despite the high and rising human toll of the pandemic, economic activity has adapted to subdued contact-intensive activity over time. The additional policy measures announced in the United States and Japan are expected to provide further support in 2021–22 to the global economy.

In advanced economies, recovery paths vary, with the United States and Japan projected to regain end-2019 activity levels in the second half of 2021. Activity is expected to remain below end-2019 levels into 2022 in the euro area and the United Kingdom. The wide divergence across countries reflects the differences in behavioral and public health responses to infections, flexibility and adaptability of economic activity to low mobility, preexisting trends, and structural rigidities entering the crisis. The recovery paths are expected to be diverging. Compared to other nations in the region, China is expected to facilitate a strong recovery with effective containment measures, a forceful public investment response, and central bank liquidity support. Considering the expected slow normalization of cross-border travel and the subdued outlook for oil prices, oil exporters and tourism-based economies within the group are expected to face particularly difficult prospects.

Global trade volumes are expected to grow about 8% in 2021, before moderating to 6% in 2022, and services trade is expected to recover more slowly due to subdued cross-border tourism and business travel until transmission declines everywhere. Inflation is expected to remain subdued during 2021–22, with advanced economies projected at 1.5% and emerging market and developing economies at just over 4%, which is lower than the historical average.

The local transmission of virus is expected to be brought to low levels everywhere by the end of 2022, with growing vaccine availability, improved therapies, testing, and tracing.

Saudi Economy

As per the Ministry of Finance (MoF) Budget Statement for FY 2022 of the Kingdom of Saudi Arabia, real GDP growth is estimated to expand by 2.9% in fiscal year 2021, supported largely by a broad increase in non-oil economic activity. Amid an easing of domestic pandemic-related containment measures and rebound in consumer and business confidence due to high international oil prices, most components of non-oil GDP have continued to expand.

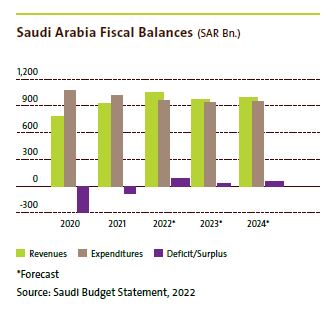

The Kingdom’s total 2021 revenues are projected to rise to SAR 930 Bn. (USD 248 Bn.) from SAR 782 Bn. (USD 208 Bn.) in 2020, despite a 3.4% drop in Saudi crude production in January-October 2021. The revenue is expected to be at SAR 1.045 Tn. (USD 279 Bn.), reflecting a 12% increase from 2021, as the OPEC+ production cuts continue to be unwound. Expenditures are expected to shrink from Riyals 1.015 Tn. (USD 271 Bn.) in 2021 to SAR 955 Bn. (USD 255 Bn.) in 2022, turning a 2.7% budget deficit into a 2.5% surplus. Planned expenditure will continue to focus on economic growth, improving spending efficiency, generating employment, and developing education, healthcare and social development as a part of its mission to fulfill Vision 2030 objectives.

Reflecting the weaning off its dependency on oil revenues by promoting its non-oil industries, the Kingdom’s non-oil GDP has grown by 5.4% in the third quarter of 2021. The ongoing recovery of the domestic non-oil sector combined with an expected increase in oil production is projected to support GDP growth in 2022.

Banking Sector

Global View

During the COVID-19 shock, banks have benefited from the support of public authorities, through direct support in the form of fiscal and monetary policy measures and indirect support in the form of easing of liquidity requirements. Regulators globally eased rules and guidance to spur bank lending and soften procyclical effects.

Net rating outlooks improved significantly, from negative 31% in October 2020, to positive 2% in November 2021. About 74% of banks are on stable outlook, 12% on negative outlook, and 14% on positive outlook.

The COVID-19 pandemic accelerated the digital transformation; and banks swiftly reacted to lockdowns by strengthening their digital products and services. The increasing usage of card and mobile payments is accelerating the move to cashless economies. It has become crucial for banks to be prepared and agile, to shift business models to the new digital normal to deliver on faster-changing client preferences. However, personal relationships will continue to play an important role. Corporate and investment banking and asset management segments will increase its digital offering. Regulators are expected to push for digital transformation and they will catch up on new emerging trends and increase supervisory focus in blockchain technology.

Saudi Banking Sector

The banking sector plays a central role in Saudi Vision 2030, in attracting foreign direct investment and facilitating economic diversification. The main areas of growth in the Kingdom’s banking sector have been residential mortgages and corporate lending.

According to Saudi Central Bank (SAMA) there has been an extraordinary growth in residential mortgage finance (houses, apartments, and land) contracts since 2016. This growth is fueled by initiatives from the Ministry of Housing and the Real Estate Development Fund (REDF), to achieve the key goal of ensuring 70% homeownership by 2030.

Expanding funding for small and medium-sized enterprise (SME) through the Kafalah program is another key area of emphasis, which has expanded rapidly over the years. Digitalization to increase banking penetration and move towards a cashless economy is another important area. Banks adopt digitalization to expand SME access and approximately, 80% of new accounts are being opened digitally, and 30-50% of banking transactions have been converted to digital mode.