Retail Banking and Digital Group

Retail banking is the visible face of banking to the general public, with the Bank’s branches located in abundance throughout the country. During the year, Alinma Bank continued to pursue the achievement of its strategic goals of

Opening of Al-Jawhara branch in Al-Khobar

New retail products/services introduced during 2021 for retail customers

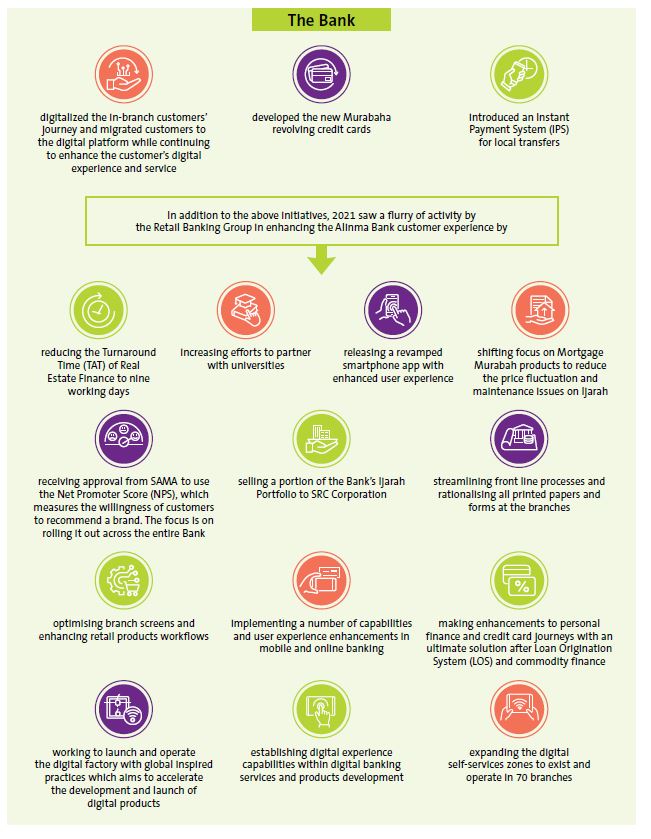

In dealing directly with the public, Alinma Bank developed many products and services that continue to feed the needs of the general populace and included the following initiatives during 2021.

Digital transformation is one of the main pillars to achieve the Saudi Vision 2030, and in the current environment of increased digitalisation, the Bank’s emphasis and efforts were primarily on this aspect of its operations. During the year, the Digital Engagement Index reached 96.4%. This was supported by an improved customer digital experience through cross platform offerings, digitally enabled Shariah-compliant investment and savings products, digitization CX and analytics capabilities in resources and tools.

- Financial transactions conducted digitally amounted to 98.92% of total transactions.

- Products per customer increased to 2.13.

The benefits that flowed through to the Bank from the above activities resulted in:

One of the ways to fuel growth at the Bank is to acquire new customers. In this regard, the Bank focussed their efforts on the experienced professionals, the digitally savvy self-employed, young Saudi professionals and university students.

The growth in customer numbers in turn calls for an increase in available facilities. In the course of the year, five new Men’s Branches were opened as were four new Women’s Branches, and digital channel users showed a 30% increase to two million.

The following table exemplifies one of the keys to the Bank’s success in the Retail Banking environment with the constantly increasing and diverse traditional and modern channels of the Bank, spanning the Kingdom.

| 2021 (Dec) | 2020 | 2019 | |

| Gents Branches | 100 | 98 | 95 |

| Ladies Branches | 78 | 75 | 75 |

| Sales Centres | 4 | 0 | 0 |

| ATMs | 1,584 | 1,557 | 1,527 |

| POS | 100,764 | 74,277 | 43,933 |

| Remittances Center | 52 | 53 | 53 |

| Digital Zones | 70 | 0 | 0 |

| Online Channels Users (million) | 2.08 | 1.52 | 1.14 |

Awards

Alinma Bank topped the Forbes List of Best Saudi Banks in 2021 and was adjudged to be the Best Islamic Bank for 2021 awarded by the Global Islamic Finance Awards (GIFA).

This is a clear endorsement of the initiatives and efforts of the Bank in a difficult operating environment.

Looking ahead in 2022 and beyond

The market experienced increasing competition from the big Saudi banks. Yet Alinma Bank, through its focus on service standards and efficiency of processes and digital and physical facilities, maintained a 90% customer satisfaction rating.

In preparation for the future, the Bank commenced working on the following initiatives to introduce the following products and services:

- Develop the home ownership ecosystem and enhance the family account ecosystem

- Introduce a unique youth offering,

- strengthen customer acquisition partnerships by improving marketing effectiveness and efficiency

- Introduce auto-financing and personal financing through commodity purchasing

- Implement a “Buy Now Pay Later” scheme

- Implement a Loan Origination System (LOS) to improve the efficiency of the loan process and reduced Turnaround Time (TAT)

- Expand digital Investment products and services.

The future progress of the Bank is heavily dependent on the digital environment with increasing demands by customers for speed, convenience and reliability. The Bank’s response to this is evidenced by the development of new products and services, such as:

- Online refinancing

- Online Loan Buyout

- Buy Now Pay Later (Fully-digital microfinancing)

- Chatbot

- Open Banking

- Youth super App

- Personal Finance Management (PFM) Tool

The use of advanced analytics through artificial intelligence tools is also being explored.