Human Capital Management

The goal of Human Capital Management is to maximise employees’ contributions in order to achieve optimal productivity and effectiveness, while simultaneously supporting individual objectives (such as having a challenging job and obtaining recognition), and societal objectives (such as legal compliance and demonstrating social responsibility).

In order to remain competitive, grow and diversify, Alinma Bank ensures that its employees are qualified, placed in appropriate positions, properly trained, managed effectively and are committed to the Bank’s success.

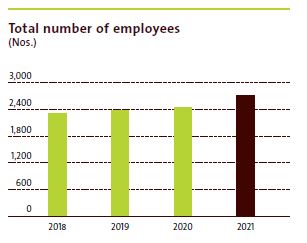

The Bank undertook major organisational restructuring during the year that better enabled the execution of its strategy. In this regard, the Bank, created a “Women Empowering Department” to increase the numbers of females hired and are supported and assisted in the workplace. The following tables show the progress made over the past four years.

Male/Female distribution

| Male | Female | Total | ||||

| Number | % | Number | % | Number | % | |

| 2021 | 2,270 | 84 | 442 | 16 | 2,712 | 100 |

| 2020 | 2,152 | 87.44 | 309 | 12.56 | 2,461 | 100 |

| 2019 | 2,084 | 87.16 | 307 | 12.84 | 2,391 | 100 |

| 2018 | 2,025 | 87.66 | 285 | 12.34 | 2,310 | 100 |

Male/Female distribution by category of employment

| Male | Female | Total | ||||

| Number | % | Number | % | Number | % | |

| SM – Senior Management | 15 | 100 | 0 | 0 | 15 | 100 |

| MM – Middle Management | 248 | 95 | 14 | 5 | 262 | 100 |

| C – Clerical | 1,926 | 82 | 428 | 18 | 2,354 | 100 |

| O – Other | 81 | 100 | 0 | 0 | 81 | 100 |

| Total | 2,270 | 84 | 442 | 16 | 2,712 | 100 |

Male/Female distribution by category of employment and education

| Male (Numbers) | Female (Numbers) | Total (Numbers) | ||||||||||

| SM | MM | C | O | SM | MM | C | O | SM | MM | C | O | |

| Doctorate | 1 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 1 | 2 | 0 | 0 |

| Master’s | 8 | 48 | 71 | 12 | 0 | 7 | 9 | 0 | 8 | 55 | 80 | 12 |

| Graduates | 6 | 160 | 1,192 | 62 | 0 | 8 | 396 | 0 | 6 | 168 | 1,588 | 62 |

| Other | 0 | 39 | 663 | 7 | 0 | 1 | 20 | 0 | 0 | 40 | 683 | 7 |

| Total | 15 | 248 | 1,926 | 81 | 0 | 17 | 425 | 0 | 15 | 265 | 2,351 | 81 |

The Bank increased employee engagement by providing flexible working hours, enabled employees to work-from-home and encouraged interaction amongst employees by staging social activities.

The Human Capital Division enhanced the hiring process and the onboarding program, to enrich the employee experience. In addition, a “Creating Employee Experience Department” was established to support this initiative and draw closer to international best practice.

Total New Hires by Age Group and Gender

| Year | 18 to 30 years | Over 30 years | ||||

| Male | Female | Total | Male | Female | Total | |

| 2021 | 199 | 129 | 328 | 103 | 21 | 124 |

| 2020 | 104 | 26 | 130 | 44 | 2 | 46 |

| 2019 | 149 | 41 | 190 | 65 | 7 | 72 |

| 2018 | 107 | 39 | 146 | 112 | 18 | 130 |

| 2017 | 92 | 26 | 118 | 98 | 14 | 112 |

The promotion of business performance and the steps to increase employee productivity were aided by the design and implementation of an incentive scheme for employees in retail banking. The scheme covers the activities in multiple segments such as, Branch banking, Retail sales, Bancassurance and Retention, and is intended to increase motivation and satisfaction amongst the employees.

Other initiatives included, enhancing the Bank’s compliance with SAMA Rules for compensation practices and conducting a comprehensive benchmarking exercise on compensation (fixed and variable) allowances and benefits offered in the banking sector.

Based on the study, it is proposed to implement an “Employee Life Insurance” scheme in the near future, to support the Bank’s quest to retain employees. The “Employee Housing Program” was introduced and added to the roster of benefits this year. No further additions or revisions are being considered at this stage, as the existing benefits are found to be competitive with market standards.

Salaries and benefits

| 2021 SAR | 2020 SAR | 2019 SAR | 2018 SAR | 2017 SAR | |

| Salaries paid | 614,807,599 | 585,660,150 | 547,301,392 | 521,532,074 | 475,198,144 |

| Benefits paid | 107,429,189 | 91,164,359 | 123,555,797 | 120,290,400 | 64,104,172 |

| Social security contributions | 46,989,195 | 44,462,917 | 41,395,361 | 38,644,413 | 34,368,123 |

| Staff insurance | 40,262,743 | 32,819,280 | 33,863,392 | 26,373,962 | 24,243,214 |

| Total salaries and benefits | 809,488,726 | 754,106,707 | 746,115,944 | 706,840,850 | 597,913,653 |

Service analysis of workforce

| Number of years of service | Male | Female | ||||

| 2021 | 2020 | 2019 | 2021 | 2020 | 2019 | |

| 0-5 years | 1,119 | 927 | 850 | 321 | 183 | 180 |

| 6-10 years | 702 | 736 | 756 | 97 | 102 | 107 |

| 11-15 years | 449 | 489 | 506 | 24 | 24 | 25 |

| 16-20 years | 0 | 0 | 0 | 0 | 0 | 0 |

| Over 20 years | 0 | 0 | 0 | 0 | 0 | 0 |

Employees by age and gender

| Age group | Male | Female | Total | ||||||

| 2021 | 2020 | 2019 | 2021 | 2020 | 2019 | 2,021 | 2020 | 2019 | |

| 18-30 years | 772 | 762 | 805 | 253 | 157 | 176 | 1,025 | 919 | 981 |

| 31-40 years | 1,001 | 841 | 902 | 162 | 128 | 114 | 1,163 | 969 | 1,016 |

| 41-50 years | 393 | 350 | 305 | 21 | 20 | 19 | 414 | 370 | 324 |

| Over 50 years | 104 | 99 | 100 | 6 | 4 | 3 | 110 | 103 | 103 |

| Total | 2,270 | 2,052 | 2,112 | 442 | 309 | 312 | 2,712 | 2,361 | 2,424 |

Employees by region/Grade

| Region | Senior Management | Middle Management | Clerical | Other | Total |

| Central Region | 15 | 223 | 1,542 | 81 | 1,861 |

| Eastern Region | 0 | 15 | 297 | 0 | 312 |

| Northern Region | 0 | 0 | 87 | 0 | 87 |

| Southern Region | 0 | 0 | 107 | 0 | 107 |

| Western Region | 0 | 24 | 321 | 0 | 345 |

| 15 | 262 | 2,354 | 81 | 2,712 |

Multiple development programs that target Bank leadership, professional certifications and fresh graduates have commenced, with a “Vitality Program” run by the Tawuniya company, launched to support and strengthen employees’ wellness.

An initiative that started the previous year was the Saudization of the workforce at the Bank. In 2021 the Saudization Rate stood at 94%.

Employee Health during the Pandemic

The health and well-being of the employees are paramount for Alinma Bank, as it is committed to follow government protocols to have a safe and healthy working environment. All safety and health protocols have and are being strictly adhered to throughout the pandemic.

The Bank facilitated the vaccination of its employees by coordinating with the health authorities. Vaccinations are made available to staff to receive within the Bank’s premises. The Bank also allows employees who contract the virus, to stay at home on full pay, until they recover.

In addition, the Bank facilitated the “work-from-home set-up”, allowing most head office employees to work remotely using VPN, Cisco Jabber and Webex tools. The Bank also made available direct support for employees to get a free COVID-19 test.

The pandemic has prompted a re-evaluation of workplace procedures. It is therefore very likely that practices such as social distancing, the use of face masks, remote meetings via Webex, and “work-from-home” for staff who are considered “not essential” to be physically present, will continue well into the future.

Saudization Policy

In accordance with the Saudization program initiated by the Saudi Government, Alinma Bank has put in place recruitment opportunities, support and training for the Bank’s national workforce

The Bank has been working on the proposed plan to Saudization on some jobs, including requiring companies to whom work is outsourced, to increase Saudization rates in technical and sensitive positions. The Bank has been able to achieve the Saudization target for Level 1 positions at the Bank.

Training and Development

Training and development of its employees is at the core of the Bank’s strategies in capacitating employees to produce their best at the workplace. The “Alinma Academy for Education and Development” has been set up for this purpose. It conducts training needs analyzes to uncover the existing gaps in either leadership or core activities. It also provides updated products training to all branches frequently and conducts awareness training courses to cover SAMA regulations. A professional certification program has been introduced for all employees, along with Board member training courses.

In 2021, the following key training programs were delivered.

- The internal training was provided virtually on the Alinma Learning Management System (LMS).

- Leadership development for executives.

- Core leadership and technical training.

- Customised technical programs covering customer care, call centre, awareness of regulatory requirements, information technology, FBP, and, cooperate banking.

- Branch Managers Development Program.

Training evaluation methods consisting of pre and post training assessments were also introduced during the year.

Training

| Description of training | Male (Numbers) | Female (Numbers) |

| Core | 1,397 | 736 |

| Leadership | 1,740 | 851 |

| Technical | 977 | 730 |

| Induction programs | 343 | |

| Awareness and Saudi Central Bank requirements training courses | 1,538 | |

| Updated products | 1,289 | |

| Preparation for professional certificate for branches | 2,523 | |

| Board member training courses | 9 | |

| Leadership development programs for executives | 28 | |

| Branch development programs | 108 | 54 |

| Core leadership and technical training | 4,027 | 2,084 |

| Customized technical programs such as customer care, cooperate, call center, FBP, and information technology | 95 | 50 |

Hours of training by grade

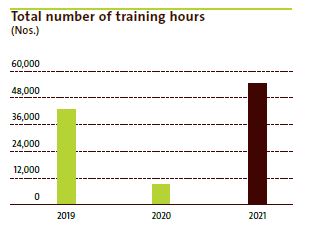

Number of training programs, participants and time

| 2021 | 2020 | 2019 | |

| Number of training programs | 108 | 252 | 89 |

| Total number of participants | 7,745 | 1,739 | 2,327 |

| Training days | 9,075 | 1,565 | 7,140 |

| Hours spent on training | 54,450 | 9,390 | 42,840 |

Hours of training undergone by Bank’s employees in 2021, by gender

| Type | Number of employees | Number of training hours | ||||

| Male | Female | Total | Male | Female | Total | |

| Mandatory | 1,311 | 227 | 1,598 | 1,362 | 7,866 | 9,228 |

| Non-mandatory | 2,792 | 1,889 | 4,681 | 11,334 | 16,752 | 28,086 |

| e-Learning | 10,187 | 61,122 | ||||

Hours of training undergone by Bank’s employees in 2021, by category

| Type | Number of employees | Number of training hours | ||||

| Male | Female | Total | Male | Female | Total | |

| Senior Management | 74 | 0 | 74 | 444 | 0 | 444 |

| Middle Management | 99 | 3 | 102 | 594 | 18 | 612 |

| Other | 3,129 | 1,973 | 5,102 | 18,774 | 11,838 | 30,612 |

Hours of training undergone by bank’s employees in 2021, by skill type

| Type | Number of persons trained | Hours on training |

| Technical skills | 1,707 | 10,242 |

| Soft skills | 3,058 | 18,348 |

Human capital related awards and achievements

- The Bank was nominated by the Ministry of Human Resources to join the Tawteen program and benefit from the support of nationalisation rewards. 200 employees have so far been added to the Program.

- Alinma Bank maintained their rating of “excellence” from the Ministry of Human Resources for the third year in a row, in relation to the Al-Safwa Program

- The Bank maintained the platinum range for saudization since 2019.

Human Capital initiatives planned for 2022

The focus for 2022 will be on developing and growing the employees in their capabilities to fulfill the 2021 – 2025 strategy and objectives of the Bank and consequently elevate the quality of work performed. Some of the initiatives center around measuring and improving employee engagement in the activities of the Bank, while regularly celebrating their successes, hiring talented individuals who are more technically inclined, implementing more rotational programs and assisting in career path progression through the Organization.

There are in addition, steps planned to digitalize and streamline HR processes that will lend to improved efficiencies. The improved processes are also designed to contribute to:

- assist in conducting training needs analyzes,

- spread learning and development throughout the Organisation.

- enhance employee experience through an improved learning management system.

- better management of the evaluation of the training program.

- facilitate improved communication with all employees.

The Bank looks forward to the coming year with optimism as the rigours of the pandemic begin to ease, with cases of COVID-19 having been well controlled and all employees vaccinated.

Please refer the women empowerment section under Our People on page 63 of this Report for more details about our efforts on women empowerment at the workplace.