Closer to home

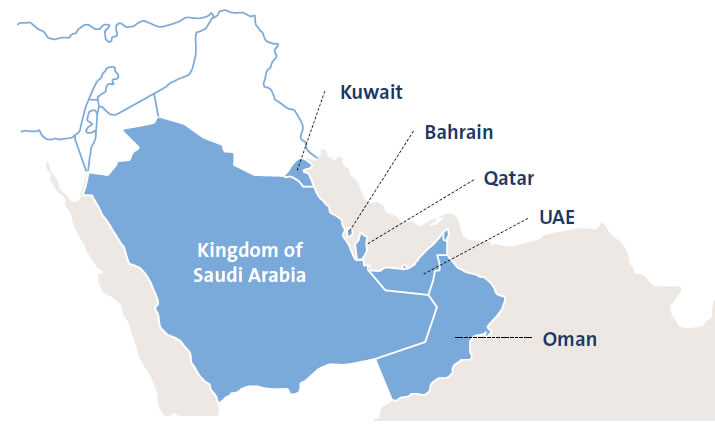

The Gulf Cooperation Council (GCC) economies already received a boost from high oil and gas prices in 2022, driven by growth in oil and non-oil revenue. Growth of individual countries in the region is expected to vary due to localized factors with KSA registering a record growth of 8.7% in 2022.

Inflation remained moderate in the GCC, and well below global levels, aided by housing and other services incurring only a modest increase in costs. The GCC was also better prepared to mitigate other unprecedented market impacts, having taken adequate steps to provide the economy with the needed financing. Some Arab countries are likely to face higher inflation rates due to local and global inflationary pressures, including the risk of monetary over-tightening, consequent to the pegging of currencies to the U.S. Dollar, and the recalibration of monetary policy by the U.S. Federal Reserve to bring surging inflation under control.

As of October 2022, the U.S. Dollar was at its strongest since 2000, and its dominance in international trade and finance with a 40% share in global exports, meant that its sharp strengthening during the year had sizeable macroeconomic implications across the world. With an estimated pass-through of a 10 percent dollar appreciation into 1 percent inflation, the stronger dollar compounded pressure on countries with a greater share of dollar-invoiced imports. The pressure was also reflected on balance sheets around the world, with almost half of all cross-border financing and international debt instruments being denominated in U.S. Dollars.

The region’s economic growth is likely to continue outperforming the global economy with a strong growth forecast for 2023, with the global economy expected to face weak growth and the possibility of recessions. Government-controlled price caps and subsidies are set to ease inflationary pressures on commodities across Gulf countries. A key factor that will shape the region’s economic performance and growth is the emergence of the non-oil economy, evidenced by expanding PMI indices in 2022 projected to continue at pace well into 2023.

The strong growth of the non-oil economy is underpinned by long-term national visions and strategies, backed by revised up credit ratings across gulf countries. As GCC countries commit to net-zero objectives laid out in these pledges and strategies, experts opine that it is important to restructure energy and water subsidies when exploring the Gulf’s opportunities of moving to a more sustainable economic model that is less hydrocarbon dependent. The GCC economies will collectively progress towards achieving the goals of the Paris Agreement, with further investments to support a low-carbon economic environment.

On the ground

KSA is expected to eclipse giant emerging economies such as India, China and Indonesia to be the world’s fastest growing economy, due to its remarkable recovery from the pandemic and as a result of higher oil prices and increased production. The Kingdom’s Gross Domestic Product (GDP) expanded by 8.7% in 2022, its fastest growth since 2011, and is expected to reach around 5% in 2023. The fiscal balance is expected to be in the black, supported by aforementioned high energy prices aided by buoyant non-oil activity. The influx of imported commodities continued to drive up price levels, with consumer inflation contained both by price caps and subsidies, and the tight monetary policy of the Saudi Central Bank (SAMA).

The Kingdom has implemented far ranging reforms targeting an improved business environment, foreign direct investment, and higher private-sector participation to drive the economy and support the labor market. The business infrastructure and facilities in the country are expected to continue to improve because of large-scale public and private investments that bode well for a wide range of sectors, including tourism and hospitality, transport and logistics, energy and derivatives, industrial production and manufacturing, and a range of consumer and business services. It will be important that the Kingdom maintains control of public spending despite higher oil proceeds, enabling more targeted social spending.

Banking

The GCC

The region recorded increased profits in the Banking sector, buoyed by higher oil prices, rising benchmark rates and new public projects. According to S&P Global Ratings, the GCC's four biggest banking markets – the UAE, Kuwait, Qatar and Saudi Arabia outpaced the previous year's performance to reach stronger full-year profits by the end of 2022. The windfall gain from oil prices saw many governments across the gulf record their first fiscal surplus in several years, enabling governments to spend on new projects. This was reflected in the growth in banking credit facilities in 2022.

Higher net profit margins offset the increased cost of risk in the second half of 2022, via loans that first benefited from support measures and were then restructured. These, and other supportive factors have together combined to ensure a net positive for banking profits in the region for the reporting period.

Customer deposits in the region grew in 2022, with KSA and UAE leading the fray with the strongest quarter-on-quarter and year-on-year growth reported in the market. Depositors sought higher income in the period, leveraging on increased benchmark rates offered by Banks in the GCC, with Central Banks following the lead of the U.S. Federal Reserve’s monetary tightening policy aimed at taming inflation.

The net income of GCC Banks reached a record high showcasing excellent bottom-line performance backed by growth in all GCC countries. Topline changes in the sector reflected the higher benchmark rates adopted by central banks across the GCC region following the rate hikes in the US. Revenue growth in the region has continued to remain robust throughout the reporting year.

Kingdom of Saudi Arabia

The total assets of the Banking sector amounted to SAR 3 Tn. at the end of 2022. The profitability of the top 10 KSA banks showed improvement in 2022, but the banks witnessed a slight deterioration of asset quality due to an increase in the non-performing loans (NPL) ratio during the year.

The overall operating efficiency of the sector improved as banks continued branch rationalization and increased digitalization. Cost efficiencies stemmed from growth in operating income outpacing growth in operating expenses.

Whilst being one of the biggest economies in the Middle East, the Kingdom also leads the global Islamic Finance markets. With total assets in Islamic Banking at SAR 2.7 Bn. according to the latest reports by SAMA above, the industry is working towards a stated commitment of reaching 22.5% of global Islamic finance assets, representing 79.3% of the GDP by 2025. The Kingdom also has the largest proportion of Islamic banks’ financing (84%) of any country that allows conventional banks to operate alongside Islamic banks.

In November 2022, SAMA announced the issuance of the Open Banking Framework as one of the key outputs of the Open Banking Program which will come into full effect in 2023. The Open Banking initiative and services are developed through collaboration with the market, in line with strategic priorities set in the Saudi Vision 2030 and in the Financial Sector Development Program (FSDP).

The fintech landscape in the Kingdom has grown exponentially, with 147 fintechs operating in the Kingdom currently, an increase of 79% from 2021. There is significant upward movement forecasted in the industry in 2022/23 following the licencing of 3 new digital banks over the past few years, with the third being launched in 2022. This is the first time since Alinma Bank was licensed in 2006 that new locally-based banks will launch in the Kingdom, promising to accelerate the pace of innovation driven by growing competition and maturity across the fintech sector.

Sources

- www.sama.gov.sa/en-US/Documents/Saudi_IF_Report_2021_Final_DIGITAL_v3.pdf

- www.fitchratings.com/research/islamic-finance/saudi-islamic-banks-2021-results-dashboard-14-06-2022

- www.sama.gov.sa/en-US/News/Pages/news-794.aspx

- openbanking.sa/index-en.html

- fintechsaudi.com/wp-content/uploads/2022/11/FintechSaudi_AnnualReport_21_22E.pdf